It was a roller coaster ride for traders as the month of May started muted with 9 straight consecutive days of fall but then bulls took control in the last 10 days to push the Nifty50 towards a record high of 12,041.

Rollovers in derivatives for June series were slightly better than the previous few months indicating the return of confidence among the investor community. For the month, the Nifty50 rose 1.48 percent while the S&P BSE Sensex rallied 1.7 percent in the same period.

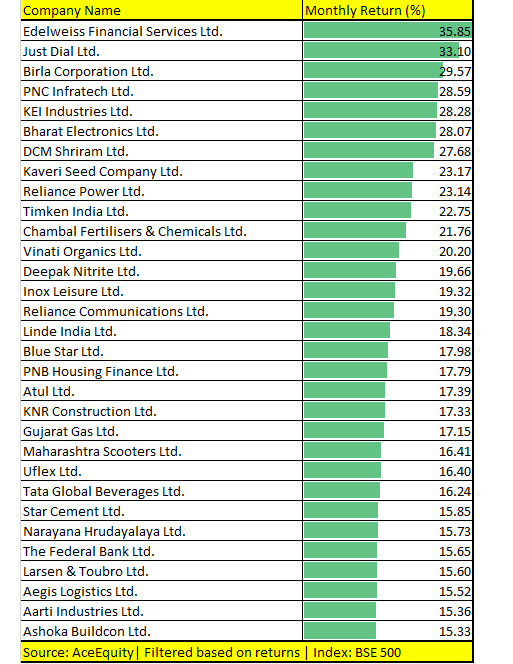

Benchmark indices might have registered minor gains but the big move was seen in the broader market. As many as 80 stocks in the S&P BSE 500 index rose 10-30 percent in May which include names like Inox Wind, Can Fin Homes, BEML, Ujjivan Financial, SpiceJet, Bajaj Finance, SBI, Birla Corporation, PNB Housing, and Edelweiss Financial Services among others.

Here is a list of top 30 stocks out of 80 stocks which have given 10-80% returns. Stocks are filtered based on highest to lowest returns.

The market is getting more visibility as things progress on the ground. The NDA II government has a broader strength of 58 Council of Ministers with 26 new ministers.

Amit Shah assumed the role of Home Minister, while Nirmala Sitharaman took over as the Finance Minister and Corporate Affairs Minister.

Most experts on D-Street gave a positive outlook on the appointment of Nirmala Sitharaman. She will present the Budget on July 5.

"Market is anticipating series of measures to be announced by the government in its first 100 days of functioning. Given this, expect the market to remain at an elevated level and inch up further in the next two months as we have the RBI meet in June followed by the Union Budget sometime in July," Rusmik Oza, Head of Fundamental Research, Kotak Securities Ltd told Moneycontrol.

"The likely news flows coming from the government side coupled with fall in crude prices and softening of Bond yields can take the Nifty closer to 12,500 faster than expected," he said.

There was plenty of action in the broader market. As many as 71 stocks hit their fresh 52-week high in May which include names like L&T, Shree Cement, Bajaj Finserv, Bajaj Finance, HDFC Bank, HDFC Ltd, Dr. Reddy’s Laboratories, Kotak Mahindra Bank, Bata India, RIL, Titan Company, Tech Mahindra, ICICI Bank, etc. among others.

The market will react to monthly auto sales numbers on June 3 which will start coming out over the weekend. On the macro front, GDP data for Q4 as well as infrastructure data released post market hours on May 31 will also weigh on sentiment.

India's gross domestic product (GDP) grew 5.8 percent in January-March, official data released on May 31 showed, confirming fears of a slowdown. The upcoming monetary policy committee meeting on 6th June will be an important event to watch out which is likely to dictate market trend.

"We maintain our cautious stance on the markets at higher levels in the near term. Domestic macro data (Q4 GDP and infrastructure output scheduled today) and RBI’s monetary policy (on June 6th) will dictate the market trend in the next couple of weeks,” Jayant Manglik, President - Retail Distribution, Religare Broking Ltd told Moneycontrol.

"Banking stocks had staged this bullish run in markets in the month of May. However, this might not be the case in June. The upside seems limited, whereas the downside is more apparent. Broader range for the Nifty might 11700-12100," he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!