Vidnyan Sawant, AVP - Technical Research, at GEPL Capital

Since the last six weeks, the Nifty50 has been making lower top lower bottom formation and through the previous four weeks it has sustained below its 20-week SMA (simple moving average) at 17,185, which shows bearish sentiment of the index.

On the daily charts, the index has faced strong resistance at 16,500 levels since the last five days, indicating negative undertone of the market.

On the indicator front, the RSI (relative strength index) plotted on the weekly charts is sustaining below 40 mark which shows negative momentum.

The Nifty has immediate resistance placed at 16,500 and 17,000, followed by 17,251 levels. The downside support for the index is placed at 15,671 followed by 15,450 levels.

We feel that the Nifty is in bearish mode. If the Nifty breaches 15,671 levels then it will move towards 15,450 levels in coming days. Our bearish view will be negated if it sustains above 17,251.

Here are three buy calls for next 2-3 weeks:

Gujarat Gas: Buy | LTP: Rs 566.95 | Stop-Loss: Rs 522 | Target: Rs 626 | Return: 10 percent

Gujarat Gas is trading at 9 weeks' high and forming higher top higher bottom formation on the weekly charts. The stock is strongly outperformed the broader market.

We witnessed a volume pick up at every rise in a stock price which shows bullish undertone of the stock. On the daily charts, the stock has given a breakout of horizontal channel pattern and sustained above 50 days SMA (Rs 517) indicating positive strength of the stock.

On the indicator front, the RSI plotted on the daily time frame has sustained above the 60 mark with a higher top higher bottom pattern, indicating increasing bullish momentum in the prices.

Going ahead, we expect the prices to move at higher levels towards Rs 594 post which we might see a move towards Rs 626 levels. We recommend a stop-loss of Rs 522 on daily closing basis.

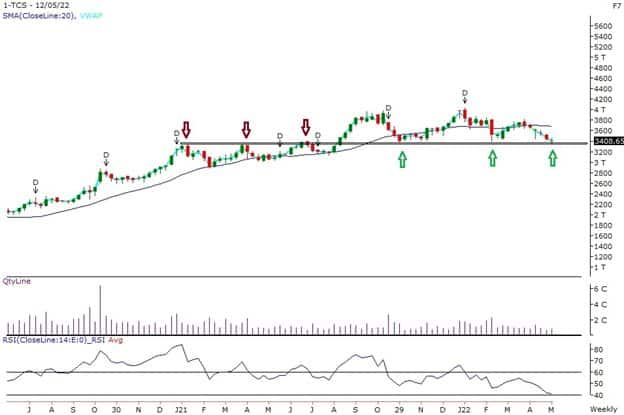

TCS: Buy | LTP: Rs 3,408.65 | Stop-Loss: Rs 3,350 | Target: Rs 3,835 | Return: 13 percent

TCS is sustaining near the major support zone of Rs 3,380 – 3,350 levels with the formation of Doji candlestick pattern. Also the stock is forming CIP pattern (Change in Polarity) at Rs 3,380 levels indicating bottom formation process is going on. The stock is offering favourable risk reward ratio at this juncture.

On the indicator front, the RSI plotted on the daily chart is giving positive diversion at oversold region.

Going ahead, we might see the prices move higher towards Rs 3,676 mark. If the prices manage to sustain above Rs 3,676 mark we might see further up move towards Rs 3,835 level. We recommend a strict stop-loss of Rs 3,350 on daily closing basis.

Avanti Feeds: Buy | LTP: Rs 456.35 | Stop-Loss: Rs 410 | Target: Rs 542 | Return: 19 percent

Avanti Feeds is taking strong support at Rs 400 levels with the formation of Double Bottom pattern on the weekly charts. The stock is sustaining above its previous week high which shows initial sign of bullishness. On the daily chart, the stock has formed Big Bullish candle and outperforming the broader market.

The RSI indicator plotted on the weekly charts is moving upward from oversold region and it is sustaining above 40 mark with the formation of higher low indicating positive momentum of the stock.

We expect the stock to move higher towards Rs 500. And if it manages to cross above Rs 500 then eventually it will move towards Rs 542 levels. One should maintain a strict stop-loss of Rs 410 on daily closing basis for this trade.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!