Moneycontrol Research

The Reliance group is creating a behemoth in the media business by bringing together its media and distribution businesses spread across multiple entities into Network18.

Three entities -- TV18 Broadcast, Hathway Cable & Datacom and Den Networks -- will merge into Network18 Media & Investments and the appointed date for the merger shall be February 1, 2020. The broadcasting business will be housed in Network18 and the cable and ISP (internet service provider) businesses in two separate wholly owned subsidiaries of Network18.

Without considering any treasury shares, the market capitalisation of the combined entity would be close to Rs 14,700 crores.

Reliance’s holding in Network18 will reduce from 75% to ~64% upon implementation of the Scheme.

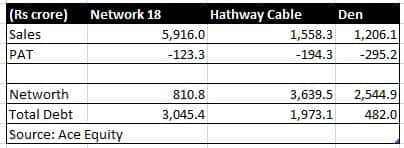

Post this integration, Network18, with revenue in excess of Rs 8600 crore, will be the largest listed media entity ahead of Zee and Sun TV.

The need for this integration

The size will render substantial economies of scale.

The Scheme shall also simplify the corporate structure of the group by reducing the number of listed entities.

The aggregation of a content powerhouse across news and entertainment and the country’s largest cable distribution network under the same umbrella shall boost efficiency and exploit synergies, creating value for all stakeholders.

The media industry is accelerating towards being a B2C (business to consumer) play, led both by market factors and through regulation. An integrated media play shall further increase the breadth as well as depth of the group’s consumer touch points, and allow for retaining a larger share of the consumer’s spend on content.

Cash flow management will be better as within the same company, entertainment will generate free cash flow while the distribution business will need cash flow.

The entity will be net-debt free at the consolidated level, providing a solid base for growth as well as improved shareholder returns.

The merged entity will also benefit from a balanced mix of cyclical and annuity revenues to unlock growth while ensuring stability.

Consolidation of media wireline distribution

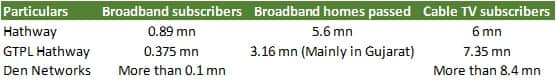

With the consolidation of cable businesses of Den network and Hathway in one entity, the company is expected to leverage the combined strength of the ~27000 LCO (Local Cable Operators) partners who act as the touch points to ~15 mn households in India and 1 mn broadband subscribers. This translates to a 12.5 percent share of India’s cable & satellite pay-subscriber base and 6.7 percent share of the country’s wireline broadband subscriber base.

Source: Company

Consolidation also brings in Hathway’s strategic investment GTPL Hathway (37.32 percent stake) into the fold. Note that Reliance through Jio has a 4.48 percent stake in the same.

The broad takeaways for investors are:

Integration of existing cable business assets along with wireline broadband is an early step towards the integration of “conduits” to offer media and entertainment business to the audience.

In this context, an interesting positive is the possible integration of the Optic Fibre Cable Network. GTPL Hathway and Hathway Cable have 43,000 km and 39,500 km of Optic Fibre Cable Network respectively.

Consolidation of both these entities is expected to bring synergy in content distribution and better leverage in negotiating for placement and carriage revenue from content providers.

For the content providers it provides wider reach as Hathway, Den and GTPL are active in regions where there is limited overlap. At the same time it should provide a single point of contact for both content and advertisement providers to Network18’s content distribution business.

Integrating with Network18 would also help in better deployment of cash flow for investment and working capital management on the distribution side. Also it brings a balance between a stream of revenue from the media & entertainment business which fluctuates with the business cycle and the steadier revenue stream from the distribution businesses.

The big picture

While investors may complain about their inability to participate in individual media businesses, the big picture is the conglomerate is moving closer to as many customers as possible with an integrated bouquet of offerings starting from telecom voice, data services, to entertainment rights right up to every good and service that can be delivered online, in order to capture every bit of customer wallet and every second of the spare time of a consumer.

Disclaimer: Reliance Industries Ltd is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!