The general insurance industry ended FY20 with a gross direct premium year-on-year (YoY) growth of 11.7 percent. Data from the Insurance Regulatory and Development Authority of India (IRDAI) showed that the non-life insurers collected premiums of Rs 1.89 lakh crore.

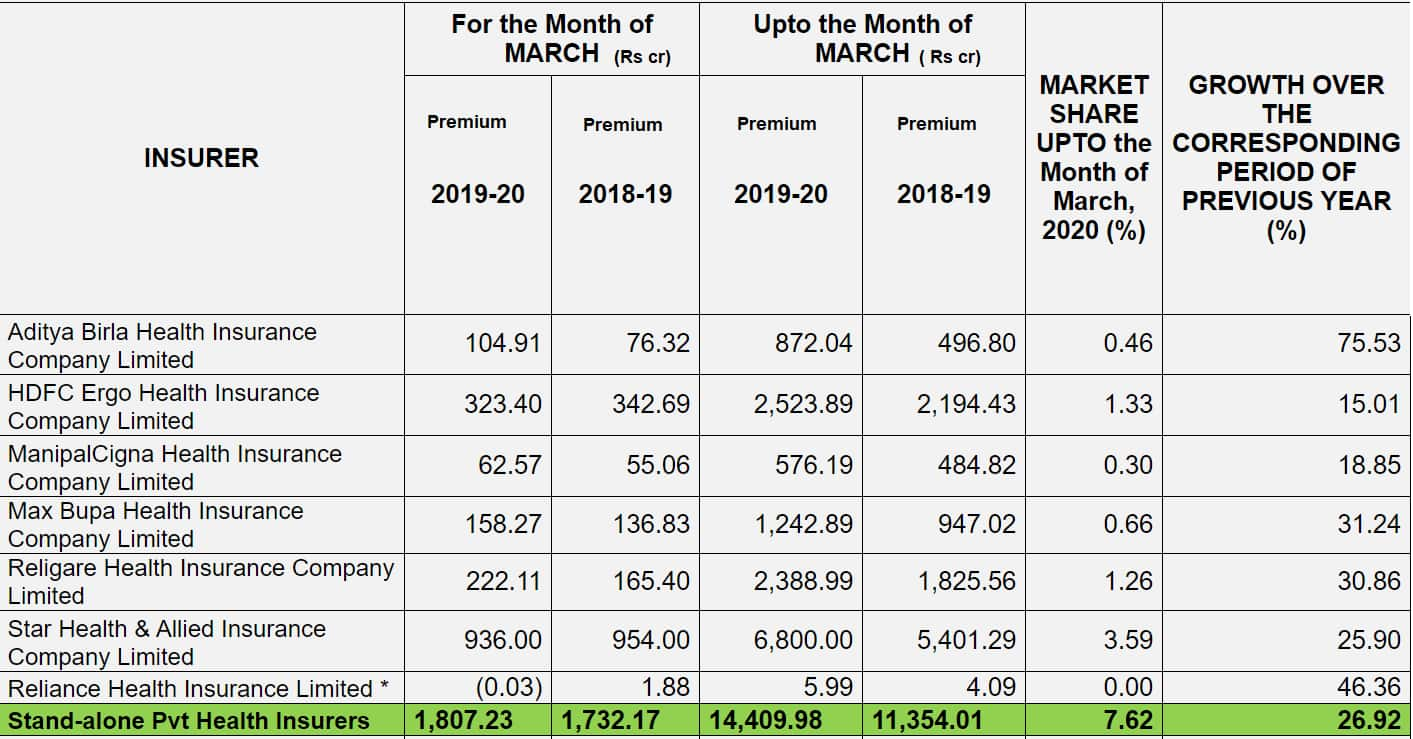

Among the different categories, standalone health insurers saw a 27 percent YoY growth with gross direct premium of Rs 14,409.98 crore in FY20. This could be a reflection of the uptake in purchase of health insurance products amidst the Coronavirus (COVID-19) outbreak.

Source: IRDAINote: Reliance Health is now merged with Reliance General

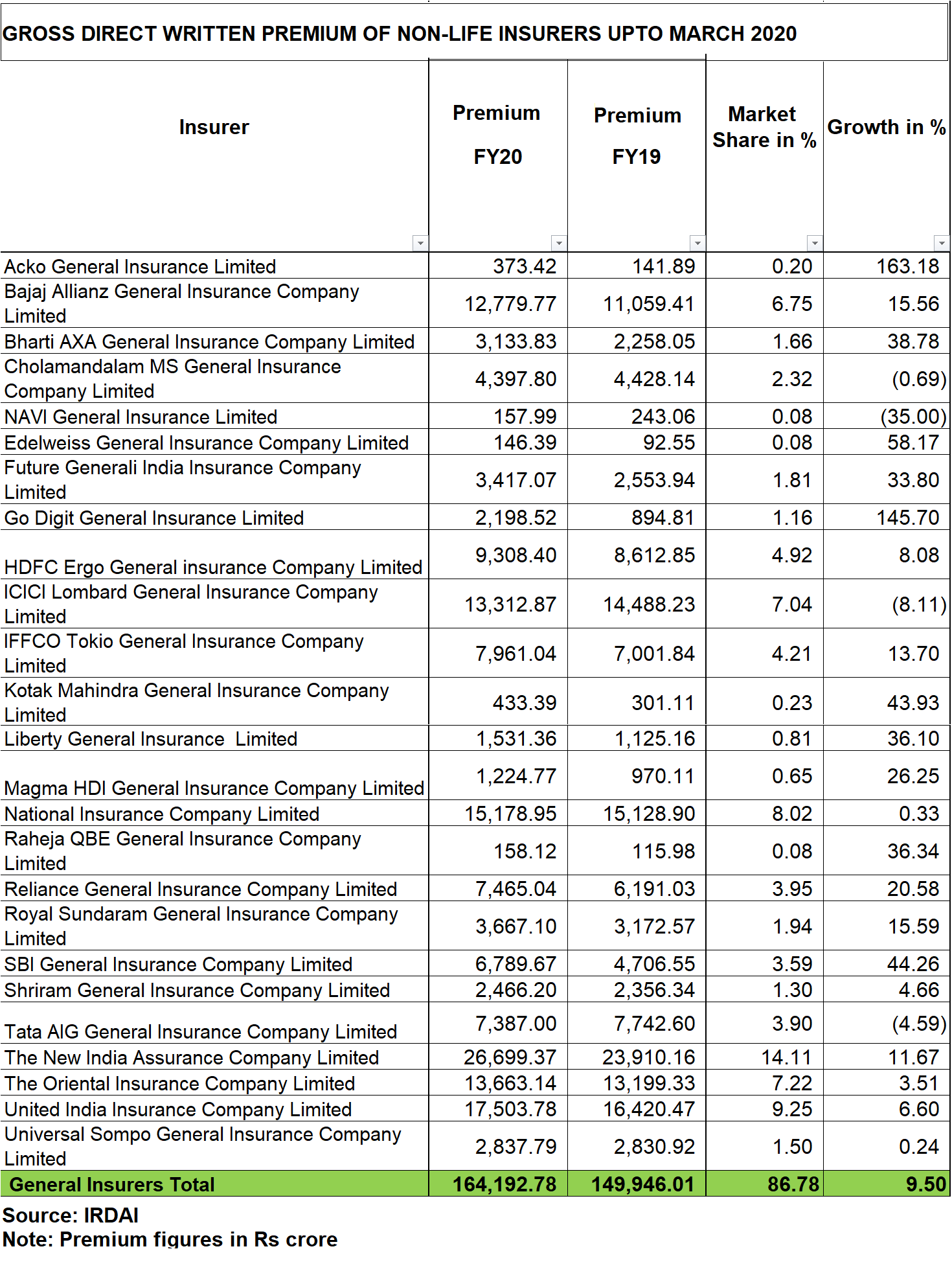

The other non-life insurers (excluding specialist insurers) saw a 9.5 percent YoY growth in gross premiums. Here, New India Assurance was the largest company in the sector with premium of Rs 26,699.37 crore, growing YoY by 11.7 percent.

With respect to the private sector general insurers, ICICI Lombard General Insurance posted a YoY decline of 8.1 percent in premium collection for FY20 at Rs 13,312.87 crore. The insurer has been seeing a decline in premium collection since a decision was taken to not take crop insurance business.

Specialist insurer Agriculture Insurance Company that only writes crop insurance business saw a 38.2 percent rise in gross direct premium to Rs 9,537.58 crore.

Industry sources said that the premium collection was impacted due to the lockdown announced by the government amidst the COVID-19 pandemic. Bank branches which are a major source of policy sales were operating with skeletal staff while agents were unable to travel to meet prospective clients due to transport restrictions.

While policy sales continue online for retail products like health, personal accident and motor insurance, for niche corporate policies face-to-face interactions are preferred before buying an insurance product.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!