Highlights

- Volume growth of 8.3 percent – Ahead of sectoral trend

- Fabric care and dishwashing segments lead

- Household insecticide a drag; recent regulatory actions offer hope- Valuation discount to FMCG peers is unprecedented

FMCG player Jyothy Labs' quarterly show came ahead of expectations, with a high single-digit volume growth. While the household insecticides segment was still a drag, recent regulatory action has restored some hope for recovery.

Having said that, competitive intensity has increased and the company has resorted to the lower advertising spend for 2019-20 as against the earlier budgeted. This can help in calibrated execution for EBITDA margin guidance of 16 percent for FY20.

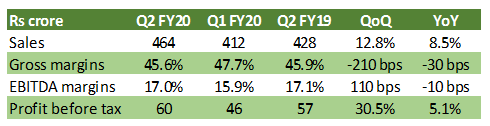

Q2 financials

Source: Company

Key positives

Sales grew 8.5 percent YoY (year-on-year) on the back of volume growth of 8.3 percent, which is commendable, given the macro challenges and consumption headwinds. Excluding household insecticides, volume growth stood at 9.1 percent.

Fabric care with 40 percent of Q2 sales posted a growth of 13.1 percent as the home-grown company continued to witness market share gains for its key brand – Ujala Fabric whitener. Also, there was a good traction reported for its post wash solution – Ujala Crisp & Shine – growing by 25 percent.

The dishwashing segment (Exo, Pril), which made up 33 percent of sales, posted 8.6 percent growth during July-September. Note that in Q1, lower primary sales were on account of introduction of new Exo Ginger, which required down-stocking of pre relaunch stock. However, in Q2, growth picked up with low unit packs (LUPs) of Exo.

Furthermore, Pril Tamarind is gaining acceptance and contributes 10 per cent to the brand in the relevant trade channel. The company also launched Pril Tamarind pouch version, which is growing two times that of liquid dishwash version.

Personal care, which accounts for 12 percent of sales, continued with strong performance expanding at 6.9 percent, aided by traction for soaps brand - Margo. Here, Jyothy Labs posted 13.3 percent sales growth in Q1 FY20 compared to the sluggish growth of 2.8 percent in Q4 FY19. Here, it is worth noting that it has achieved this without resorting to price cuts as was done by peers – HUL and Godrej Consumer. The management doesn’t see the need of price reduction due to its differentiated positioning.

Key negatives

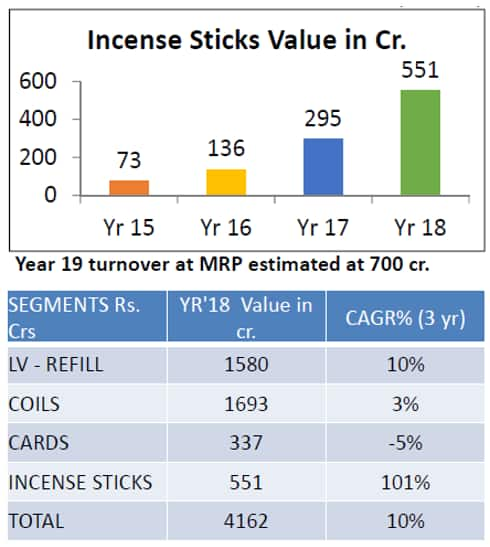

The household insecticides segment (10 percent of sales) continue to see headwinds. Unlike positive commentary by Godrej Consumer, the segment sales declined by 1.3 percent due to the delay in onset of rains in UP and eastern states, which are among major geographies for the company.

The FMCG player maintained market share in the coils sub-segment which contributes 70 percent of the revenue for the segment. However, for the liquid segment (Maxo LV), there was a sequential decline in market share. Still, the management expects some recovery due to regulatory action on illegal incense sticks. The Union government has recently put curbs on import of agarbatti, which will prompt consumers to either shift to natural agarbatti or the coil segment.

Graph: Sub-segment sales trend for Household insecticides industry

Source: Jyothy Labs, AC Nielsen

Further, EBITDA margin contracted marginally due to higher advertising spend and employee cost, which was partially offset by lower other expenses.

Outlook

Quarterly results beat expectations mainly on account of the traction in fabric care and dishwashing segments. Excluding household insecticides, the company does not see any major slowdown in rural areas, which contributes about 40 percent of sales. Promotional intensity has increased, particularly for the modern trade channel.

As far as the near-term outlook is concerned, the company continues to guide for 10-12 percent sales growth in the standalone business in 2019-20. It expects to deliver 16 percent EBITDA margin in FY20. Here, it doesn’t see any major gross margin improvement in H2 though it has deferred earlier advertising spend guidance due to weak market conditions, which would be supportive of operating margin.

The stock trades at 24x FY21e earnings, which is more than 40 percent discount to the average of FMCG majors.

This valuation discount remains unprecedented in spite of the recent run-up. In our view, discount should further shrink, going ahead, as the earnings potential unfolds further. Investors can keep this stock on their investment radar.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!