June quarter failed to revive investor sentiment with signs of slowdown seen across sectors. The overall net profit of Nifty companies after excluding banks fell by over 5 percent coupled with contraction in operating margin.

The management commentary continued to highlight growth concerns amid a slowdown in consumptions and muted capex. On a quarter-on-quarter basis, Nifty NER (the number of upgrades minus the downgrades divided by total stock) deteriorated and stood at negative 10 percent for FY20, Elara Securities said in a report.

The brokerage firm also downgraded Nifty EPS for FY20 to Rs 582, and FY21 to Rs 701 from the past quarter, primarily due to auto, energy and IT.

At the current levels, FY20 and FY21 EPS reflects 17.6 percent and 20.5 percent growth over FY19 and FY20, respectively, hinging largely on earnings expansion in banks, healthcare and industrials.

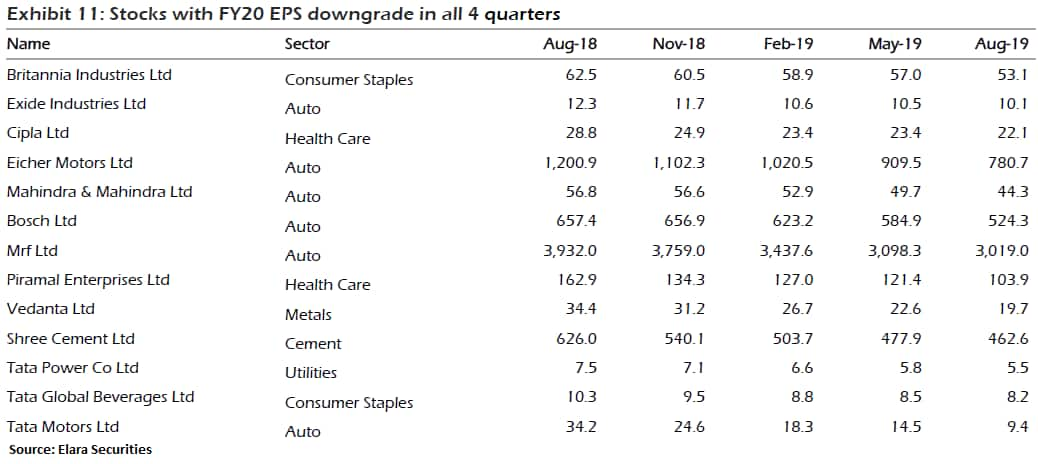

Most brokerage firms have downgraded EPS estimates for Nifty. There are as many as 28 stocks in BSE100 that saw FY20 EPS downgrades in the last four quarters.

Stocks that saw EPS downgrades include Britannia Industries, Exide Industries, Cipla, Eicher Motors, M&M, Bosch, MRF, Vedanta, Shree Cements, Tata Power, Tata Motors, Shriram Transport, Lupin and Avenue Supermarts, among others.

“Earnings downgrades creates a negative perception about the stock and temporarily clouds the earnings visibility beyond the next few quarters. Generally speaking, investors need to evaluate whether such earnings downgrades are temporary in nature or are likely to continue for a significant period of time,” Saurabh S Jain, MD, SSJ Finance & Securities said.“Earnings/EPS downgrades implies that the market is likely to be disappointed with future earnings of the company, which at times leads to the vicious cycle of de-rating in price-earnings multiples as well for the company,” he said.

The consistent downgrades reflect the state of the economy that is showing signs of cooling off or a slowdown. Most global rating agencies have also cut the growth forecast for India for FY20.

But, given the fact that the slowdown is largely external, investors could use the opportunity to buy stocks that are impacted but at the same time have strong fundamentals.

“I think it can be an opportunity for investors to start buying/accumulate (small quantities on dips) in some of these stocks with a good track record and otherwise sound fundamentals,” Romesh Tiwari, Head of Research, CapitalAim, said.

“Many of these stocks, from the auto sector, are getting beaten down due to the economic slowdown and may take a long consolidation period before meaningful revival. I will advise buying in Tata Motors, Exide, Eicher Motors and Mahindra & Mahindra on dips for a long term return of 20-25 percent or more from these levels,” he said.

Other Parameters

EPS downgrades immediately affect the valuation of a stock and make a share overpriced for the current market price due to the reduced earning possibility of the company, suggest experts.

When the earning per share (EPS) downgrade results in more than proportionate decrease in the stock price, it starts looking cheaper and makes a case for value buying.

But, if the EPS downgrades are due to some fundamental changes in the industry that can affect the prospects of the business then investors should avoid the stocks, suggest experts.

“Besides EPS and PE multiples, investors need to evaluate their belief in the management’s ability to steer the company back to the growth path given the business environment that it operates in,” says Jain of SSJ Finance & Securities.

“Investors should also attempt to gauge if the earnings downgrades are temporary in nature and whether these have already been priced in by way of price corrections in these stocks. Investors, therefore, need to be very conscious of the time horizon for which they intend to remain invested in these stocks,” he said.

If the investor believes that the earnings downgrades are temporary and may revive during their investment horizon, they should remain invested in these stocks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!