Buoyed by FM's announcement of a comprehensive economic package to tackle the coronavirus outbreak, Indian equity markets rallied for the third consecutive day on March 26.

The Finance Minister announced an economic package worth Rs 1.7 lakh crore under the 'Prime Minister Gareeb Kalyan Scheme' with an aim to protect the poor from the economic fallout of the lockdown.

Sensex closed the day 1,411 points, or 4.94 percent, at 29,946.77, while Nifty ended 324 points, or 3.89 percent, up at 8,641.45.

"Market has cheered this fiscal package and now expect relief measures for Corporates, Banks, SMEs, start-ups, etc. It would continue to be highly volatile and would track global markets along with the trend in coronavirus cases globally and locally," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 15 data points to help you spot profitable trades:

Note: The OI and volume data of stocks given in this story are the aggregates of the three-months data and not of the current month only.

Key support and resistance level for Nifty

According to the pivot charts, the key support level is placed at 8,381.22, followed by 8,120.98. If the index continues moving upward, key resistance levels to watch out for are 8,825.37 and 9,009.28.

Nifty Bank

The Nifty Bank index closed at 19,613.90, up 6.13 percent. The important pivot level, which will act as crucial support for the index, is placed at 18,515.84, followed by 17,417.77. On the upside, key resistance levels are placed at 20,560.64 and 21,507.37.

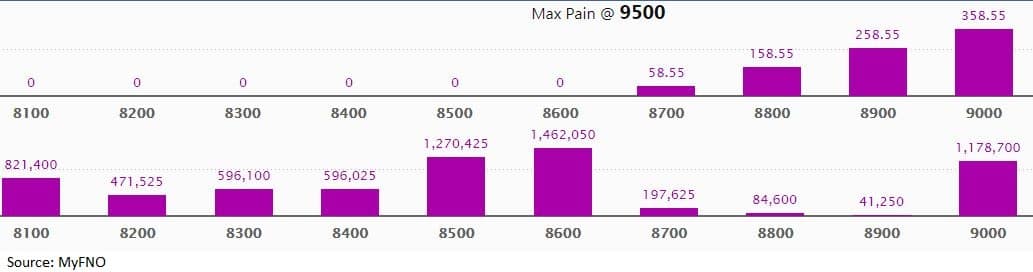

Call options data

Maximum Call Open Interest (OI) of 22.67 lakh contracts was seen at the 9,000 strike price. It will act as a crucial resistance level for the April series.

This is followed by 8,700 strike price, which now holds 16.10 lakh contracts in open interest, and 8,800, which has accumulated 10.60 lakh contracts in open interest.

Significant Call writing was seen at 8,700 strike price, which added 12.13 lakh contracts, followed by 8,800 strike price, which added 4.73 lakh contracts and 9,000 strike which added 2.77 lakh contracts.

Call Unwinding was seen at 8,500 strike price, which shed 6.38 lakh contracts, followed by 8,400 strike, which shed 2.92 lakh contracts and 8,300 strike which shed 2.73 lakh contracts.

Put options data

Maximum Put Open Interest of 14.62 lakh contracts was seen at 8,600 strike price, which will act as crucial support in the April series.

This is followed by 8,500 strike price, which now holds 12.70 lakh contracts in Open Interest, and 9,000 strike price, which has now accumulated 11.79 lakh contracts in open interest.

Put writing was seen at the 8,600 strike price, which added 13.26 lakh contracts, followed by 8,400 strike, which added 4.27 lakh contracts.

Put unwinding was seen at 8,100 strike price, which shed 3.3 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are bullish on the stock.

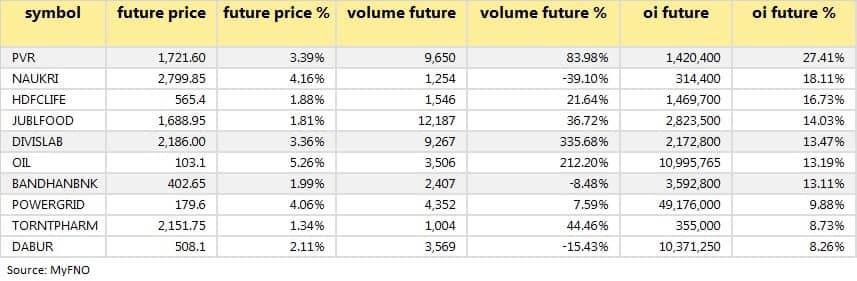

102 stocks saw a long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

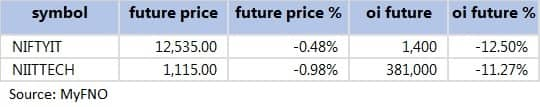

2 stocks saw long unwinding

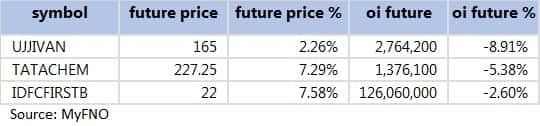

3 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

39 stocks saw a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

Rollovers

Analyst or Board Meetings/Briefings

State Bank of India: The bank's board will meet on March 27 for general purposes.

Relic Technologies: The board will meet on March 27 for general purposes.

Dr. Reddy's Laboratories: The board will meet on March 27 for general purposes.

Ceinsys Tech: The board will meet on March 27 for general purposes.

Modern Threads (India): The board will meet on March 27 to consider and approve quarterly results.

Stocks in the news

Piramal Enterprises: CARE affirmed its AA/Stable credit rating for additional NCD of up to Rs 1,000 cr.

PVR: Vishal Kashyap Mahadevia, Non-Executive Director resigned.

NTPC: Company executed SPA with Govt for the acquisition of THDC India and NEEPCO for Rs 11,500 crore.

Lupin: Company appointed Ramesh Swaminathan as Chief Financial Officer and Head Corporate Affairs.

Arvind Fashions: Company deferred the rights issue due to novel coronavirus.

Sanghvi Movers: ICRA retained company's long-term rating at A-, but revised outlook to Negative from Stable.

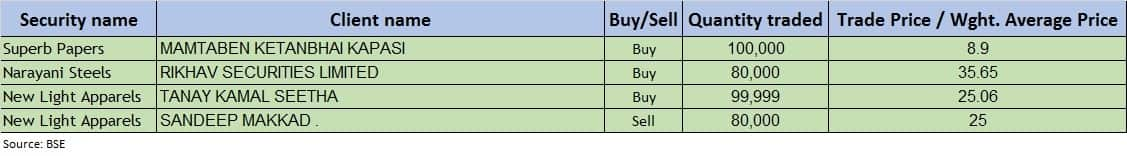

Bulk deals

(For more bulk deals, click here)

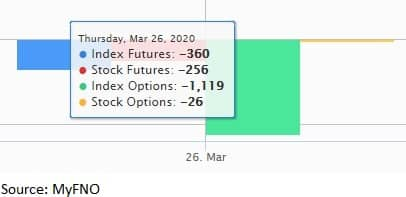

Fund Flow Picture

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth net Rs 484.78 crore, while Domestic Institutional Investors (DIIs), too, sold net Rs 769.93 crore worth of shares in the Indian equity market on March 26, as per provisional data available on the NSE.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!