Shubham Agarwal

Indian market started on a weak note and bears pushed the Nifty50 to the low of 10,746 before it bounced back, but it failed to break in the green.

The Nifty50 closed with losses of 0.7 percent while Nifty futures closed within a kissing distance from the infamous level of 11,000 for the week ended September 6.

Traders mostly covered their shorts which they initiated probably at the beginning of the week. The total tally of change in open interest for Nifty futures remains close to zero.

On the other hand, similar attempts were not good enough for Bank Nifty as despite the respite from early fall Bank Nifty futures carried forward 12 percent increment in the open interest.

Among stock futures with every passing week, the number of stocks adding shorts for the week is depleting. Also, being the first week of the expiry the number of stocks losing open interest remained relatively low.

However, even among them, the number of stocks covering stocks were double the number of stocks unwinding longs.

Oil India led by OMCs and bargain hunting in big boy RIL saw fresh long positions. IT was one more sector to add longs for the week led by Infosys.

On the flip side, shorts were seen in the NBFC sector led by LIC Housing Finance, Muthoot Finance and a bit by HDFC Ltd. India VIX also saw a pullback as the index inched upwards.

On the options front, the tally of Nifty options has more Puts than Calls keeping the Open Interest Put Call Ratio tilted towards the bulls.

The heaviness in open interest in Puts of 10,800 raises the consensus floor a tad bit higher. On the upside, the consensus more or less indicates congestion around recent highs of 11,100-11,200.

Repetitive rebounds indicate an unwillingness to fall further, hence amid consolidation, strategies restricting profit upon rise shall be avoided.

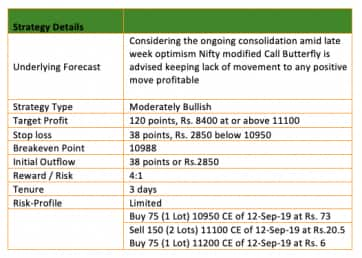

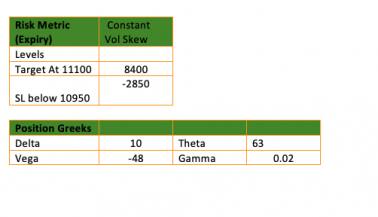

Considering the ongoing consolidation, we recommend traders to initiate Nifty modified Call Butterfly amid lack of movement, and any positive move will be profitable. This takes care of even a slim possibility of index overshooting the level of 11,200.

Modified Call Butterfly is a four-legged strategy where one lot of Call close to current underlying level is bought against that two lots of higher strike calls are sold and one more lot of Call is bought but closer to the call sold strike.

This keeps the lower but constant profits in case of an upward breakout. This is a fairly risk-averse and a universal strategy.

(The author is CEO & Head of Research at Quantsapp Private Limited.)

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!