Earnings are vital from an investor's point of view, and more often than not, the market rewards those companies that post robust quarterly results.

The first quarter of FY20 was no different during which more than 50 BSE500 stocks returned in double-digits driven by the respective companies' strong performance in the preceding quarter.

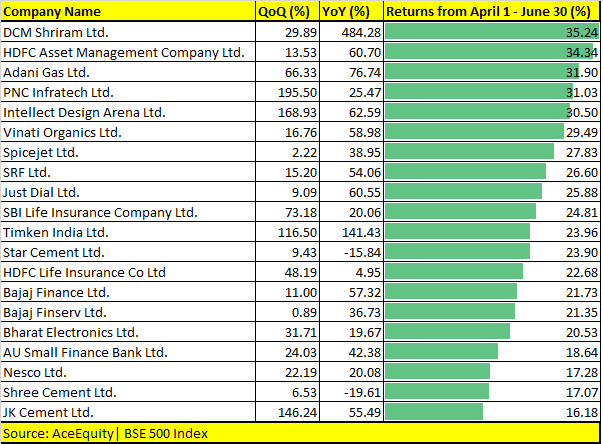

They include DCM Shriram, HDFC AMC, SpiceJet, SBI Life Insurance, HDFC Life, Bajaj Finserv, Bajaj Finance, AU Small Finance, Shree Cements and PNC Infratech, among others.

These stocks surged 10-35 percent in the April-June period on their companies' positive quarter-on-quarter (QoQ) profit during the March quarter, data from AceEquity showed. In the same period, Sensex rose just about 2 percent.

Quarter Se Quarter Tak: Top 20 companies that have delivered double-digit returns in the April-June period.

Will June quarter be better than the March quarter?

Indian market entered the March quarter with high expectations but experts are not very enthusiastic about June quarter. Most analysts at top brokerage firms are of the view that the earnings during Q1FY20 are most likely to be a mixed bag.

"Overall, June quarter earnings are expected to be quiet, although we expect a stronger recovery in the second half of FY20. From a sectoral perspective, we expect private financials and to an extent capital goods companies to post strong earnings during the quarter," Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life Insurance told Moneycontrol.

With demand showing signs of a slowdown in the consumption space, high rural distress, ongoing NBFC crisis and below normal monsoon could hit earnings growth of India Inc. in June and September quarters.

At the same time earnings are likely to remain strong in pockets like privates banks, upstream oil companies, cement, and selective infra companies, experts suggest.

"The Q1FY20 earnings is expected to be a mixed bag with BFSI, pharma witnessing strong growth. Auto and commodity-based sectors such as oil & gas and metals are witnessing earnings pressure," ICICI direct said in a note.

"Top line and bottom line growth in Sensex companies are expected at 4.5 percent and 20.8 percent, respectively. Key earnings driver for the quarter would be the banking sector performance aided by a pick-up in advances, decline in slippages (both YoY, QoQ) as well as benefits of G-sec yield correction," it said.

"IT, FMCG and consumer discretionary are expected to deliver steady growth of 10-13 percent YoY. Capital goods are likely to outperform with continued strong execution. On the other hand, sectors like auto, oil & gas and metals are likely to underperform with a weak top line and decline in the bottom line," the report highlighted.

Disclaimer: The views and investment tips expressed by investment experts and brokerages on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!