Indian equity benchmarks opened in the green but failed to hold to their gains, ending in the red on August 13. Investors booked profits as valuations are no longer cheap and the earnings season is largely coming to an end.

The Sensex closed 59 points, or 0.15 percent, lower at 38,310.49 and the Nifty ended at 11,300.45, with a loss of 8 points, or 0.07 percent.

"The market is likely to be volatile, largely mirroring global cues. Investors would lookout for fresh triggers amid a continued surge in domestic coronavirus cases. The adjusted gross revenue (AGR) case hearing on Friday (August 14) would keep telecom and banking stocks in focus," Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services, said.

"Nifty formed a small bearish candle. Now, it has to continue to hold above 11,200 to witness an up move towards 11,400-11,500 while support exists at 11,200-11,150," Khemka added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,260.57, followed by 11,220.63. If the index moves up, the key resistance levels to watch out for are 11,349.87 and 11,399.23.

Nifty Bank

Bank Nifty closed 0.30 percent lower at 22,196.35. The important pivot level, which will act as crucial support for the index, is placed at 22,077.3, followed by 21,958.3. On the upside, key resistance levels are placed at 22,377.6 and 22,558.9.

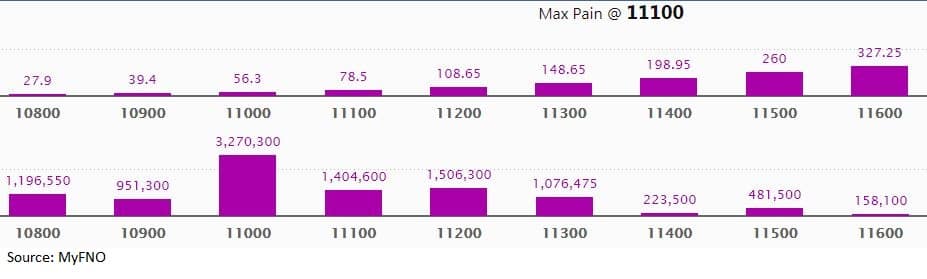

Call option data

Maximum call OI of nearly 23.21 lakh contracts was seen at 11,500 strikes, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 13.16 lakh contracts, and 11,400 strikes, which has accumulated 11.14 lakh contracts.

Call writing was seen at 11,500, which added 2.43 lakh contracts, followed by 11,700, which added 2.19 lakh contracts, and 11,400 strikes, which added 2.12 lakh contracts.

Call unwinding was seen at 11,200, which shed 15,300 contracts, followed by 11,100 strikes, which shed 13,800 contracts.

Put option data

Maximum put OI of 32.70 lakh contracts was seen at 11,000 strikes, which will act as crucial support in the August series.

This is followed by 11,200, which holds 15.06 lakh contracts, and 11,100 strikes, which has accumulated 14.05 lakh contracts.

Put writing was seen at 11,000, which added 2.07 lakh contracts, followed by 11,200, which added 1.90 lakh contracts, and 11,300 strikes, which added 1.67 lakh contracts.

Put unwinding was witnessed at 10,800, which shed 45,525 contracts, followed by 11,500 strikes, which shed 29,325 contracts.

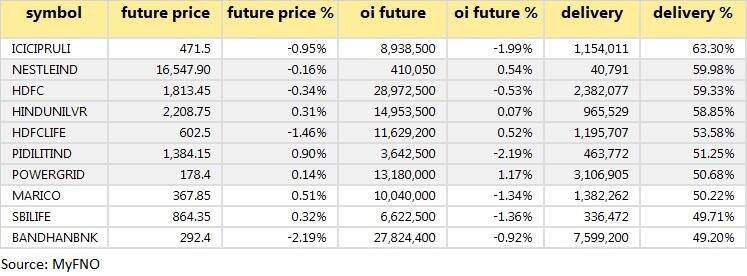

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

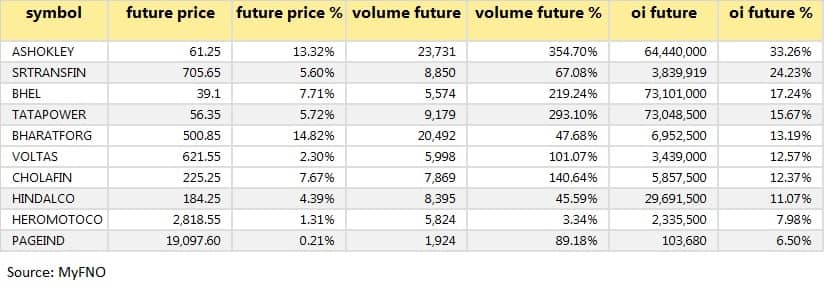

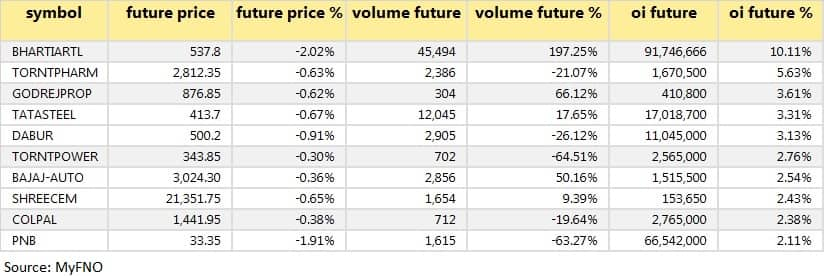

40 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

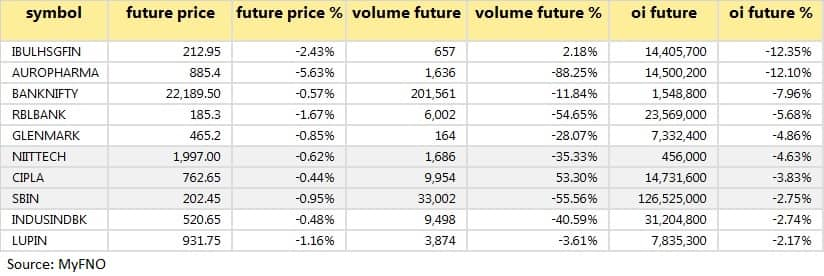

24 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

26 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

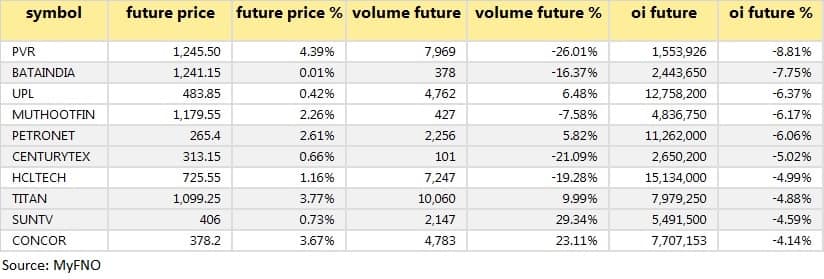

48 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

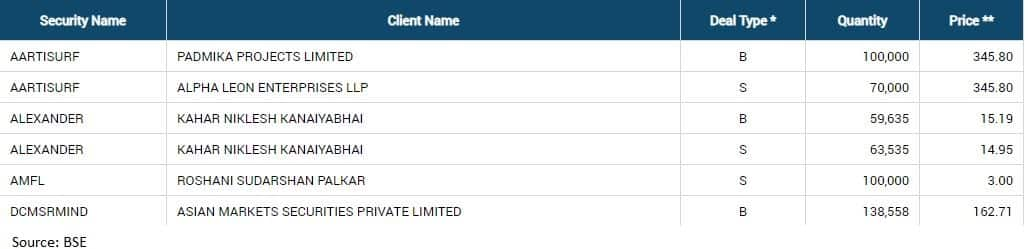

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 14Hindalco Industries, NTPC, Glenmark Pharmaceuticals, Berger Paints, Bodal Chemicals, Borosil, Clariant Chemicals, Dilip Buildcon, Dollar Industries, Emkay Global, Finolex Cables, Fortis Healthcare, Greenply Industries, HG Infra Engineering, IIFL Wealth Management, Indian Bank, MRF, Nagarjuna Fertilizers, New India Assurance Company, Ramco Cements, Sun TV Network, United Breweries, Varroc Engineering, Voltas, VRL Logistics, Zuari Global, etc.

Stocks in the newsBPCL: Q1 net profit stood at Rs 2,076 crore on account of operating income but the COVID-19-led lockdown hit demand, which resulted in a falling gross refining margin (GRM).

Eicher Motors: Q1 loss at Rs 55.2 crore versus a profit of Rs 451.8 crore, revenue at Rs 818.2 crore versus Rs 2,381.9 crore YoY.

City Union Bank: Q1 profit at Rs 154.3 crore versus Rs 185.6 crore, net interest income (NII) at Rs 437 crore versus Rs 416.8 crore YoY.

Redington: Q1 profit at Rs 99 crore versus Rs 110.2 crore, revenue at Rs 10,697.1 crore versus Rs 11,674 crore YoY.

SpiceJet: July passenger load factor at 70 percent versus 68 percent in June. July market share at 15.7 percent versus 16.8 percent in June.

InterGlobe Aviation: IndiGo July passenger load factor stood at 60.2 percent versus 60.7 percent in June. July market share at 60.4 percent versus 52.8 percent in June.

Praj Industries: Q1 loss at Rs 10.5 crore versus profit of Rs 8.8 crore, revenue at Rs 129.5 crore versus Rs 211.6 crore YoY.

Fund flow

FII and DII dataForeign institutional investors (FIIs) bought shares worth Rs 416.28 crore while domestic institutional investors (DIIs) sold shares worth Rs 763.54 crore in the Indian equity market on August 13, as per provisional data available on the NSE.

Stock under F&O ban on NSETwelve stocks -- Ashok Leyland, Aurobindo Pharma, Bata India, Bharat Heavy Electricals (BHEL), Canara Bank, Century Textiles, Glenmark Pharmaceuticals, Indiabulls Housing Finance, Vodafone Idea, Muthoot Finance, Steel Authority of India (SAIL) and Vedanta -- are under the F&O ban for August 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!