Infrastructure major Larsen & Toubro (L&T) is expected to report a decent growth in sales and net profit for the quarter ended December 2022. It will report its quarterly numbers tomorrow.

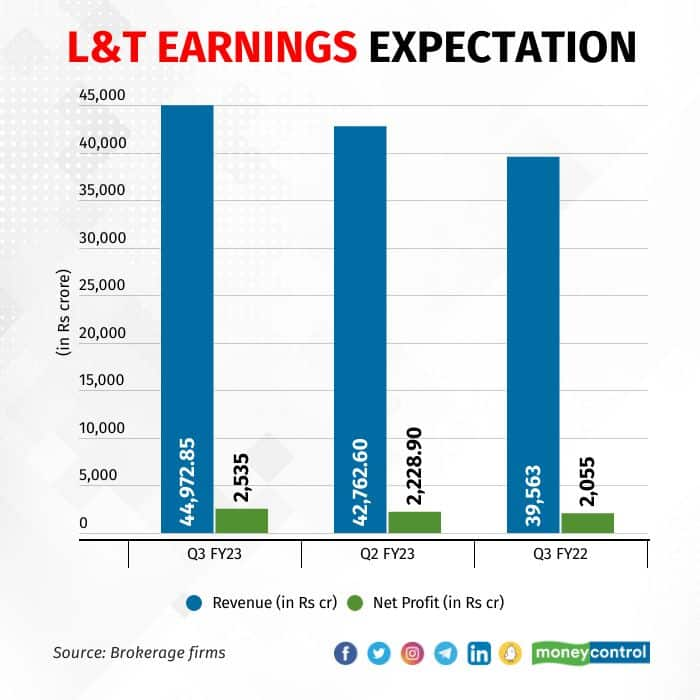

Consolidated revenue for the third quarter of FY23 is seen rising 5.2 percent sequentially and 13.7 percent annually to Rs 44,972.85 crore, according to a brokerage poll conducted by Moneycontrol. The company's net profit is likely to increase 13.7 percent on-quarter and 23.4 percent on-year to Rs 2,535 crore during the period under review.

Analysts believe the December quarter numbers should reflect a pick-up in the execution activity.

Kotak Institutional Equities expects a 9 percent on-year improvement in core EPC (Engineering Procurement and Construction) revenues as it takes into account improved construction activity across projects during the quarter.

Brokerage firm Sharekhan anticipates the core engineering business to drive the topline growth, given a healthy opening order book, and it also sees the company’s management increasing the order intake guidance for FY23.

Also Read | These 14 hand-picked stocks will get you ready for the Budget 2023

Jefferies said that L&T’s green portfolio is 30 percent of revenues and on an upward trend. Solar and hydro power projects, power transmission and distribution, green buildings, water and resource conservation, solid waste management and emission reduction through building mass rapid transport systems are a part of the same.

Announced order inflows for the quarter so far includes large and mega contracts from high-speed rail, metals and mining segment, said Kotak Institutional Equities.

The announced order inflow for L&T for the December quarter has so far remained below expectations of Kotak Institutional Equities, but the announcements do not include orders where negotiations are still ongoing with clients, the brokerage firm pointed out.

“Our 3QFY23 order flow expectation is Rs 544 billion, which is 8 percent YoY growth for L&T,” Jefferies said. It added that the FY23 order flow should comfortably end the year at the management’s guidance range of 12-15 percent YoY based on this trend.

“During Q3FY23, EPC order inflows announced by L&T are in the range of around Rs 20,500-34,000 crore (as on date, ex-services segment) across railway, hydrocarbon, power T&D (transmission and distribution), water treatment, heavy engineering, buildings and factories segments indicating strong order inflows for the quarter amid a challenging environment,” ICICI Securities said.

As order flow and execution outlook remain healthy, L&T could see an additional re-rating on the ESG leg if more funds get an exemption, according to Jefferies, which added that rerating should also be driven by peak of non-core investments being behind and better capital allocation.

Talking about the operational performance, Kotak Institutional Equities said that EBITDA (Earnings Before Interest, Tax, Depreciation, Amortisation) margin will start reflecting the recent moderation in commodity prices.

Even Sharekhan is of the view that the engineering major’s margin will witness a marginal increase, both on-year and on-quarter, due to operating leverage and lower input cost.

Also Read | MC Explains: What is National Green Hydrogen Mission and what is India’s policy?

Analysts believe that overall, EPC companies, including L&T, are expected to remain focused on working capital and cash flow management amid better execution and focus on receivables collections.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!