Avenue Supermarts, the hypermarket retail chain D-Mart operator, entered the top 20 stocks list in terms of market capitalisation with a valuation of more than Rs 1.5 lakh crore.

The stock gave more than 60 percent return in the last six months. After its run-up, today it was quoting at Rs 2,395.35, down 3.57 percent with a market cap of Rs 1,50,374 crore on the BSE at 1503 hours.

It was especially after the Rs 4,000 crore QIP issue launched by the company with a floor price of Rs 1,999.04 per share last week.

The company opened its QIP issue on February 5 and closed on February 10 after receiving Rs 4,098 crore at a final issue price of Rs 2,049 per share.

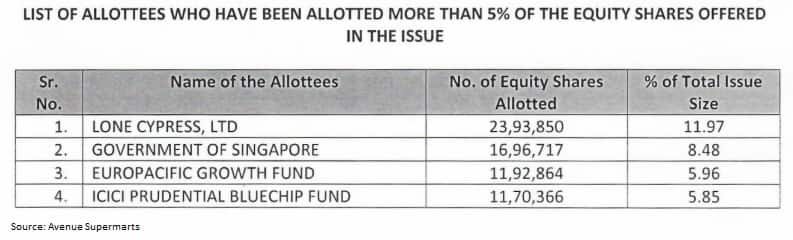

The qualified institutional placement issue has received a stellar response from investors including Lone Cypress, Government of Singapore, Europacific Growth Fund, ICICI Prudential Bluechip Fund etc which each received more than 5 percent of the total issue size.

CNBC-Awaaz sources had said the demand might be more than Rs 24,000 crore from large investors considering the growth delivered by the company.

After the allotment of equity shares in the issue, the paid-up equity share capital of the company stands increased to Rs 6,47,77,46,910 crore, comprising of 64,77,74,691 equity shares, Avenue said in its BSE filing.

Hence, the promoter and promoter group's shareholding in the company reduced to 77.27 percent from 79.73 percent at the end of December 2019.

Ace investor Radhakishan Shivkishan Damani himself holds 36.04 percent stake in the company, and the rest is held by other promoters.

The stock which had listed at a 102 percent premium, at Rs 604 against issue price of Rs 299 has consistently been making investors wealthier.

The stock has risen more than eight-fold since March 2017, which proved investors' appetite for shares of the company which beat analyst expectations on all earnings parameters in December ended quarter 2019 despite the economic slowdown and muted festive season.

The D-Mart operator reported 53.3 percent year-on-year growth in Q3FY20 profit driven by lower tax cost, and higher revenue and operating income. Revenue from operations grew by 23.9 percent year-on-year to Rs 6,751.9 crore.

The company added 7 stores in Q3FY20, and 20 stores in 9MFY20 against 9 stores in 9MFY19.

"We expect the acceleration in new store additions will support future revenue growth. We expect revenue to grow at around 26 percent CAGR while margin may improve to 9 percent from 8.2 percent over FY19-22," said Geojit which has a hold rating on the stock.

"We continue to like DMart due to consistent strong growth and operational efficiency," it added.

The brokerage believes that DMart’s strong growth in earnings should continue aided by faster store additions, reduction in debt and tailwinds from GST which will support higher premium in the medium term.

At the operating level, its earnings before interest, tax, depreciation and amortisation (EBTIDA) increased 30.8 percent year-on-year to Rs 593.1 crore, and its EBITDA margin expanded by 50 basis points to 8.8 percent in Q3 FY20.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!