Domestic equity benchmark indices closed in the red on May 14 amid weak global cues as investors sought clarity about the government's mega fiscal announcement of Rs 20 lakh crore.

Sensex closed the day with a loss of 886 points, or 2.77 percent, at 31,122.89 and Nifty settled 241 points, or 2.57 percent, lower at 9,142.75.

The Indian equity market is likely to witness a weak to flat opening on May 15 as there was no trigger for the market in Finance Minister's announcements and the market has to wait a little longer to get clarity of government's Rs 20 lakh crore fiscal stimulus, said experts.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,081.3, followed by 9,019.85. If the index moves up, key resistance levels to watch out for are 9,242.65 and 9,342.55.

Nifty Bank

The Nifty Bank closed 2.88 percent lower at 19,068.50. The important pivot level, which will act as crucial support for the index, is placed at 18,935.5, followed by 18,802.5. On the upside, key resistance levels are placed at 19,513.1 and 19,290.8.

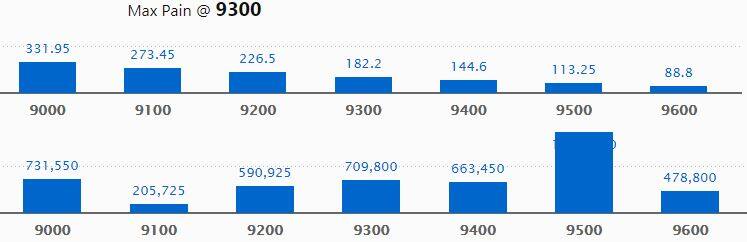

Call option data

Maximum call OI of 17.29 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,000, which holds 7.32 lakh contracts, and 9,300 strikes, which has accumulated 7.10 lakh contracts.

Significant call writing was seen at the 9,500, which added 3.66 lakh contracts, followed by 9,300 strikes that added 3.27 lakh contracts.

No call unwinding was witnessed on May 14.

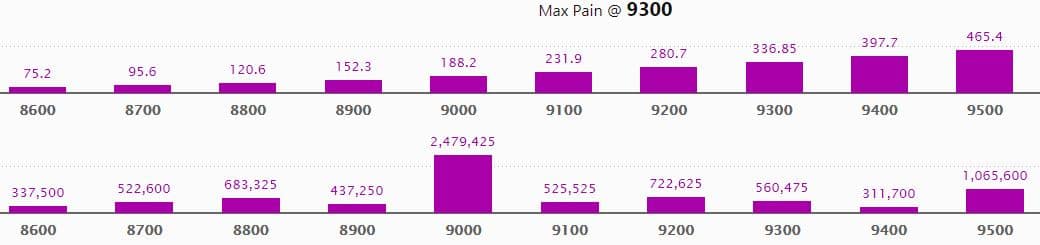

Put option data

Maximum put OI of 24.8 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,500, which holds 10.66 lakh contracts, and 9,200 strikes, which has accumulated 7.23 lakh contracts.

Significant Put writing was seen at 8,800, which added 1.06 lakh contracts, followed by 8,700 strikes, which added 1.03 lakh contracts.

Put unwinding was seen at 9,400, which shed 80,250 contracts, followed by 9,500 strikes that shed 60,375 contracts.

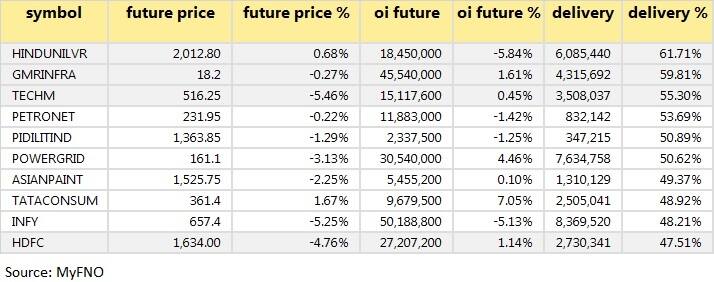

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

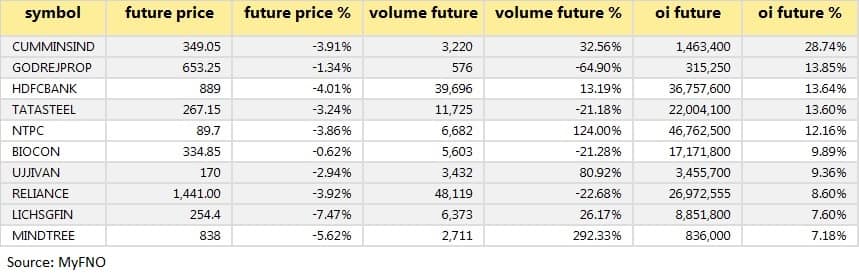

21 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

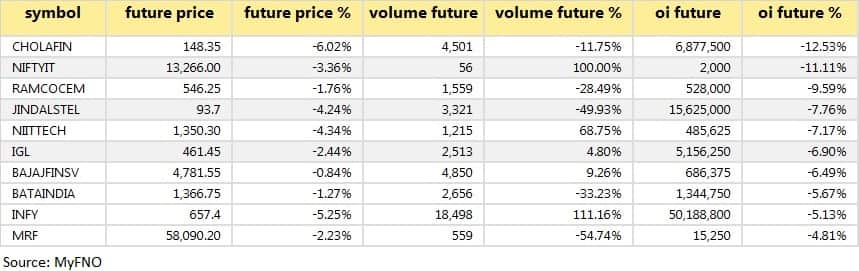

48 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

55 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

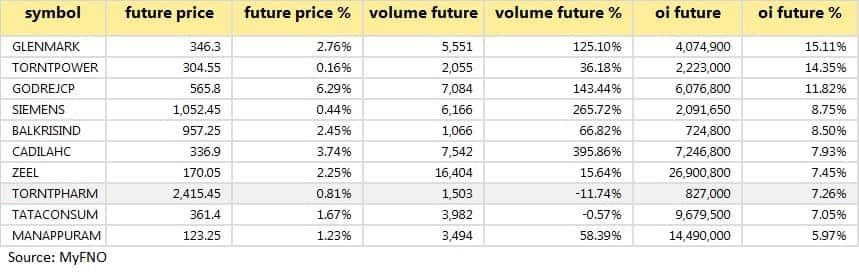

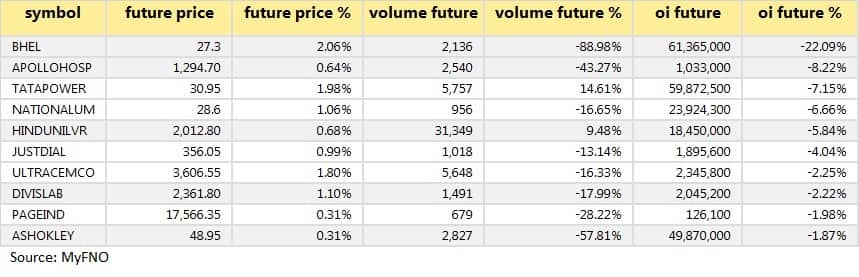

22 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

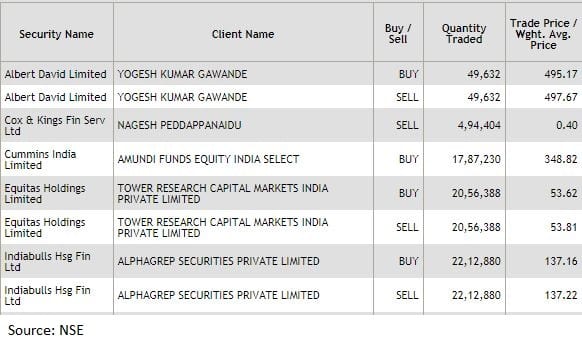

Bulk deals

(For more bulk deals, click here)

Results on May 15

Cipla, Crompton Greaves Consumer, IIFL Securities, L&T Finance Holdings, L&T Technology, M&M Financial, Tata Chemicals, Aarti Drugs

Stocks in the news

Cummins India: Amundi Funds Equity India bought 17,87,230 shares in the company at Rs 348.82 per share.

Unichem Labs: Company received Establishment Inspection Report from USFDA for APIs facility at Roha.

India Energy Exchange Q4: Profit rose to Rs 45.6 cr versus Rs 38.85 cr, revenue rose to Rs 69.44 cr versus Rs 56.44 cr YoY.

Mahindra Lifespace Q4: Loss at Rs 223.90 cr versus profit at Rs 30.44 cr, revenue fell to Rs 101.42 cr versus Rs 234.27 cr YoY.

Indiabulls Real Q4: Loss at Rs 110 cr versus profit at Rs 109 cr, revenue fell to Rs 116.3 cr versus Rs 1,821.54 cr YoY.

Accelya Solutions Q3: Profit fell to Rs 23.67 cr versus Rs 26.47 cr, revenue rose to Rs 107.61 cr versus Rs 103.35 cr YoY.

AAVAS Financiers Q4: Profit rose to Rs 59.72 cr versus Rs 54.33 cr, revenue rose to Rs 234.42 cr versus Rs 204.29 cr YoY.

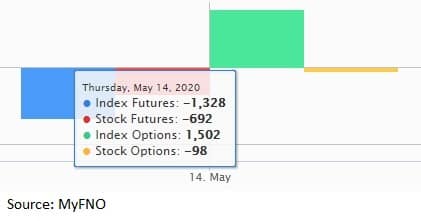

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 2,152.52 crore, while domestic institutional investors (DIIs) bought shares worth Rs 802.36 crore in the Indian equity market on May 14, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Vodafone Idea is under the F&O ban for May 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!