The Finance Minister Nirmala Sitharaman's Budget 2020 failed to cheer D-Street as market witnessed its biggest fall on the Budget Day in the past 11 years, according to CNBC-Tv18 data.

Both Sensex & Nifty posted their biggest single-day fall in nearly 5 years. The Nifty Bank posted the 2nd biggest one-day fall ever. Nifty Midcap index slipped nearly 500 points, its biggest 1-day fall in 16 months.

The S&P BSE Sensex was down by nearly 1,000 points while the Nifty50 plunged over 300 points on the Budget Day. Investor wealth as per average market capitalisation of the BSE listed companies was down by nearly Rs 4 lakh crore.

Sectorally, Realty sector was the biggest loser followed by Capital Goods, Industrials, public sector, finance, and metal indices. IT index was the lone gainer.

Experts are of the view that Budget was below par and uninspiring. The need of the hour was much more than what the Budget delivered. Income tax changes were positive but additional riders disappointed the Street, they say.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level is placed at 11,524.3, followed by 11,386.8. If the index starts moving upward, key resistance levels to watch out for are 11,908.3 and 12,154.8.

Nifty Bank

The important pivot level, which will act as crucial support for the index, is placed at 29,409.73 followed by 28,998.57. On the upside, key resistance levels are placed at 30,575.33 and 31,329.77.

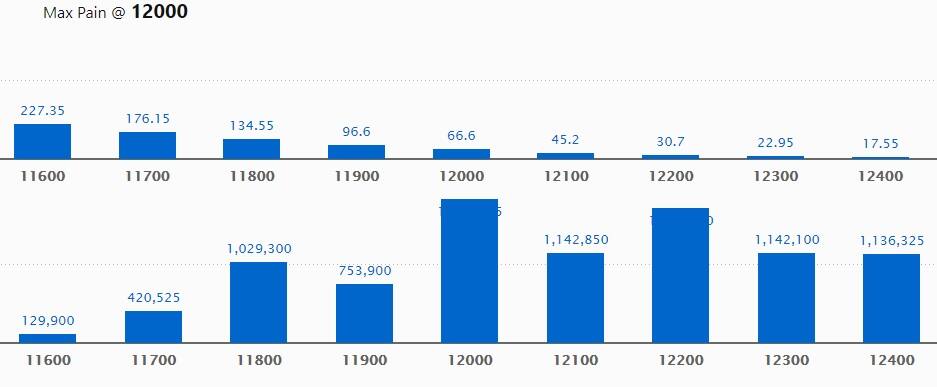

Call options data

Maximum Call open interest (OI) of 18.19 lakh contracts was seen at the 12,000 strike price. It will act as a crucial resistance level in the February series.

This is followed by 12,200 strike price, which holds 17.11 lakh contracts in open interest, and 12,100, which has accumulated 11.42 lakh contracts in open interest.

Significant call writing was seen at the 11,800 strike price, which added 9.34 lakh contracts, followed by 12,000 strike price that added 8.61 lakh contracts and 11,900 strike which added 6.43 lakh contracts.

There was hardly any Call unwinding on February 1.

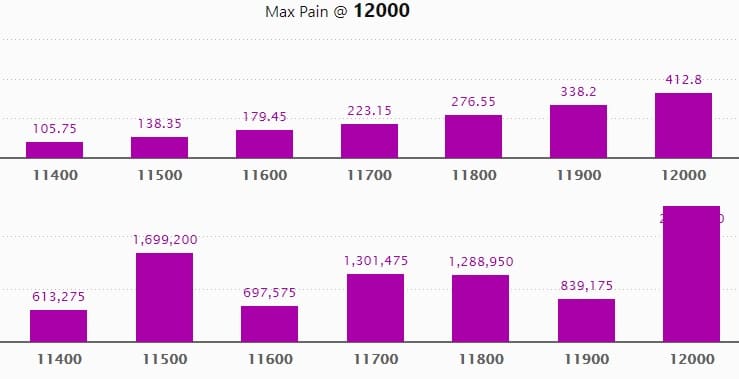

Put options data

Maximum Put open interest of 16.99 lakh contracts was seen at 11,500 strike price, which will act as crucial support in the February series.

This is followed by 11,000 strike price, which holds 12.42 lakh contracts in open interest, and 11,300 strike price, which has accumulated 10.65 lakh contracts in open interest.

Put writing was seen at the 11,800 strike price, which added 4.5 lakh contracts, followed by 11,700 strike, which added 4.2 lakh contracts and 11,200 strike which added 3.57 lakh contracts.

Put unwinding was seen at 12,000 strike price, which shed 2.41 lakh contracts, followed by 12,100 strike which shed 0.99 lakh contracts.

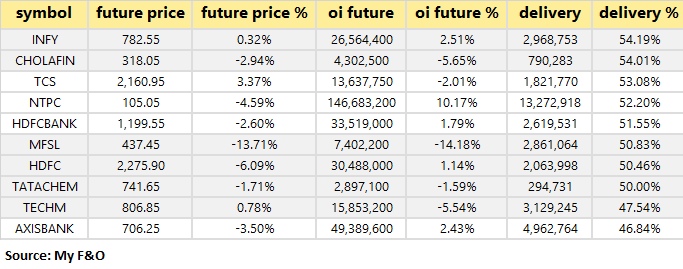

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are accepting delivery of the stock, which means they are bullish on it.

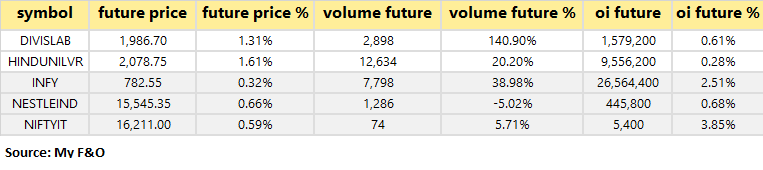

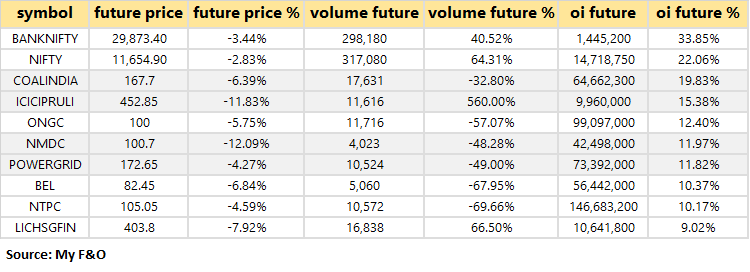

5 stocks saw long build-up

Based on open interest (OI) future percentage, here are the 5 stocks in which long build-up was seen.

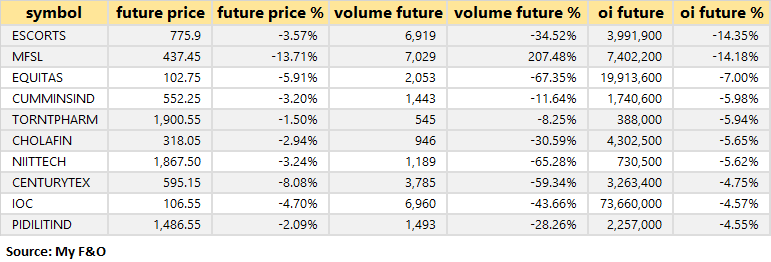

53 stocks saw long unwinding

78 stocks saw short build-up

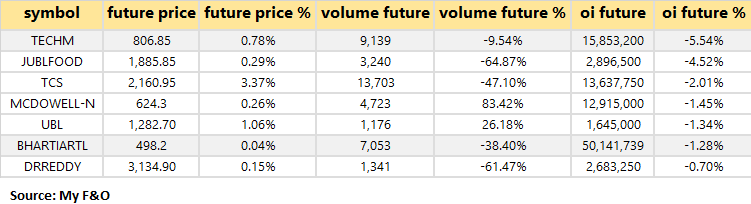

7 stocks witnessed short-covering

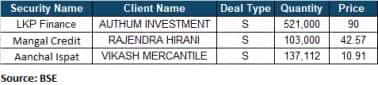

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Visa Steel: To consider and approve the financial results for the period ended December 31, 2019, and other business matters.

R Systems: To consider and approve the financial results for the period ended December 31, 2019, and other business matters.

Ansal Housing: To consider and approve the financial results for the period ended December 31, 2019.

Kiri Industries: To consider and approve the financial results for the period ended December 31, 2019.

Stocks in news

Results on February 2: IG Petrochemicals, Tata Chemicals, Ujjivan Financial Services, HUDCO, Galaxy Surfactants, Dr Lal Pathlabs, Umang Dairies, Sutlej Textiles, Borosil Glass, Sharda Motors

Mahindra & Mahindra: Mahindra and Mahindra on Saturday reported a 6% decline in total sales at 52,546 units in January. The company had sold 55,722 units in the same month last year, M&M said in a statement. In the domestic market, sales were down 3% at 50,785 units last month compared to 52,500 units in January 2018. Exports dropped by 45% to 1,761 units as against 3,222 units in the year-ago month.

Maruti Suzuki: The country's largest carmaker Maruti Suzuki India on Saturday reported a 1.6% increase in sales at 1,54,123 units in January. The company had sold 1,51,721 units in January last year, Maruti Suzuki India (MSI) said in a statement. Domestic sales increased by 1.7% at 1,44,499 units last month, as against 1,42,150 units in January 2018, it added.

Tata Motors: Tata Motors on Saturday reported a 17.74% decline in total sales at 47,862 units in January. The company had sold a total of 58,185 units in January 2019, Tata Motors said in a statement. Total domestic sales were down 18% at 45,242 units as compared to 54,915 units in January last year, it added.

Coal India: January coal production grew 10.3% at 63.11 mt against 57.21 mt (YoY). January coal offtake grew 6.9% at 56 mt against 52.44 mt (YoY)

Eicher Motors: January Sales - Total motorcycle sales went down 13% at 63520 units against 72701 units (MoM). Total exports went up 22% at 2228 units against 1829 units (MoM)

Chambal Fertilisers Q3: Consolidated net profit at Rs 479.2 crore against Rs 159.6 crore YoY. Consolidated revenue went up 36.5% at Rs 3,832 crore against Rs 2,807 crore YoY.

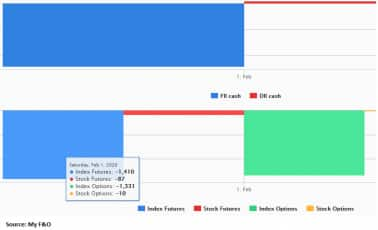

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,199.53 crore, while domestic institutional investors (DIIs), bought shares of worth Rs 36.64 crore in the Indian equity market on February 1, provisional data available on the NSE showed.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!