In the week gone by, the market witnessed volatility and ended flat amid domestic data including weak CPI and WPI numbers. Global markets were also under pressure as fear over the novel coronavirus in China intensify.

The Sensex rose 115.89 points (0.28 percent) to end at 41,257.74 in the week ended February 14. Meanwhile, the Nifty climbed 15.15 points (0.12 percent) to end at 12,113.5.

The broader market underperformed the frontliners. BSE Largecap was down 0.20 percent, while BSE Smallcap index fell 1 percent and the BSE Midcap index shed 1.53 percent.

The upcoming week will be a truncated one as the markets will remain shut on February 21 on account of Mahashivratri.

"With most of the major events now over, the market will now start focusing on Donald Trump's India visit later this month. In the coming week, the market would focus on export-oriented and automobile-related stocks. Technically, the market is heading for the levels of 12,000 or 11,950 levels. On the higher side, 12,200 and 12,250 would be hurdles," Shrikant Chouhan, Senior Vice-President, Equity Technical Research, Kotak Securities, said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 12,054.23 followed by 11,994.97. If the index continues moving up, key resistance levels to watch out for are 12,209.73 and 12,305.97.

Nifty Bank

The important pivot level which will act as crucial support for the index is placed at 30,595.03, followed by 30,355.27. On the upside, key resistance levels are placed at 31,255.63 and 31,676.46.

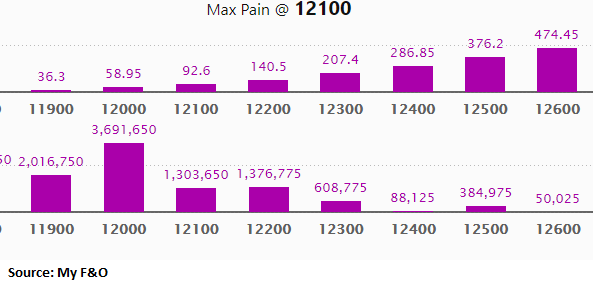

Call options data

Maximum call open interest (OI) of 27.01 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the February series.

This is followed by 12,400 strike price, which holds 21.81 lakh contracts in open interest, and 12,300, which has accumulated 21.75 lakh contracts in open interest.

Significant call writing was seen at the 12,300 strike price, which added 3.32 lakh contracts, followed by 12,200 strike price that added 2.79 lakh contracts and 12,500 strike price, which added 2.13 lakh contracts.

Call unwinding was witnessed at 12,700 strike price, which shed 72,675 lakh contracts, followed by 11,900 which shed 46,050 lakh contracts.

Put options data

Maximum put open interest of 36.91 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the February series.

This is followed by 11,800 strike price, which holds 21.10 lakh contracts in open interest, and 11,900 strike price, which has accumulated 20.16 lakh contracts in open interest.

Put writing was seen at the 12,200 strike price, which added 7,875 contracts, followed by 12,800 strike, which added 300 contracts.

Put unwinding was seen at 12,000 strike price, which shed 1.39 lakh contracts, followed by 11,700 strike price which shed 1.32 lakh contracts.

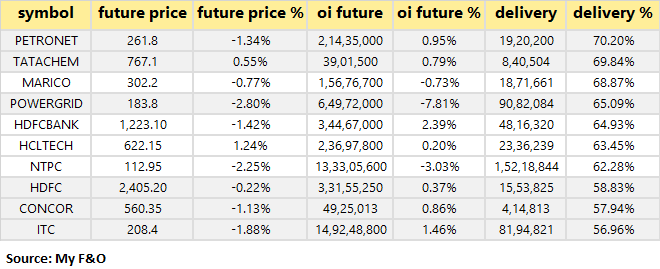

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

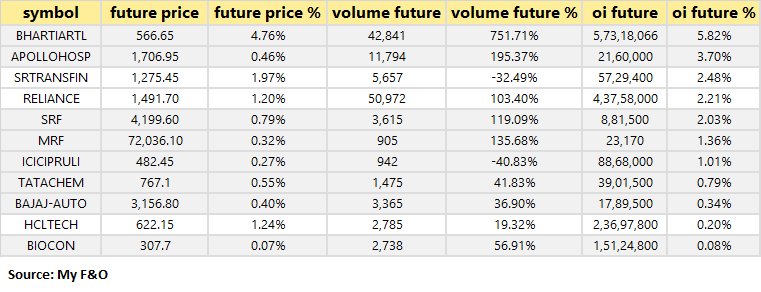

11 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

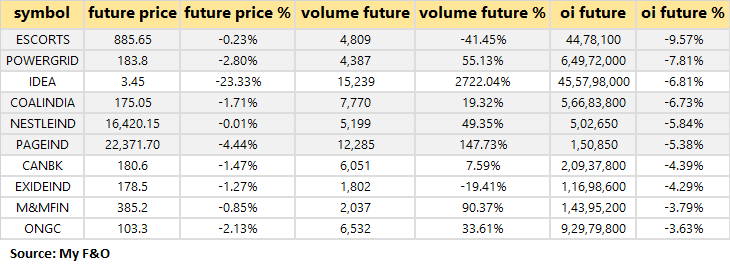

64 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

42 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

26 stocks witnessed short-covering

Bulk deals

(For more bulk deals, click here)

Quarterly earnings: Firstsource Solutions, Bihar Sponge Iron, Kaira Can, Orchid Pharma, Huhtamaki PPL, SBEC Sugar are among the companies that will release their December quarter numbers on February 17.

Stocks in the news

Vodafone Idea: The company received letters from DoT directing immediate payment. Currently assessing amount the company will be able to pay DoT towards AGR dues as interpreted by the Supreme Court. The company proposes to pay the amount so assessed in the next few days.

Granules India: USFDA completed inspection of the company's Hyderabad unit with 2 observations.

Bharti Airtel: Bharti Airtel has told DoT that it will deposit Rs 10,000 crore by February 20, following the Supreme Court ruling that required telcos to pay their adjusted gross revenue (AGR) dues. The company has said that it is in the process of self-assessment to comply with the court order on repayment of AGR dues and that it expects to complete the same shortly.

ONGC: Oil and Natural Gas Corporation (ONGC) posted a 49.75 percent year-on-year (YoY) fall in standalone profit at Rs 4,151.63 crore for the quarter ended December 31. The state-run oil explorer had posted a profit of Rs 8,262.70 crore in the same period last year. Revenue from offshore and onshore operations declined 16.83 percent and 9.1 percent YoY to Rs 15,764.66 crore and Rs 7,945.39 crore, respectively, during the quarter under review.

SAIL: Steel Authority of India reported Rs 343.57 crore consolidated net loss for the third quarter ended December 31, mainly on account of increased expenses. The company had a net profit of Rs 638.79 crore during the same quarter a year ago, the state-run firm said in a BSE filing.

Reliance Infrastructure: The company reported an 18 percent rise in its consolidated net profit at Rs 345.51 crore for the quarter ended December 31, 2019. The Anil Ambani-led company had clocked a net profit of Rs 293.77 crore for the corresponding quarter of the previous fiscal.

CG Power: CG Power and Industrial Solutions' consolidated net loss almost doubled to Rs 210.07 crore in the December 2019 quarter, mainly due to lower revenues. Its consolidated net loss was Rs 105.78 crore in the corresponding quarter a year ago, according to a BSE filing. The company's total income came down to Rs 1,190.47 crore in the third quarter, from Rs 2,084.12 crore in the year-ago period.

Fortis Healthcare: The company reported narrowing of its consolidated net loss to Rs 69.32 crore for the quarter ended December 31, 2019, mainly on account of robust performance in its hospital business. The company had posted a net loss of Rs 180.11 crore for the corresponding period of the previous financial year, Fortis Healthcare said in a filing to the BSE.

Maruti Suzuki: Maruti Suzuki India will not only defend its market share but also "charge" at and "chase" competitors in the wake of newcomers, such as Kia and Chinese players, intensifying competition, according to a top company official. "I am not defending, I am charging. We are charging anytime. If they are good products, we try to chase them," said Managing Director and CEO Kenichi Ayukawa.

Sun TV: Sun TV Network reported a 7.15 percent increase in consolidated profit after tax for the December quarter at Rs 384.69 crore. It had reported profit after tax of Rs 359.01 crore in the October-December period a year ago, Sun TV said in a BSE filing. However, total income dipped 7.89 per cent to Rs 914.17 crore during the quarter under review, as against Rs 992.58 crore in the corresponding period of the previous fiscal.

Glenmark Pharma: Glenmark Pharma reported a 64.02 percent jump in its consolidated net profit to Rs 190.83 crore for the quarter ended December 31, 2019, mainly on account of robust sales in the Indian market. Its board also approved raising of funds up to USD 400 million (over Rs 2,855 crore) through issuance of securities.

Reliance Power: Consolidated net profit dipped over 57 percent to Rs 49.39 crore in the December 2019 quarter, mainly due to lower income. The company's consolidated net profit had stood at Rs 116.44 crore in the corresponding quarter of the previous financial year, according to a BSE filing.

Muthoot Finance: The company reported 66 percent jump in its consolidated net profit to Rs 803 crore in the third quarter ended December 31. The company's net profit was at Rs 485 crore in the corresponding October-December period of 2018-19.

Srei Infra: Srei Infrastructure reported a 34.4 percent fall in consolidated net profit at Rs 60 crore for the third quarter of the current fiscal. The company had posted a net profit of Rs 91.41 crore during the corresponding October-December period of the previous fiscal.

BGR Energy: BGR Energy Systems on Friday registered over 200 percent rise in its consolidated net profits for the quarter ending December 31, 2019 at Rs 26.54 crore. Total income on consolidated basis for the quarter under review was Rs 1,171.42 crore against Rs 803.49 crore registered during the same period last year.

Intellect Design: Intellect Design Arena recorded consolidated net loss of Rs 10.67 crore for the third quarter ending December 31, 2019. For the nine month period ending December 31, 2019 consolidated net loss was Rs 23.41 crore against a net profit of Rs 89.72 crore.

Shree Cement: The company reported a consolidated net profit at Rs 311.83 crore for the third quarter ended December 2019. The company had posted a net profit of Rs 329.83 crore in the October-December quarter a year ago, Shree Cement said in a BSE filing. Its total income was at Rs 3,211.65 crore during the quarter under review. It was Rs 3,195.59 crore in the corresponding quarter.

IRB Infra: IRB Infrastructure Developers reported a 27 percent decline in consolidated profit after tax (PAT) at Rs 159.73 crore for the quarter ended December 2019. The infrastructure company had clocked a consolidated PAT of Rs 218.90 crore for the corresponding period the year-ago period, it said in a regulatory filing to the BSE.

Future Enterprises: Future Enterprises reported a 66.96 percent decline in its consolidated net profit to Rs 12.06 crore for the third quarter ended December 2019. The company had reported a net profit of Rs 36.51 crore for the October-December quarter a year ago, Future Enterprises said in a regulatory filing.

Transformers and Rectifiers: Transformers and Rectifiers reported a consolidated net profit of Rs 1.56 crore in the December quarter. The company had posted a loss of Rs 1.85 crore in quarter ended on December 31, 2018, a BSE filing said. Total income rose to Rs 211.97 crore in the third quarter from Rs 197.84 crore in the year-ago period.

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 704.92 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 219.54 crore in the Indian equity market on February 14, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for February 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!