The market hit a fresh record high in December with Nifty trading about a 1,000 points higher than pre-COVID peak levels, even though COVID-related fear is not over yet.

In the last nine months since March 23 low, the benchmark indices have gained 77 percent each. Meanwhile, the broader markets have outperformed frontliners with Nifty Midcap index rising 82 percent and Smallcap index gaining 97 percent, respectively.

The easing monetary policy across the globe to support economic recovery, better-than-expected September quarter earnings, government's supportive policy measures, vaccine progress and recovery in economic activity have all played a key role in taking the market to newer levels.

There was a steep correction earlier this week due to the discovery of a new strain of coronavirus in the United Kingdom, but the market recovered gradually.

FIIs have invested more than Rs 1.5 lakh crore in the current calendar year so far.

"Year 2021 would be a year for restarting India with mass-vaccination drive, economic recovery and earnings growth which will lead to positive GDP growth. We believe India is on the cusp of a cyclical recovery and events such as virus outbreak are likely to be more frequent and investors' portfolios have to be better positioned to weather these kinds of storms with proper asset allocations," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

"Overall markets will seemingly maintain volatility in the short and medium-term while on the long term, the resumption of economic activity and the vaccination drive will dictate investor sentiment going forward, hence, we remain bullish on markets," he said.

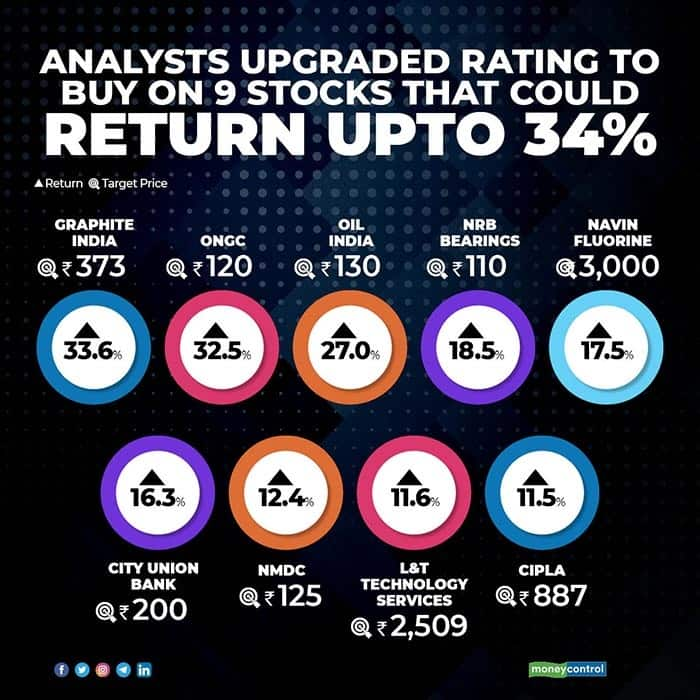

A lot of stocks have seen an upgrade in rating since October. More than 100 stocks already had received buy ratings in the previous two months, especially after September quarter earnings. Given the signs of economic recovery and increasing participation of several industries in the recovery which as a result increased hopes for better earnings growth ahead, brokerages upgraded another 9 stocks in the month of December.

Here is the list of 9 stocks which got an upgrade to buy rating in December:

With 2 recent big deal wins & increasing discretionary spends, Prabhudas Lilladher believes LTTS revenue growth will pick up faster than expected and there will be an improvement in margins too.

"Hence, we are increasing our EPS estimates by around 10 percent for FY22/23. We assign 25X (earlier 22X) multiple, 12 percent premium to 5-year average multiple of 23X to arrive at a changed target of Rs 2,509 (earlier: Rs 1,860). We upgrade LTTS to buy from Accumulate," the brokerage said.

"To strengthen its specialty chemicals division and for growth, Navin Fluorine announced Rs 195 crore capex in agro and pharma, expected to be funded through internal accruals and debt. The multi-purpose plant at its wholly-owned subsidiary, Navin Fluorine Advanced Sciences, at Dahej, Gujarat, is expected to be commissioned in H1 FY23, with around 1.4x asset turnover. The expansion would help launch products of complex fluorinated chemistry and strengthening customer relations," said Anand Rathi.

The brokerage upgraded rating to buy with a higher target of Rs 3,000, valuing the stock at 34x FY23e EPS, earlier Rs 2,500.

"NRB's performance is largely correlated with the domestic auto segment as around 70 percent of the topline comes from domestic OEMs. Hence, demand sustenance in the auto segment in the near term should be a key monitorable. The company has reduced its debt by Rs 58 crore in H1 led by strong CFO generation to the tune of Rs 63 crore," ICICI Direct said.

Going ahead, "we expect positive operating leverage to improve margins from 11 percent in FY20 to 16 percent by FY22. We build in revenue, EBIDTA & PAT CAGR of 8.2 percent, 24.1 percent & 39.3 percent, respectively, in FY20-23. We estimate an EPS of Rs 7.4 per share for FY23E, implying earnings yield of 8 percent at the CMP. Reflecting the improved outlook for NRB, we upgrade the stock from hold to buy ascribing a 15x multiple to FY22 EPS to arrive at a target price of Rs 110 per share," the brokerage added.

Prabhudas Lilladher upgraded Cipla to buy (earlier hold) as it included Rs 51 per share benefit from Revlimid launch which leads to a new target of Rs 887 (earlier Rs 836).

"Cipla is now the fourth player to settle Revlimid patent litigation with BMS (Bristol Myers Squibb) for volume restricted launch post-March-CY22 and no volume restriction post-January-CY26. Volume restriction and launch date are kept confidential, but we believe Cipla's settlement agreement could be similar to DRRD, Natco/ALLGERGAN and ALVOGEN. Volume restriction for each player would be capped at 10 percent of total Revlimid volume for initial years and gradually increase till CY25, while launch date will be in the order of settlement done," the brokerage said.

"We revise FY22-23 Brent assumption to $55 a barrel (from $50 a barrel) as positive COVID-19 vaccine developments are fuelling hopes of a quicker-than-previously-expected recovery in oil demand. Also, stringent compliance by OPEC+ has expedited normalisation of excess oil inventory. Hence, we upgrade FY22 PAT estimates for ONGC/Oil India by 30 percent/14 percent. ONGC and Oil India could also benefit from potential deregulation/hike in domestic gas prices," JM Financial said.

Hence, "we upgrade target for ONGC to Rs 120 per share and for Oil India to Rs 130 per share on the following: a) a Brent-linked sharp earnings upgrade and b) a reduction in P/E valuation discount to the historical average due to improving earnings visibility. Hence, we upgrade ONGC and Oil India as tactical buys on rising crude price. ONGC is our preferred play due to production growth visibility and its higher leverage to crude price," the brokerage added.

"A continued conservative approach and yield led to pressure on margin is expected to keep the operational performance muted with a gradual pick-up in H2FY22, as the tide turns towards normalcy. Sequentially, asset quality has improved but the quantum of loans that would be coming up for restructuring and slippages number in the coming quarter would be key to monitor. We remain positive on fundamentals and upgrade the recommendation from hold to buy with a revised target price of Rs 200 (Rs 130 earlier)," ICICI Direct said.

"Weak demand and heightened inventory led to Graphite India's (GRIL) subdued realisations and lower sales volumes (last six quarters). We expect it to benefit, however, from coming tailwinds: 1) A pick-up in steel production globally (up 2.3 percent YoY in Q2 FY21); 2) the recent rebound in graphite-electrode (GE) prices in China; 3) expectations of complete de-stocking of electrode stocks in the next two quarters and 4) benign raw material prices," said Anand Rathi.

"Q2 FY21 capacity utilisation improved sequentially from 42 percent to 72 percent, which, we believe would continue. Hence, we turn positive on the company, thereby upgrading our rating from a sell to a buy, with a revised target price of Rs 373 (8x FY22 EV/EBITDA), earlier Rs 212," the brokerage added.

"NMDC underperformed steel stocks by a wide margin over the last three months due to uncertainty regarding payment of premium for its Donimalai mine’s lease renewal. After two years impasse, Govt of Karnataka renewed Donimalai mines (with a capacity of 7mtpa) at a premium of 22.5 percent of sales price. We expect that similar premium would be paid for its iron ore operations in Chhattisgarh, which constitutes 78 percent of its overall volumes," Prabhudas Lilladher said.

"Severe shortage in domestic market (due to supply disruptions in Odisha), strong profitability of steel producers and firm outlook on global prices shall help NMDC to mitigate higher costs with stronger product prices. In light of strong price outlook and attractive valuations, we upgrade NMDC to buy with a target of Rs 125 (earlier Rs 98) based on 1) EV/EBITDA of 3.7x FY22 for iron ore operations (factoring 22.5 percent premium on entire operations) and 2) EV/T of $475 for 3mtpa steel plant," the brokerage added.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!