Indian market had a volatile week, with recovery setting in the last two trading sessions. While the Sensex rallied over 200 points, the Nifty reclaimed 12,200 levels on January 24.

For the week, the Sensex closed 0.79 percent lower, the Nifty ended with losses of 0.84 percent. The Nifty Midcap rose 1.6 percent for the week.

Technically, the weakness in the near term shall resume on a close below 12,100. But, a pre-Union Budget rally could take the indices higher, say experts.

Nifty50, after opening lower at 12,174.55, hit an intraday low of 12,149.65 but immediately recouped those losses and gained momentum as the day progressed. The index hit a day's high of 12,272.15 in the last hour of trade and closed 67.90 points higher at 12,248.30.

Bank Nifty managed to surpass its previous day's high and extended its gains towards 31,375 levels. The index closed 0.77 percent higher at 31,241.80 and formed a bullish candle on a daily scale while Bearish Candle on a weekly scale which suggests dips are being bought into; while supply is visible at higher levels.

"Volatility is likely to stay higher ahead of the upcoming Union Budget 2020," Chandan Taparia, Vice President and Analyst-Derivatives at Motilal Oswal Financial Services said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 12,174.53 followed by 12,100.87. If the index continues moving up, key resistance levels to watch out for are 12,297.03 and 12,345.87.

Nifty Bank

The important pivot level, which will act as crucial support for the index, is placed at 30,955.46 followed by 30,669.13. On the upside, key resistance levels are placed at 31,451.76 and 31,661.73.

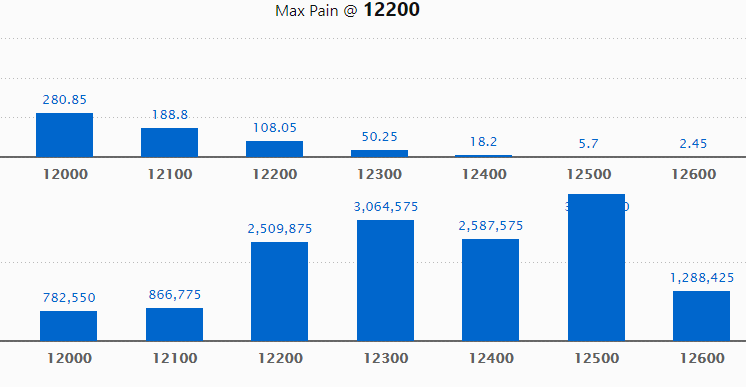

Call options data

Maximum call open interest (OI) of 37.11 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the January series. This is followed by 12,300 strike price, which holds 30.64 lakh contracts in open interest.

Call writing was seen at the 12,500 strike price, which added 1.69 lakh contracts, followed by 12,800 strike price that added 67,200 contracts.

Call unwinding was witnessed at 12,200 strike price, which shed 6.46 lakh contracts.

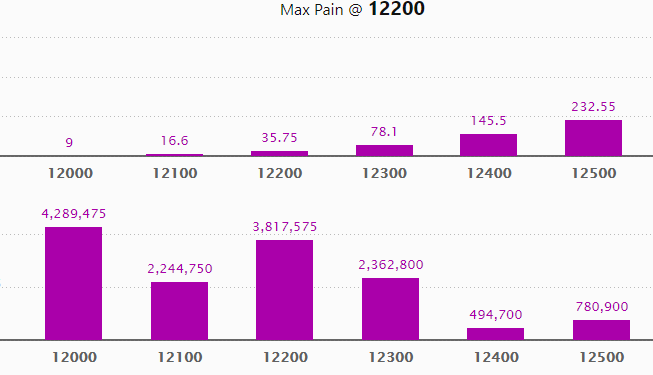

Put options data

Maximum put open interest of 42.89 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the January series. This is followed by 12,200 strike price, which holds 38.17 lakh contracts in open interest, and 11,800 strike price, which has accumulated 24.36 lakh contracts in open interest.

Put writing was seen at the 12,200 strike price, which added 10.6 lakh contracts, followed by 12,300 strike, which added 5.41 lakh contracts.

Put unwinding was seen at 11,700 strike price, which shed 1.98 contracts.

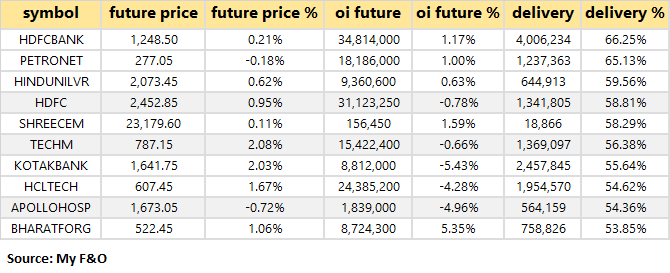

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

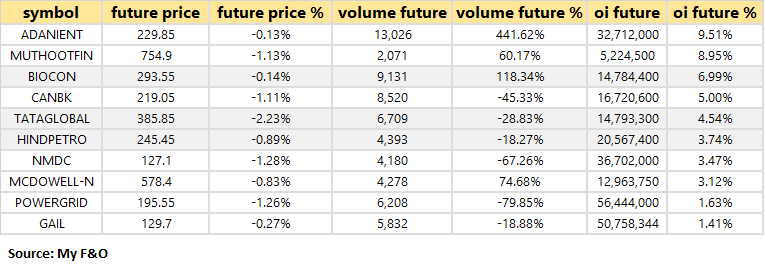

57 stocks saw a long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

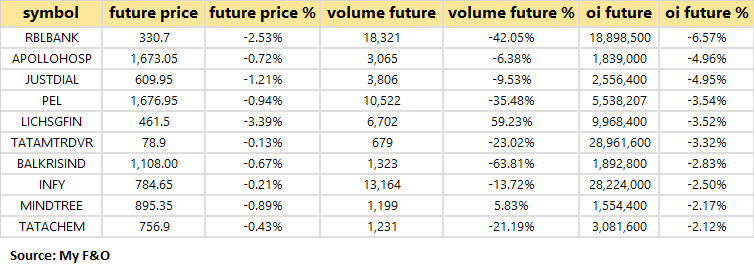

17 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

21 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

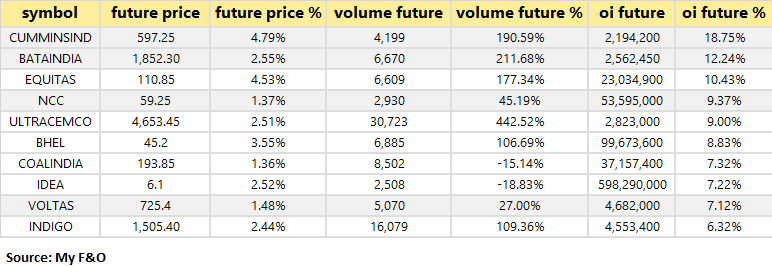

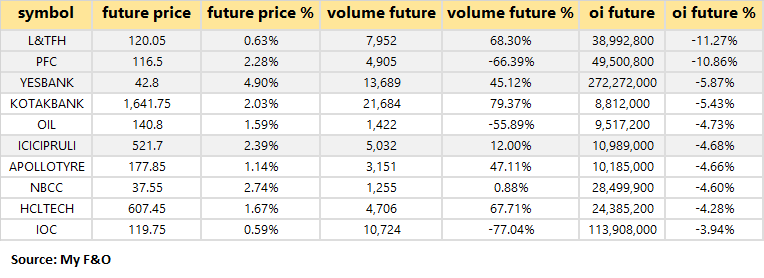

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

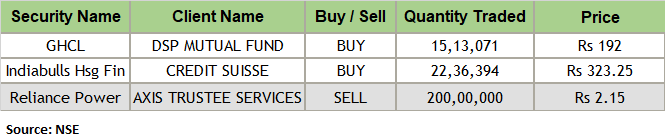

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Bajaj Finance: Meeting of the Board of Directors of the company is scheduled to be held on January 29, 2020, to consider the unaudited financial results for the quarter and nine months ended December 31, 2019 and will also consider raising of funds by issue of non-convertible debentures as a part of the proposed increase in the overall borrowing limit.

Vedanta: To consider and approve the financial results for the period ended December 31, 2019.

Future Consumer: To consider and approve the financial results for the period ended December 31, 2019.

BF Utilities: To consider and approve the financial results for the period ended December 31, 2019.

Stocks in news

Results on January 27: Dr Reddy's Labs, CCL Products, HCL Infosystems, InterGlobe Aviation, Mahindra Life, Navin Fluorine, Shanti Gears, Torrent Pharma, V2 Retail and Wockhardt.

ICICI Bank Q3: Bank posted healthy year-on-year (YoY) growth in Q3FY20 profit, on the back of lower provisions and recoveries from non-performing loans (NPLs). Net profit increased significantly to Rs 4,146.46 crore, while NII grew by 24.3 percent to Rs 8,545.32 crore, YoY.

DCB Bank Q3: Net profit up 12.3 percent at Rs 96.7 crore against Rs 86.10 crore YoY. NII up 10 percent at Rs 323.1 crore against Rs 293.6 crore YoY.

Strides Pharma: Company said the US health regulator has completed inspection of its Alathur facility in Tamil Nadu with zero observations. "This is the second consecutive Zero 483 inspection for the site," Strides Pharma Science said in a filing to the BSE.

Wendt Q3: Wendt India Ltd on January 24 recorded consolidate profit after tax at Rs 2.20 crore for the October-December quarter. For the nine month period ending December 31, 2019, net profit after tax was at Rs 10.80 crore as against Rs 15.41 crore.

Siemens: Company said it has inked an agreement to acquire 99 percent equity in New Delhi-based C&S Electric for around Rs 2,100 crore.

Bank of Baroda: Bank of Baroda posted a loss of Rs 1,407 crore for the quarter ended December 2019. Numbers missed the estimates of an analysts poll conducted by CNBC-TV18 that pegged profit at Rs 645.2 crore for the quarter.

JSW Steel: Lower price realisation dented net profits of India's leading steelmaker JSW Steel by 88 percent in the third quarter. JSW Steel had a net profit of Rs 187 crore in the October to December quarter, as compared to Rs 1,603 crore in the same quarter a year earlier.

TVS Motor Company: Launches its first electric two-wheeler, The iQube Electric at Rs 1.15 lakh

Vodafone Idea: India Ratings cuts company's long-term rating to BBB- from BBB

APL Apollo Tubes Q3: Net profit at Rs 83.3 crore against Rs 12.9 crore YoY. Revenue at Rs 2,115.9 crore against Rs 1,691.2 crore YoY

Reliance Capital: Payment of NCD interest and principal obligations due on January 24, delayed

Reliance Infra: Company says CARE Ratings revised rating of NCDs of the company to ‘CARE D; Issuer Not Cooperating’

CG Power: Company says to seek removal of joint auditor SKK Mankeshwar & Co. Came across unexplained payments made to M/SKK Mankeshwar & Co

Cipla: US FDA completes cGMP inspection at company's Bommasandra unit W/4 observations

Prestige Estates Q3: Consolidated net profit at Rs 216 crore against Rs 67.4 crore YoY. Consolidated revenue at Rs 2,680.9 crore against Rs 1,053.5 crore YoY.

EIH Q3: Consolidated net profit went up 5.3 percent at Rs 95 crore against Rs 90.3 crore YoY.

Axis Bank: Proposes to raise funds up to Rs 5,000 crore via NCDs.

Bajaj Finance: Board to mull raising funds via NCDs on January 29.

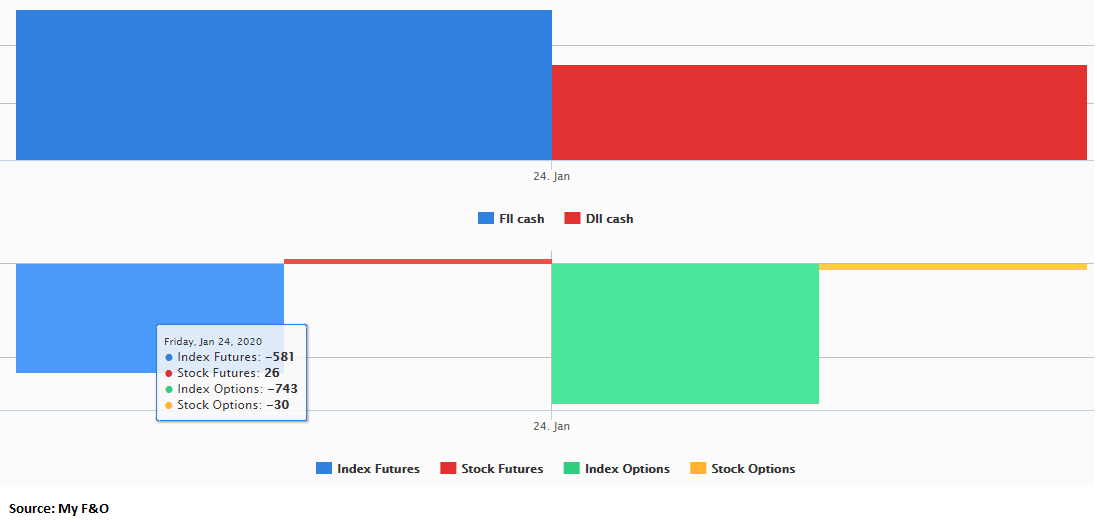

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 659.11 crore, while domestic institutional investors (DIIs) sold shares of worth Rs 417.96 crore in the Indian equity market on January 24, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for January 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!