Investors of many non-banking financial companies (NBFC) have been served with a platter full of problems—tight liquidity, allegations of fraud, a series of defaults and rating downgrades—that has led to erosion of their hard earned wealth.

The share price of DHFL, after hit by rating downgrades, is down by 63 percent so far in 2019 and over 80 percent in the last 12 month. Indiabulls Housing Finance, after allegations of misappropriation of funds, has tanked 18 percent so far in 2019, and about 40 percent in last one year.

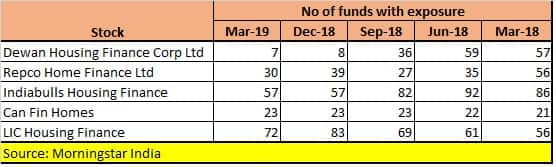

This has also resulted in mutual funds (MF) dumping NBFC stocks to cut their losses. For example, DHFL, which was part of the portfolio of 57 MF schemes in March 2018, no longer enjoyed the same popularity by the end of March 2019. Fifty fund managers completely reduced their exposure to DHFL in one year. A similar trend was seen for Repco Home Finance and Indiabulls Housing Finance which were shunned by various fund managers (see table below).

On the other hand, Can Fin Homes and LIC Housing Finance, which have a solid parentage, saw increased interest from fund managers in the same period.

“Credit markets have been roiling with a series of rating downgrades since August 2018 starting with IL&FS, Zee Group, Reliance ADAG Group and now DHFL,” Rajesh Cheruvu, CIO of WGC Wealth told Moneycontrol.

“This has also led to banks and mutual funds being risk-averse towards non-banking firms. NBFCs with higher real estate lending portfolios have been punished severely. This could have a spiralling impact on mutual funds having exposures to them,” he added.

Table: Numbers of mutual fund schemes exposed to select NBFCs in the last five quarters.

Now the question is what should an investor do with the NBFC stocks in his or her portfolio? Analysts propose moving some money out of NBFCs to more secured private sector banks that have delivered strong growth in March quarter 2019.

Private banks have demonstrated a strong operating performance improvement, with a steep decline in net stressed loans (barring IIB and YES Bank due to IL&FS downgrade/new names added to the stressed pool).

HDFC Bank has maintained steady earnings growth; ICICI Bank and RBL Bank have reported margin expansion; while Kotak Mahindra Bank and DCB Bank have delivered stable margins, Motilal Oswal said in a report.

The recent default by DHFL on interest payment to its debenture-holders followed by its rating downgrade by ICRA and CRISIL has raised fresh concerns on liquidity and growth sustainability of NBFCs.

“Until any concrete steps by RBI and government are announced to resolve the NBFC crisis, we feel it is better to avoid taking any exposure to this sector, especially in smaller NBFCs, which have weaker balance sheet and run the similar risk of default going forward,” Jayant Manglik, President - Retail Distributor, Religare Broking Ltd told Moneycontrol.

“However, one can consider investing in larger and better-rated NBFCs like HDFC, Bajaj Finance and LIC Housing Finance, as they would be less impacted by the on-going issue due to liquid balance sheet thus enabling them to focus on growth going forward,” he said.

Manglik further added that investors can look to switching over a part of the NBFC portfolio from smaller and risky NBFCs to private sector banks with strong growth prospects. “Some of the prominent names that can be considered for investment include HDFC Bank, ICICI Bank, Axis Bank, and RBL Bank,” he added.

Umesh Mehta, Head of Research, SAMCO Securities thinks otherwise. He told Moneycontrol that investors who are holding NBFCs in their portfolio should not panic sell at current levels instead they should wait for the tide to pass.

“Since NBFC stocks have already faced the wrath of the liquidity gods, selling these shares at the current levels will do no good to an investor,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!