Mutual funds raised stake in as many as 185 companies while reducing in 178 companies in the March quarter, according to the shareholding data declared by companies and collated by AceEquity.

Fund managers were net buyers in Indian equity market purchasing shares worth Rs 1,000 crore in the January-March period.

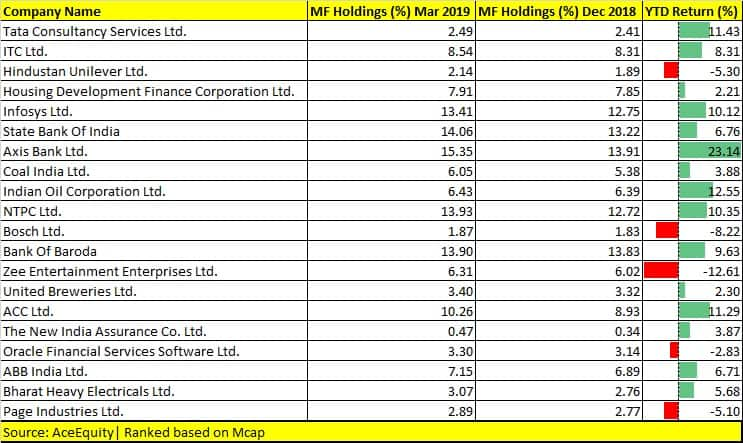

Companies in which fund managers raised their stakes include TCS, ITC, HUL, HDFC, Infosys, SBI, Axis Bank, Bank of Baroda, IOC, Coal India among others.

Higher allocation of funds to the banking and financial services companies helped Nifty Bank to hit fresh record highs. The index has been in an uptrend since the last one month. It has rallied over 11 percent so far in 2019.

The expectation of likely strong quarterly results and NPA worries largely being over have put banking stocks in focus, experts say.

“Fund managers are cherry-picking certain IT and banking stocks that indicate that they are specifically entering secular trends in the market. Banking stocks are expected to post slightly better results this quarter considering NCLT’s continuous efforts to reduce NPAs, drop-in slippages and various new regulatory norms that have created a bullish sentiment among the market participants,” Umesh Mehta, Head of Research, SAMCO Securities told Moneycontrol.

“IT space, on the other hand, might experience slower growth considering the run-up experienced by a few companies after the current results. Hence, investors can accumulate a few quality companies from both these sectors with a long-term perspective,” he said.

Table: Companies in which MFs have increased stake (in order of their market cap)

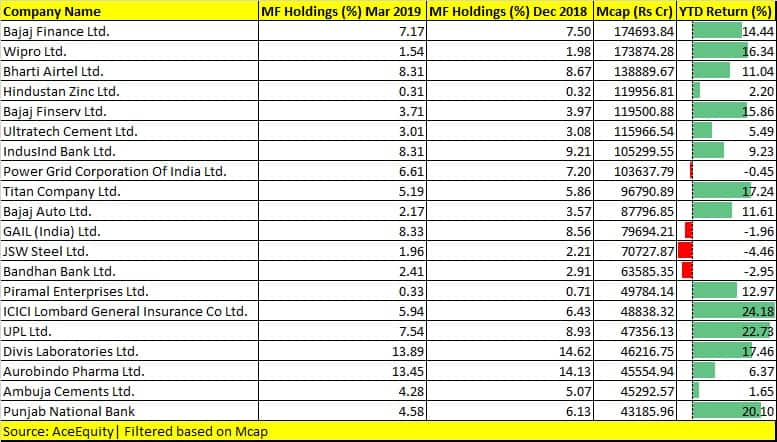

Mutual fund managers cut stakes in 178 companies that include Bajaj Finance, Wipro, Bharti Airtel, Bajaj Finserv, UltraTech Cements, IndusInd Bank, Bandhan Bank, JSW Steel, Divi’s among others.

Fund managers have been quick in reducing exposure in stocks that look expensive. For example, Bajaj Finance and Titan have rallied about 14 percent and 17 percent, respectively in 2019, taking their valuations higher.

Table: Companies in which MFs have decreased stake

These stocks have run-up a lot and therefore fund managers are selling them in order to build a higher margin of safety, suggest experts.

A selective stock picking strategy is being followed by these managers which make for a good filtered list for investors to consider when valuations become cheaper, they say.

“Barring a few sectors like telecom and auto, we believe this to be normal profit booking and these stocks will be on fund managers radar once valuations become attractive,” Atish Matlawala, Sr Analyst, SSJ Finance & Securities told Moneycontrol.

“After demonetisation, the mutual fund has seen an unprecedented level of inflows. In FY18 alone mutual fund invested more than Rs 1 lakh crore into the equity market and we believe the same to continue in FY19. With such an inflow, fund managers are compelled to keep investing,” he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!