Getty Images

Getty ImagesGoing ahead, the pace of coronavirus infections in the country, and global cues will be key for Indian markets.

“The markets were undecided and finally ended slightly negative, after 6 successive days of gains. The banking index which had driven the gains for the last few days was incidentally the biggest loser in today’s trade,” said Vinod Nair- Head of Research- Geojit Financial Services.

“Global cues were also mixed after Asian markets ended positive but European markets were awaiting details on ECB’s stimulus plans. Domestically, markets still seem to be forward-looking, ignoring the recent quarterly results and economic data, and anticipating a turnaround in the economy,” he added.

BSE barometer Sensex reversed initial gains to settle 129 points 0.38 per cent lower at 33,981, with banking stocks contributing the most to the benchmark’s decline.

Mortgage lender Housing Development Finance Corp (HDFC) was the top drag as it shed 3.95 per cent. Top private lender HDFC Bank followed next, with a 1.84 per cent decline. Rivals Kotak Mahindra Bank and ICICI Bank dropped 3.67 per cent and 2.47 per cent, respectively.

In the 30-pack index, 15 shares advanced and 15 declined with Tech Mahindra as the best performer and Asian Paints as the worst.

Agencies

AgenciesPeer Nifty shed 32 points to close at 10,029 points.

The broader market declined but managed to outperform the benchmark. BSE Midcap and BSE Smallcap dropped 0.06 per cent and 0.05 per cent, respectively.

BSE Bankex was the top sectoral loser as it shed 2.70 per cent, while BSE Finance index dropped 2.54 per cent. BSE Telecom index, on the other hand, was the top sectoral gainer as it advanced 3.47 per cent.

Telecom major Bharti Airtel rallied 3.89 per cent in late trade after reports that Amazon.com is in early-stage talks to buy a stake worth at least $2 billion in mobile operator.

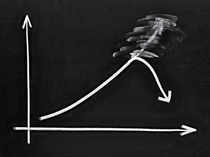

From here, the path of the market in the near-term was uncertain.

“Technically, the Nifty has made a lower top compared to June 3 but did not close at the intraday low. Hence it continues to give mixed signals after registering large gains over the last 6-7 days,” said Deepak Jasani, Head Retail Research, HDFC Securities.

MARKET AT A GLANCE

- Sensex drops 0.38% or 129 points to 33,981

- Nifty sheds 0.32% or 32 points to 10,029

- Half of Sensex stocks close lower

- Top Sensex losers: Asian Paints down 4.85%, Bajaj Finance 4.13%

- Top Sensex gainer: Tech Mahindra up 5.34%, Sun Pharma 3.98%,

- Market breadth marginally favours the bulls; advance-decline ratio 1.1:1

- BSE Midcap index down 0.06%, BSE Smallcap 0.05%

- Sectoral Space: Bankex top loser, falls 2.70%; RBL Bank drops 6.31%, City Union Bank 5.16%

- BSE Finance index down 2.54%; Cholamandalam Investment down 8.41%, Bandhan Bank 6.47%

- BSE Telecom top gainer, up 3.47%; Vodafone Idea up 6.41%, Tejas Networks 4.98%

- Bharti Airtel jumps 3,89% on Amazon $2 billion stake buy report

- Multiplex operators Inox Leisure, PVR rally 15.49%, 6.63%, respectively

Sensex snaps 6-day winning streak to end 129 pts lower, Nifty below 10,050

WHO MOVED MY MARKET

- Traders locked in gains

- Mixed world markets

The pan-European STOXX 600 index slipped 0.4 per cent, while MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.43 per cent

- Record spike in Covid-19 cases

- Tech Glitch

WHAT TO WATCH OUT FOR

- Speed of rising coronavirus cases will also be keenly watched.

- Investors will also keep an eye on the riots in the USA.

- The developments over souring US-China ties will be closely watched.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times