After touching record highs in January 2018, Nifty Midcap and Smallcap have continued to underperform the frontliners. As a result, the valuations appear attractive. Nonetheless, not every stock has the untapped potential, especially in the light of issues such as the recent slowdown, corporate governance concerns, asset quality concerns, liquidity crisis, weak earnings among others.

Despite the fiscal stimulus provided by the government, including the corporate tax cut, more than 70 percent stocks in the Nifty Midcap 100 are trading in the red zone.

The Midcap index hit a record high of 21,840.85 on January 15, 2018, and since then it has lost 25 percent of its value, while the Smallcap index shed nearly 41 percent in the same period. On the contrary, the benchmark index Nifty50 jumped 7 percent.

Out of 70 midcaps, the top 30 stocks are still down between 40-95 percent from January 2018 highs; and the next 30 stocks showed 20-40 percent fall. These include Bharat Forge, Bharat Electronics, Engineers India, Cummins India, Tata Power, Apollo Tyres, IDFC First Bank, RBL Bank, LIC Housing Finance, Escorts among others.

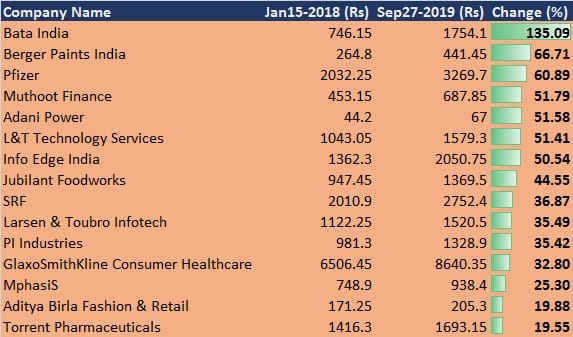

However, there are a few stocks that have shown resilience and have managed to outperform significantly in the face of mounting concerns over the last 20 months.

Bata India was the biggest gainer among the midcap kitty between January 15, 2018, to September 27, 2019, rallying more than 135 percent. Other major gainers include Berger Paints (66.71 percent), Pfizer ( 60.89 percent), Muthoot Finance (51.79 percent), Adani Power (51.58 percent), L&T Technology Services (51.41 percent) among others.

Note: It is just an interpretation of data and not a recommendation.

Stable earnings and fundamentals, positive global conditions (for few sectors), improved consumer demand played key support for above stocks, experts say.

After a prolonged slowdown, the government finally took stock of the situation, introducing key measures including a 10 percent cut in the corporate tax rate, offering some respite to the investors.

Hence, experts expect most of the midcaps, as well as, the smallcaps to rally and even to outperform the largecaps, albeit not immediately. This is because the slowdown seen in the past was so severe that the benefits of these measures will be seen only after a couple of quarters.

"Generally, in the first leg of a bull market, top quality frontline stocks move first, thereafter, when the bullish sentiment spreads wider and deeper, only then small and midcaps find favour from investors, given that risk appetite by that time is increased and the largecap stocks are pricier. As and when the bull market develops, the midcap shares will perform," Umesh Mehta, Head of Research, SAMCO Securities told Moneycontrol.

Ajit Mishra, Vice President Research at Religare Broking said the sharp decline in midcap and smallcap stocks from 2018 has definitely alleviated valuation concerns. However, the slowdown in the economy and corporate governance issues in certain companies has somewhat restricted the outperformance of midcaps versus frontliners, he added.

Going forward, he believes the rally in midcaps would not be broadbased, as witnessed in 2017, but it would be limited to companies with the sound fundamental track record, healthy growth prospects and no corporate governance issues.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!