Brokerages expect the demand to sustain for IT Services companies heading into the first quarter of the financial year 2020; albeit margins shall decline on the back of a resurgence of the US dollar, wage hikes, high attrition, visa costs and a strong rupee.

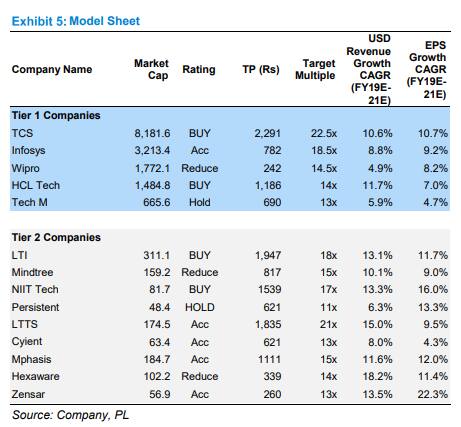

According to them, tier-I companies such as TCS, Infosys, Tech Mahindra will drive growth in the sector, while mid caps or tier-II companies shall deliver mixed results heading into the quarter.

Here is a gist of what Motilal Oswal, Prabhudas Lilladher and Edelweiss expect from Q1 performance of IT Services companies.

Brokerage: Motilal Oswal

The firm expects revenue to grow 11 percent, while EBITDA and PAT could grow 9 percent and 4 percent respectively, in the first quarter of FY20.

"We expect the EBIT margin across the top-tier to shrink by 50-160 bps, with the contraction particularly pronounced (100bp+) at TCS, Infosys and Tech Mahindra," said Motilal Oswal in a report.

The firm also said that they would keep an eye on attrition rates this quarter, along with the impact of visa expenses on profitability.

"As attrition rates have been high and visas remain hard to come by, commentary on margins across the board may shape the course for the sector’s FY20 earnings expectations and near-term valuations," it added.

Top picks: Cyient, Infosys, Tech Mahindra, Zensar Technologies

Brokerage: Prabhudas Lilladher

The brokerage expects the first quarter of FY20 to deliver mixed results.

"We expect revenue growth in constant currency (CC) between 0.7-3.2 percent QoQ for tier-1 IT companies. We expect TCS to deliver 3.2 percent QoQ CC broad-based growth across verticals and geographies, while Infosys shall deliver steady growth of 2.5 percent QoQ CC, with 146 bps QoQ decline in margins led by wage hikes, H-1B visa costs and rupee appreciation," said Prabhudas Lilladher in a report.

They expect tier-I companies to deliver mixed growth, while growth for tier-II companies could be muted. The firm also expects margins to remain under pressure across the pack.

"While Q1 is a seasonally strong quarter for IT services, we can observe pressure on YoY revenue momentum and there are headwinds on margins such as higher onsite costs, investments in digital and weakening rupee advantage," they added.

Top picks: TCS, L&T Technology Services

Brokerage: Edelweiss

The financial company expects TCS, Infosys and HCL to report healthy 2.8–2.9 percent QoQ revenue growth in CC in Q1 FY20. Meanwhile, it expects Wipro and Tech Mahindra to deliver flattish revenue growth.

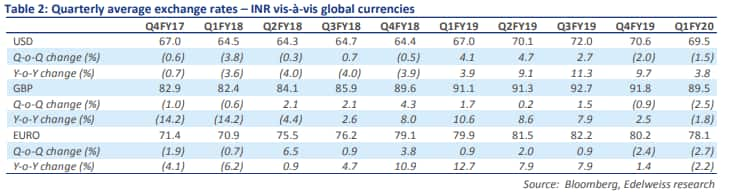

Edelweiss expects cross-currency headwinds, owing to the resurgence of US dollar, to dent the dollar revenue growth rate by 20-25bps QoQ.

"Wage hikes, high attrition, visa costs and a strong rupee are expected to keep margins under pressure, which is estimated to decline 60-200 bps for the top five IT companies. However, sustained momentum in digital and strong deals pipeline across verticals are likely to underpin strong management commentaries," they said in a report.

The company said investors should watch out for growth rates and deal size in digital; demand commentary by industry, while monitoring BFSI; attrition commentary; and commentary on local hiring.

Top picks: Infosys, Tech Mahindra, HCL Technologies, L&T Infotech, L&T Technology Services

Disclaimer: The views and investment tips expressed by brokerages on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!