After the initial euphoria around Budget gets over, D-Street will eye the monsoon that will play an important role in charting the direction of the market at least in the short term.

Last week, the critical Southwest Monsoon advanced to cover parts of Uttar Pradesh, Madhya Pradesh, interiors of Karnataka and the remaining parts of Northeast states. Southwest Monsoon delivers 70 percent of India’s annual rainfall. Indian Meteorological Division (IMD) expects the Monsoon to advance deeper into the Northwest only after July 3.

Initial reports suggest cumulative rainfall to date (as on June 26) has been 36 percent below its long period average (LPA). The LPA for India at 89cm is computed as the average Monsoon received over the past 50 years.

June 2019 has ended with a deficit of 33 percent. Geographically, Central India is witnessing the highest deficit at 43.9 percent, followed by East and Northeast India at 41.3 percent, Elara Capital said in a report.

The report further added that the June deficit comes at a time when more than 44 percent of the area in the country is reported to be under various degrees of drought conditions, 11 percent higher than a year ago, according to Drought Early Warning System (DEWS).

Delay in monsoon is already affecting the sowing of key kharif crops, but experts are of the view that the Budget should have significant dole outs for the agricultural sector.

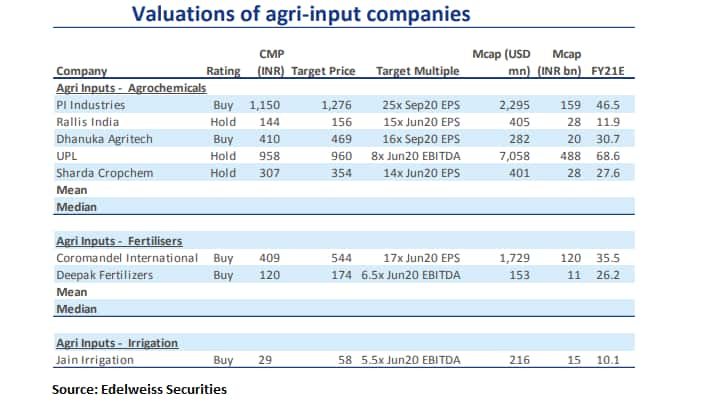

“We believe that the likely benefit of income support scheme, the potential increase in MSPs and expected increase in budgetary allocation for agriculture may spur agri-input consumption while a weak monsoon casts a cloud on outlook,” Edelweiss Securities said in a report.

“We continue to like domestic formulation players—Dhanuka Agritech (BUY) and Rallis (HOLD)—given their favourable risk-reward while fertiliser player, Coromandel (BUY) may feel the brunt of inventory-related losses,” it said.

The good news is that the Bureau of Metrology (Australia) expects that the immediate likelihood of El Nino developing has passed and its ENSO (El-Nino Southern Oscillation) outlook has now turned inactive.

Monsoon is expected to gain strength in July and subsequent months. “Off-late we have seen rainfall spreading across various parts of India in the last 5-6 days leading to spur in crop sowing and agri-input sales,” Prabhudas Lilladher said in a report.

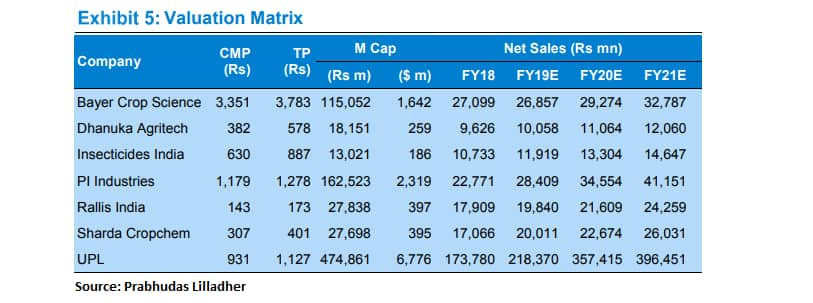

“We continue to remain watchful as monsoon and quantum of pest infestation over the next 3 months are critical for the domestic agrochemical companies like Bayer CropScience, Dhanuka Agritech, Insecticides India and Rallis India,” it said.

Disclaimer: The views and investment tips expressed by brokerages on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Note: The story has been updated to fix a type in the strap.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!