Madhuchanda Dey

Highlights:-

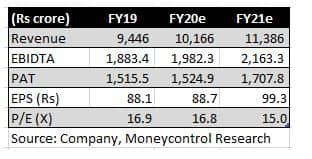

Although no IT company has so far predicted any broad-based demand challenge, for smaller companies, it is difficult to offset client-specific issues with new businesses in the short term. With earnings growth likely declining to a CAGR of high single digits in the next couple of years, we would wait for meaningful correction to buy the stock.

Key negatives

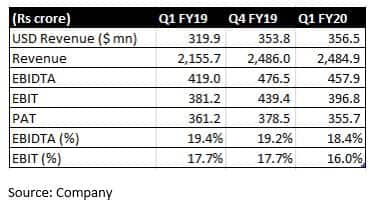

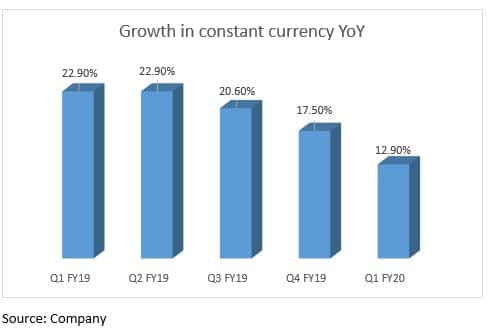

For LTI (CMP: Rs 1,490, market cap: Rs 25,863 crore) the quarter was weaker than usual. Revenue stood at $356.5 million showing sequential growth of 0.8 percent. The quarter on quarter growth in constant currency at 1 percent was the weakest in the past nine quarters.

The quarter also saw 170 basis points of sequential decline in margin to 16 percent. This could be attributed to higher visa costs (100 bps), sales and marketing expenses (100 bps) and currency headwinds (20 bps) that were offset partially by higher working days and transition to Ind AS 116 accounting.

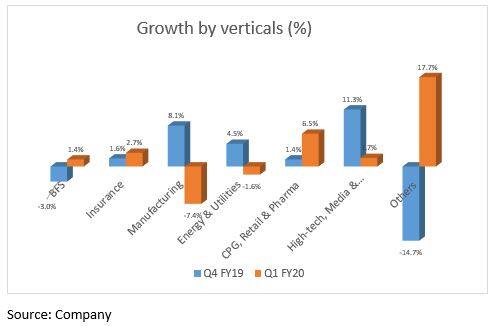

The softer revenue performance was on account of weakness in its top banking client and another banking client in Africa. This is also reflected in the soft performance of its banking and financial services vertical (BFSI) and de-growth in top five clients.

The dependence of smaller companies on large accounts came to the fore with issues at LTIL’s top client -- apparently, it has cut down on technology spend -- that impacted revenue for its top 20 account bucket as well.

In addition, performance of manufacturing, energy utilities and high tech media and entertainment was challenging. In high tech, the management alluded to client weakness as one of the reasons for the lacklustre show.

The company also saw an increase in attrition rate to 18.3 percent from 17.5 percent in the previous quarter. This is a number that warrants close monitoring in view of the supply crunch that the industry is facing with respect to highly skilled IT professionals. However, the only comforting data point is the trend in net hiring that remains strong.

The onsite offshore mix cannot be improved from hereon, according to the management.

Key positives

Deal pipeline remains healthy and the company won a large deal ($44 million) from the insurance vertical.

The weakness in FY20 is LTIL’s client-specific issues and the management did not point to weakness in any particular geography or macro challenges.

Digital continues to drive growth with a share at 39 percent – growth of 27.5 percent year on year.

Although there is weakness in top account, North American geography showed a decent 4.4 percent sequential growth in constant currency.

The company guided to a better Q2 compared to Q1, but sees meaningful recovery from the second half of the fiscal.

The company guided to 170 bps negative impact on margin due to wage hike in the coming quarter which will get largely offset by absence of visa costs and lower sales and marketing expenses (Q1 had 50 bps impact due to a client event).

Outlook

The stock has underperformed in the past six months on the back of concerns that its balance sheet might be used to fund the stake purchase in rival Mindtree, followed by softer Q4 on account of weakness in key accounts. Rupee appreciation added to the headwinds. However, we are positive about LTIL coming out of this rough patch (not yet factoring in integration with Mindtree which could happen only in the medium term despite management’s denial currently). We expect the stock to remain soft for a while and recommend adding on deeper correction.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!