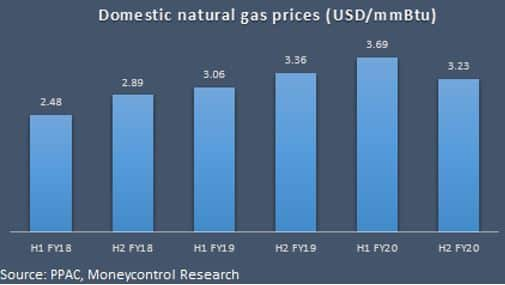

The price of domestically produced natural gas has been reduced by 12 percent in the latest bi-annual revision. The gas prices have been lowered to $3.23/mmBtu (million British thermal units) from $3.69/mmBtu. The downward revision in prices is applicable from October 1, 2019 and will continue to be in effect for the next six months, i.e., up to March 31, 2020, i.e., H2-FY20.

First reduction after 30 months

Given the buoyancy in demand and uptick in global commodity prices, natural gas prices have been trending higher for the past couple of years. Domestic natural gas prices surged 50 percent between H1 FY18 and H1 FY20. This reduction is the first downward revision after a span of 30 months and the impact of this will be widespread, as natural gas is a key input ingredient for many industries. The consumption of natural gas is split almost equally among energy and non-energy sectors.

Mixed impact on sectors

The decrease in the prices of natural gas could have a visible impact on the associated sector companies. While the move might be negative for upstream oil and gas companies with reduced per unit realizations, it is positive for the margins of downstream gas marketing players. Downward revision in the natural gas prices would reduce the input costs for the gas marketing players such as IGL (Indraprastha Gas), MGL (Mahanagar Gas) and GG (Gujarat Gas), and would boost their margins. The other beneficiaries from the cut would be fertilizer companies, tile and power firms and logistics operators. If the benefits are passed on, the positive direct impact would be for the end-consumers of these goods and services who might benefit from the lower prices of CNG, piped gas, electricity, tiles and fertilizers.

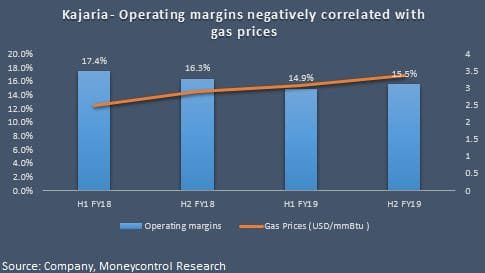

Tile manufacturers among the major gainers

Among the beneficiaries, the impact is anticipated to be the most for tile manufacturers since they are power-intensive businesses. Natural gas and electricity account for 30-35 percent of total manufacturing costs and the reduction in power bill gives a much-needed breather to the industry players as the sector is facing multiple challenges in the form of subdued demand and high competitive intensity. While the impact on individual companies might vary depending on their gas usage and cost structure, the decline in commodity prices should aid a margin expansion of 40-50 bps for efficient players such as Kajaria Ceramics.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!