Bears retained their control on Dalal Street for yet another week ended July 19, thanks to heavy selling pressure in last two trading sessions. It dragged benchmark indices to two-month low breaking psychological levels like 11,500 on Nifty and 39,000 on Sensex.

Pre-existing factors such as economic and consumption slowdown, consistent FII selling after Finance Minister Nirmala Sitharaman denied to tweak surcharge on the super-rich and relentless asset quality concerns added more fuel to the fire.

The BSE Sensex slipped 1.03 percent to 38,337.01 and Nifty50 declined 1.15 percent to 11,419.25 as selling was seen across sectors barring IT (which up 1 percent). The broader markets too were hit badly with the Nifty Midcap and Smallcap indices falling around 4 percent each amid disappointing earnings from some companies.

After shedding around 4 percent since the Budget day, the market looks oversold so there could be some short covering-led rebound initially but overall there could be more volatility amid cautious trend and F&O expiry week, along with more stock-specific action due to earnings in the coming week, experts feel.

"The markets are expected to be volatile in the near term on account of eclectic events viz., US Fed policy meeting scheduled on July 30/31, the progress of monsoon and results of various companies. Though the slowdown issues could drag the markets in the medium term, it offers an opportunity for long term investors who have an investment horizon of more than 3 years," Arun Thukral, MD & CEO, Axis Securities told Moneycontrol.

Jagannadham Thunuguntla, Senior VP and Head of Research (Wealth) at Centrum Broking said with the crisis deepening and widening, markets are eagerly hoping that policymakers can talk-up the markets with market-friendly tones.

Going forward, Fed's policy holds key to revive the market sentiment if they can provide delight with 50 bps rate cut, he added.

The week beginning July 27, the market will first react to Reliance Industries (RIL) and HDFC Bank's results.

Here are 10 key things that will keep traders busy this week:

Earnings season, so far, has been steady except for a few banks reporting slight weakness in asset quality. Largely Reliance Industries, RBL Bank, ACC, Dabur India, Bandhan Bank, Colgate Palmolive, InterGlobe Aviation and HDFC AMC reported a good set of numbers while Yes Bank, Wipro and Mindtree disappointed street.

In the coming week, about 250 companies will announce their June quarter earnings including Nifty50 companies like Kotak Mahindra Bank, Hindustan Unilever, Asian Paints, L&T, Zee Entertainment, Bharti Infratel, Tata Motors, Bajaj Finance, Maruti Suzuki, Bajaj Auto and ICICI Bank.

United Spirits, DHFL, Oriental Bank of Commerce, TVS Motor, ICICI Securities, Just Dial, Jyothy Labs, Torrent Pharma, SBI Life, NIIT Technologies, M&M Financial Services, HDFC Life, Indian Overseas Bank, Quess Corp, Security & Intelligence Services, ICICI Prudential, Syngene International, Oberoi Realty, IDFC First Bank, Canara Bank, Jubilant Foodworks, Reliance Nippon Life, Syndicate Bank, Karur Vysya Bank, Crompton Greaves Consumer, Tata Steel BSL, Bank of Baroda, Ambuja Cements, Biocon, Bajaj Finserv, Persistent Systems, PVR, AU Small Finance, South Indian Bank, JSW Steel, Polycab India, ABB India, GIC Housing Finance, Vedanta, Teamlease Services, Mahindra Lifespace, Havells India and Escorts among others will also declare their quarterly earnings this week.

After better-than-expected earnings by Dabur India given current environment, all eyes will be on earnings of FMCG major Hindustan Unilever which is scheduled to be released on July 23.

According to brokerage houses' estimates, the revenue growth could be in the range of 7-10 percent YoY on the back of around 6 percent volume growth in June quarter despite an expected slowdown in rural demand. This along with cost-saving measures and operating leverage could boost operating income and profit.

The volume growth in June quarter last year was 12 percent and in March quarter it was 7 percent. Considering weak rural demand, 6 percent is satisfactory, brokerages said.

Engineering & infrastructure major Larsen & Toubro will also declare its quarterly earnings on July 23, which are expected to be good on the back of execution but the order inflow could be muted compared to year-ago, brokerages feel.

"L&T received reasonable order inflows in the range of Rs 13,000 crore-21,500 crore, which includes more than Rs 2,500 crore in hydrocarbon, more than Rs 7,000 crore in power, over Rs 3,500 crore in water & effluent treatment segment. Order intake during the quarter was impacted by slower pace of order awarding during general elections coupled with muted private capex," ICICI direct said.

The brokerage further said L&T's order backlog suggests better execution rate in the domestic market in Q1FY20E and FY20. Consequently, it expects the company's standalone revenue to grow 10.2 percent, EBITDA to grow 13.5 percent with margin expansion.

Kotak, too, expects 10 percent growth in core EPC execution in Q1FY20 driven by infrastructure segment (11 percent), defence engineering, and heavy engineering, but it said power, E&A and others segments could drag down revenue growth.

The auto sector is expected to report weak earnings for another quarter in Q1FY20 due to decline in volume amid subdued demand, tight liquidity, rising buying cost and pollution norms.

Hence, the sharp fall in vehicle sales is expected to reflect in all parameters from topline to bottomline levels, brokerages feel.

Nifty Auto index fell nearly 5 percent against 1.5 percent increase in Nifty50. Tata Motors was down 6.7 percent and Maruti Suzuki 2 percent during the quarter.

According to brokerages, Tata Motors is likely to report a loss of more than Rs 1,200 crore in June quarter 2019 and around 16 percent decline in consolidated revenue due to 22 percent fall in standalone (domestic) volumes and around 16 percent dip in JLR volumes YoY.

Key issues to watch out for would be current demand trends for JLR and outlook for key markets, update on cost-cutting initiatives at JLR, demand trend in domestic markets and new product launch, and impact of forex hedge loss.

In the case of Maruti Suzuki, brokerages expect double-digit decline across parameters due to 18 percent YoY degrowth in volumes. "Revenues are expected to decline by 14 percent YoY in Q1FY20, which will be offset by 4 percent YoY increase in ASPs due to an increase in costs owing to new safety regulations," Kotak said.

Kotak further expects EBITDA to decline by 42 percent YoY in Q1FY20 led by rise in commodity costs, negative operating leverage and high fixed costs in the Gujarat plant due to low volumes.

The country's largest private sector lender is expected to report strong profits in June quarter with improvement in asset quality, on July 27. The loan book as well as NII both may grow double-digits YoY but net interest margin may contract a bit sequentially due to increasing funding cost.

"We expect core earnings (base quarter had stake sale gains of ICICI Life) trajectory to remain strong at around 15 percent YoY, led by healthy loan growth (around 15 percent YoY) and better NII growth (19 percent YoY). NIM will decline QoQ by around 10bps due to lower one-offs," said Kotak which expects profit at Rs 1,393.1 crore against loss of Rs 119.6 crore in Q1FY19.

The brokerage expects reduction in gross NPLs on the back of write-offs. "Credit costs will decline QoQ led by lower slippages (around below 1.7 percent of loans, primarily from agriculture). Below investment grade portfolio would decline QoQ and coverage ratio would improve QoQ," it said.

Key things to watch out for would be outlook on asset quality and trend on further relapse from restructured loans, and growth in CASA + retail term deposits.

FIIs & DIIs

FIIs sold around Rs 3,000 crore worth of shares during last week, taking total net July outflow to around Rs 8,000 crore thanks to Finance Minister putting surchage on super-rich in Budget and concerns over consumption slowdown along with asset quality headwinds. This was against consistent buying worth Rs 79,000 crore in previous five consecutive months, as per data available on Moneycontrol.

On the other hand, domestic institutional investors remained net buyers to the tune of around Rs 6,500 crore, lending major support to the market.

Hence going forward, the key thing to watch out for would be any revival in FII flow which could be possible only if Federal Reserve cut interest rate in coming policy meetings to support US economic growth and if June quarter earnings season hints at a major recovery in coming quarters or any major policy change to boost consumption/growth.

Technical Outlook

The Nifty50 has broken crucial support levels of 11,600 and 11,500 on closing basis, and even 11,400 intraday in the week gone by and formed bearish candle on the weekly scale.

With the Nifty correcting sharply, the bears seem to be in control and the sentiments are so bearish that the index could break 11,300 levels, though there is a possibility of relief rally initially in the coming week, experts feel.

"The weekly price action for Nifty resulted in a sizable bear candle with lower high and lower low, signalling continuation of negative bias. Breach of key rising trend line (placed at 11,530) and lack of faster retracement of preceding declining legs makes us believe that Nifty is heading towards 11,300 levels, while stock-specific action would continue as we sail through Q1FY20 earnings and derivatives expiry of July 2019 series," Dharmesh Shah, Head – Technical at ICICI direct told Moneycontrol.

He said for the first time since October 2018, the index has retraced its preceding major rally by more than 61.8 percent, indicating extended consolidation going ahead. This development coupled with the shallow nature of pullbacks led him to believe that 11,600-11,650 will act as key hurdle going forward as it is the low of Exit poll session and recent breakdown area.

F&O Expiry

On the option front, maximum Put open interest (OI) is at 11,300 followed by 11,400 strike, which could act as support levels in near term while maximum Call OI is at 11,600 followed by 11,700 strike which could be resistance levels.

We have seen Put writing at 11,400 and 11,350 strike while meaningful Call writing is at 11,500 followed by 11,600 strike.

Hence, a major shift in OI concentration suggests a shift in lower trading range in between 11,300 to 11,600-11,700 zones and which could also be a range for coming F&O expiry week, experts feel.

"The Nifty succumbed to FII selling pressure and declined from the highest Call base of 11,700, which remains a short-term hurdle for the market on intermediate pullbacks. The index is heading towards 11,300 Put strike, which gained open interest since the Budget day," Amit Gupta of ICICI direct said.

"Nifty future premium has reduced in the last couple of weeks. This translates into current profit booking trend in the market. It may still take some time for the index to start getting the momentum back," he added.

India VIX moved up by 4.29 percent from 12 to 12.51 levels in the last week. Volatility index is at the lowest levels of the last 15 months even after a sharp cut of 300 points.

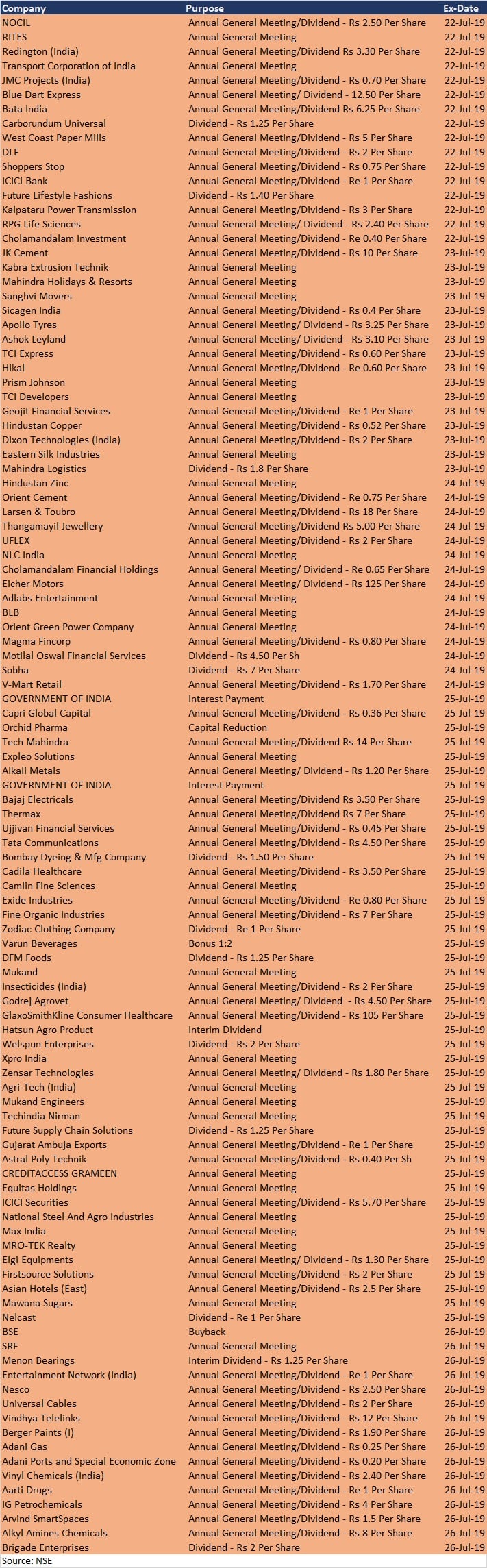

Corporate Action

Global Cues

Apart from following macro data points, globally investors will also closely watch US-China trade developments and geo-political tensions, along with being ready for commentary and interest rate decision by US Federal Reserve towards the end of this month.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!