Highlights

- Disappointing numbers from auto majors across segments

- Slowdown, new axle load norms, tight liquidity and finance woes weigh

- Tractors grow strong but PVs and three-wheelers post mixed numbers

- Pre-buying ahead of BSVI is an important catalyst

- The Coronavirus outbreak may impact the supply chain

- Upcoming quarters are expected to be more challenging --------------------------------------------------

The automobile sector, especially the commercial vehicle (CV) segment, is running downhill fast. There appears to be no relief in sight, given the weak macro environment and a strong regulatory framework.

Any pre-buying ahead of the BS VI implementation is a critical catalyst for the growth of the sector in the March quarter of 2019-20. The next financial year will be no less challenging for companies as the cost of ownership is expected to rise after the new emission regime kicks in, which may impact demand further.

Higher reservoir levels, adequate soil moisture and a good Rabi crop are expected to strengthen demand for tractors and two-wheelers (2W) in the next few months.

Thankfully, the Coronavirus outbreak had minimal impact on the production of automobiles in the month gone by. But the going could get tough, with China accounting for much of the auto component imports.

Commercial Vehicle – A big drag!

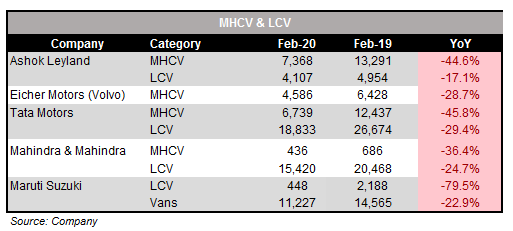

CV sales continue to remain under tremendous pressure. Factors such as the overall economic slowdown, the liquidity crunch and non-availability of retail finance have led to significant decline in demand within the segment. This got further aggravated by the axle load norms, which increased carrying capacity in M&HCV (medium and heavy commercial vehicles) segment.

According to Tata Motors’ management, there has been a pick-up in buying interest, especially from fleet owners, which prompted the company to reduce its stocks even further to an all-time low.

Tata Motors registered a 35 percent year-on-year (YoY) decline in CV volume led by a drop of 45.8 percent in the M&HCV segment and 29.4 percent in LCVs (light commercial vehicles). For Eicher Volvo, the drop is 28.7 percent while the decline for Ashok Leyland is 37 percent and 25 percent for M&M.

Cars segment – Not much respite

Cars segment – Not much respite

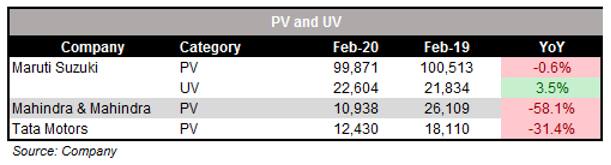

The car segment did well -- relatively. The leader, Maruti, reported a flat volume growth in February. Its utility vehicles sales grew 3.5 percent while passenger vehicles (PVs) saw a marginal decline of 0.6 percent.

Other players continue to disappoint. M&M’s PVs took a significant sales hit of 58.1 percent YoY. Tata Motors is no better, with sales declining by 31.4 percent.

The increase in total cost of ownership led by mandatory long-term insurance is partly to blame for such demand softness. Further, implementation of safety norms have pushed up prices and impacted sales amid an already weak consumer sentiment. Demand is expected to remain sluggish, post BS VI implementation, due to a further rise in the total cost of ownership.

Two-wheelers (2W): The sob story

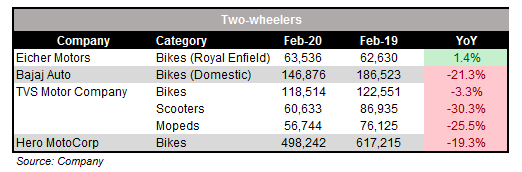

Hero, the leader in this space, witnessed a sharp decline of 19.3 percent in volume. Bajaj Auto and TVS too took a beating of 21.3 percent and 17 percent, respectively. Eicher, the dominant player in the premium bike segment, however, bucked the trend with a marginal growth of 1.4 percent in its monthly sales numbers.

Three-wheelers (3W): Mixed numbers

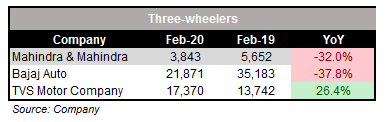

It’s a set of mixed numbers for the overall three-wheeler market in February. TVS sales clocked a strong growth of 26.4 percent whereas other players fell by the wayside. M&M’s sales decline is a sharp 32 percent while that of Bajaj Auto is 37.8 percent.

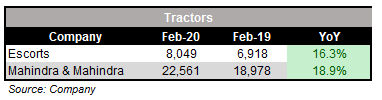

Tractors: Good numbers

Delayed rainfall and uneven rainfall distribution have played spoilsport for the tractor segment. However, there are signs of stability now. Escorts sales grew 16.3 percent and M&M’s 18.9 percent. The M&M management expects tractor demand to strengthen on the back of a robust Rabi output and the prevailing crop prices. Going forward, the increase in rural and agriculture spending on core schemes by the government should be music to the ears of the industry.

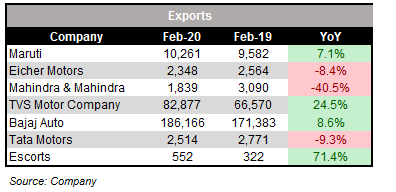

Exports: Mixed sentiments

Auto export numbers for February have its share of hits and misses. Escorts, Bajaj, TVS and Maruti gained traction on this front whereas others got sucked into the slowdown undercurrent.

For more research articles, visit our Moneycontrol Research page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!