In the Union Budget 2019, Finance Minister Nirmala Sitharaman maintained railways' capital expenditure (capex) at Rs 1.58 lakh crore, as announced during the Interim Budget in February.

The government has continued with its policy to pump money in the sector as the investment in railways surged about 170 percent over FY15-20.

According to brokerages, the substantial allocation for railways will likely be directed towards the acquisition of rolling stocks, improving passenger comfort and safety, electrification and ramping up freight business.

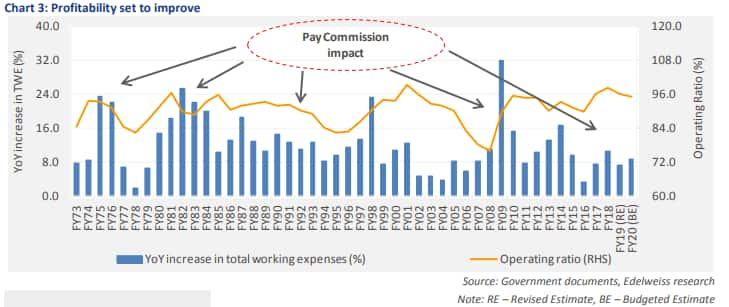

Brokerages also expect the profitability of the Indian Railways to bounce back after being adversely affected by the Seventh Pay Commission recommendations and sluggishness in the freight business.

"After touching a high of 98 percent in FY18, the operating ratio improved to 96 percent in FY19 (R.E.) and is further expected to improve to 95 percent in FY20," said Edelweiss.

Edelweiss expects Indian Railway to focus on ramping up its freight business, which in turn could improve profitability metrics.

Some of the key beneficiaries could be wagon manufacturers like Texmaco Rail and Titagarh Wagons, while the sustained focus on electrification will aid Kalpataru Power and KEC International, said Edelweiss.

Source: Edelweiss Research

JM Financials believes that the ramping up of freight business would be supported by the acquisition of rolling stocks that witnessed a healthy increase of 15 percent over FY19RE.

"We are likely to see a healthy increase in procurement of wagons, coaches and locos in FY20. In the recent tender, Indian Railways substantially increased the wagon orders to 21,758 per annum from an average of 12,000 per annum in the last three years," JM Financials said.

The brokerage expects companies such as Texmaco and Titagarh, from the wagon manufacturing segment, SKF, Timken and Schaeffler from the bearings segment, to benefit from the renewed focus in the segment.

According to brokerage firm Anand Rathi, the government would need private-sector participation (PPP) in railways to meet the proposed investment requirement of Rs 50 lakh crore over 2018-30.

The brokerage expects the introduction of PPP model to present a positive outlook for companies such as Ashoka Buildcon, Dilip Buildcon, NCC

and Simplex Infrastructures.

Disclaimer: The views and investment tips expressed by investment experts and brokerages on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!