Highlights:- Yes Bank has reportedly concluded its Rs 1,937 crore QIP

- QIP raised at one-time Q1 FY20 adjusted book

- The fund raising results in a 9.5 percent equity dilution

- Improves CET I to 8.6 percent

- Asset quality overhang lingers on with deteriorating macros

- Stock likely close to its bottom

- Gradually accumulate for the long-term

-------------------------------------------------

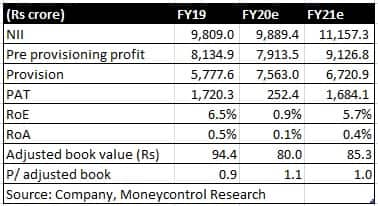

Yes Bank has reportedly ended raising of equity capital by way of a qualified institutional placement (QIP) at a floor price of Rs 87.9 per share and at no more than a five percent discount. Capital raising should definitely lift sentiment from the nadir as it is rational to assume that institutional investors would invest their money after a thorough scrutiny of the books.

Read: Yes Bank falls 5% after launching QIP to raise Rs 2,000 cr; mgmt rejig imminent

While the QIP has taken place at a valuation of one-time Q1 FY20 adjusted book is prima facie not exciting, this is the first step in breaking the vicious cycle that the bank had fallen into.

Investors should view this development positively and this is the first signal for long-term investors to start accumulating the stock.

Read: Yes Bank at a 5-year low: What should investors do?

How large is the QIP?Contrary to earlier expectations of a big bang capital raising, which would have been disastrous at the current valuation, the management has taken baby steps to emerge from the crisis with a QIP of Rs 1,937.6 crore, which entails an equity dilution to the tune of 9.5 percent.

What happens to CET post-QIP?In the June quarter, the bank’s core capital CET 1 (common equity Tier 1) had hit eight percent from 8.4 percent in the previous quarter. There were several reasons for the sequential erosion of core capital -- 20 bps due to higher risk weight on unrated exposure, 16 bps due to rating downgrade of financial service companies and 10 bps due to higher operational risk. This was dangerously close to the regulatory threshold of 7.375 percent for March 2019 and eight percent for March 2020.

Any big slippage could further erode core capital and bring it below the regulatory threshold.

After the equity infusion, core capital – CET I -- moves up to 8.6 percent, providing some short-term respite.

The lack of capital would have not permitted the bank to grow its book and earn incrementally to provide a cushion for a toxic pool of assets.

What is the best case outcome after the QIP?With the immediate regulatory risk averted in terms of CET I falling below the regulatory threshold, should the bank succeed in sticking to its overall credit cost guidance of 125 bps for FY20, the stock could form a bottom at the current level and continue to head northward. This could pave the way for capital raising for growth at a much better valuation going forward.

The question that remains unanswered is how honest is the disclosure on asset quality?The sub-investment grade pool of the bank had actually worsened to 9.4 percent at Rs 29,470 crore in Q1. However, a large part of the addition (the movement of sub-investment grade book to Rs 29,470 crore at present from Rs 20,000 crore at the end of Q4 FY19) was from bond downgrades (close to Rs 7,367 crore) and two finance companies (Rs 6,000 crore) accounted for the bulk of it.

What also beckons close attention was the slippage. The bank reported a gross slippage of Rs 6,232 crore and net slippage of Rs 4,500 crore in Q1 FY20. Of the net slippage – Rs 2,500 crore came from the watch list and close to Rs 1,900 crore came from the sub-investment grade book outside of the watch list.

The credit cost was 31 basis points despite a large slippage. The bank had actually used the provision created in Q4 FY19 (Rs 1,399 crore of the Rs 2,100 crore) and had provided very little from its Profit & Loss Account for non-performing assets (NPA) in Q1 FY20. Consequently, the provision cover had remained at 43 percent and the bank guided to incremental credit cost of 94 bps in the coming three quarters.

This raises a serious question – can slippage happen from outside the watch list. As of now there is a huge gap between the watch list, which is Rs 10,000 crore, and the sub-investment grade funded exposure, which is above Rs 20,000 crore. So, nobody knows how much will actually slip from this pool, given the weak macro outlook.

While these questions do not go away with the capital raising, the risk absorption capacity improves a bit. Rumoured senior level management changes too could lend confidence.

Should the bank report asset quality on guided lines, we see limited downside from the current level and future capital raising at much better valuation will be rewarding.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!