The Indian equity market witnessed selling pressure for the second session in a row on February 10, largely weighed down by concerns around coronavirus.

Sensex closed 162 points, or 0.39 percent, lower at 40,979.62 while Nifty ended with a loss of 67 points, or 0.55 percent, at 12,031.50.

"Going ahead, markets would continue to be volatile as it would closely watch the developments over coronavirus and its economic impact. Investors would also be cautious ahead of the macroeconomic data-points due to be released during the week including CPI, WPI Inflation and IIP data. Further, this would also be the last week of the earnings season which would keep the markets volatile," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,980.37, followed by 11,929.23. If the index continues moving up, key resistance levels to watch out for are 12,093.07 and 12,154.63.

Nifty Bank

Nifty Bank closed 0.46 percent down at 31,058.15. The important pivot level, which will act as crucial support for the index, is placed at 30,927.34, followed by 30,796.47. On the upside, key resistance levels are placed at 31,218.94 and 31,379.67.

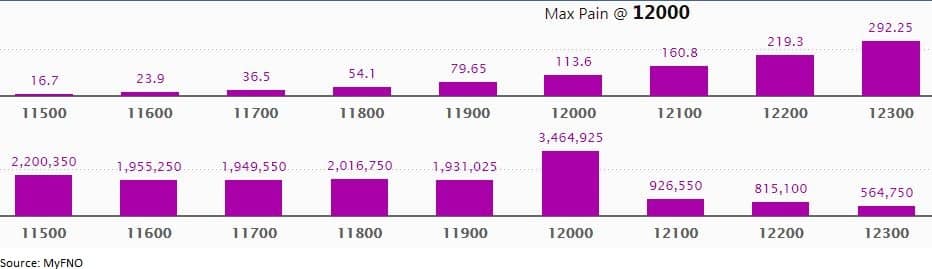

Call options data

Maximum call open interest (OI) of 27.20 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the February series.

This is followed by 12,400 strike price, which holds 16.95 lakh contracts in open interest, and 12,300, which has accumulated 16.05 lakh contracts in open interest.

Significant call writing was seen at the 12,000 strike price, which added 3.3 lakh contracts, followed by 12,300 strike price that added 89,100 contracts.

Call unwinding was witnessed at 11,800 strike price, which shed 52,200 contracts, followed by 12,400 which shed 50,550 contracts.

Put options data

Maximum put open interest of 34.65 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the February series.

This is followed by 11,500 strike price, which holds 22 lakh contracts in open interest, and 11,800 strike price, which has accumulated 20.17 lakh contracts in open interest.

Put writing was seen at the 12,000 strike price, which added 3.05 lakh contracts, followed by 11,700 strike, which added 1.88 lakh contracts and 11,800 strike which added 1.82 lakh contracts.

Put unwinding was seen at 12,100 strike price, which shed 1.08 lakh contracts, followed by 12,200 strike price which shed 70,200 contracts.

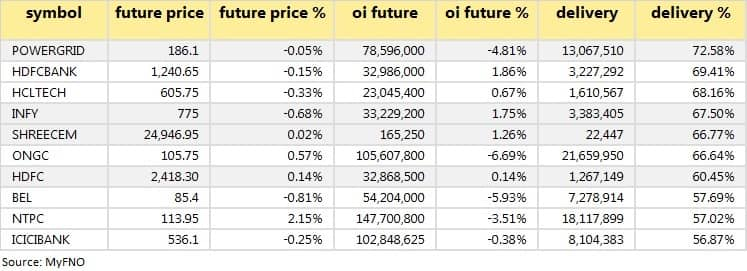

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

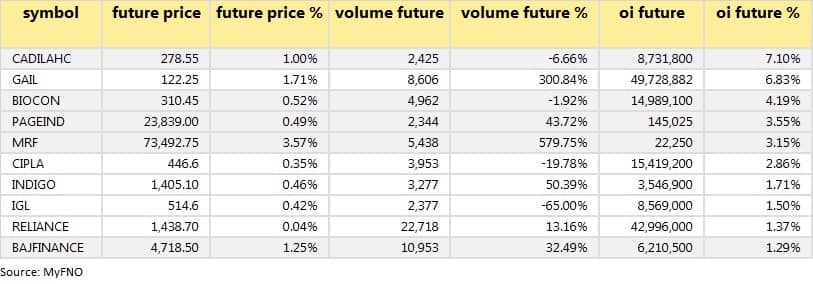

18 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

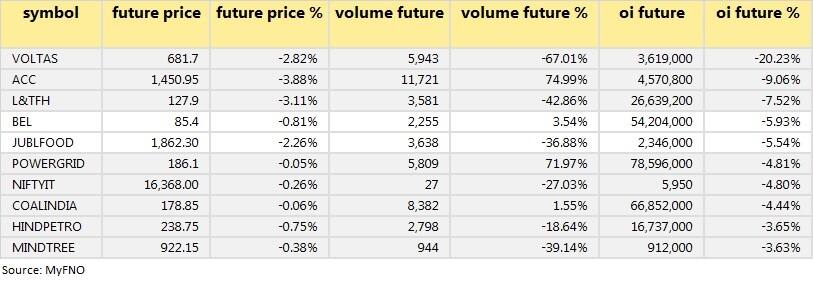

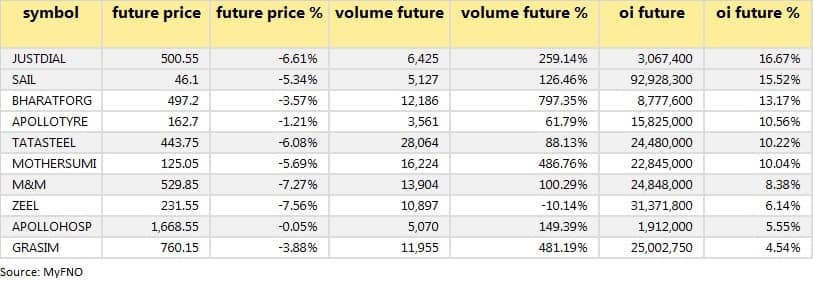

46 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

63 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

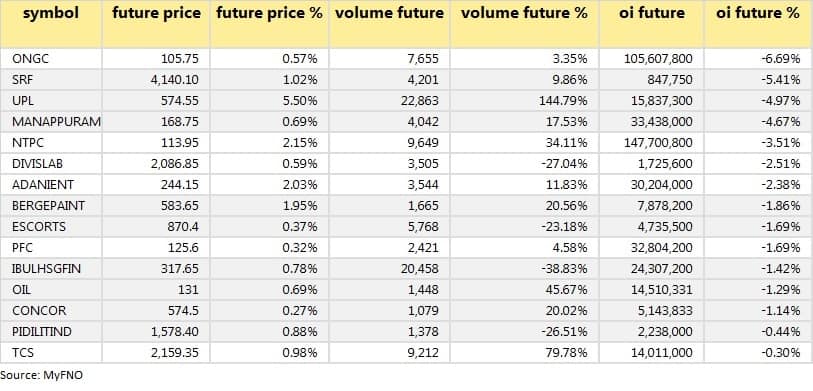

15 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

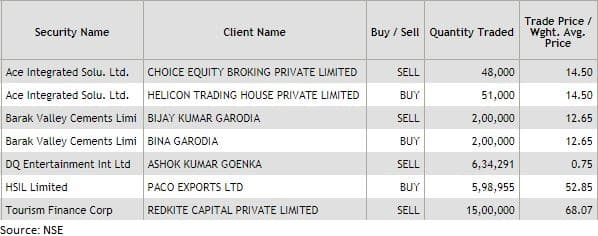

Bulk deals

(For more bulk deals, click here)

Quarterly earnings

BHEL, Ballarpur Industries, Atlanta, Arvind Fashions, Chamak Holdings, Cochin Shipyard, D B Realty, Greenply, GNFC, Gic Housing Finance and IDBI are among the companies that will release their quarterly earnings on February 11.

Stocks in the news

ITC: Company hiked prices across various lengths of cigarettes by 10-12 percent - Source CNBC-TV18.

Chalet Hotels: Q3 profit jumps 126 percent to Rs 33.4 cr, revenue rises 12.4 percent to Rs 278.1 cr YoY.

Oil India: Q3 profit dips 35.2 percent to Rs 406.4 cr, revenue slips 5.5 percent to Rs 2,952 cr QoQ.

Bombay Dyeing: Q3 profit at Rs 162.4 cr versus the loss of Rs 159.3 crore, revenue dips 8.6 percent to Rs 377.7 cr YoY.

IOL Chemicals: Q3 profit rises 19.5 percent to Rs 98 cr, revenue rises 6.9 percent to Rs 511.2 cr YoY.

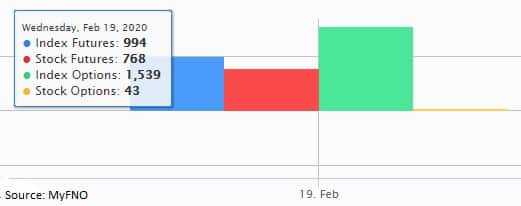

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 184.58 crore, while domestic institutional investors (DIIs), too, sold shares of worth Rs 735.79 crore in the Indian equity market on February 10, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for February 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!