Equity benchmarks closed in the red on May 12, extending losses into the second consecutive session amid weak global cues.

The Sensex closed the day with a loss of 190 points, or 0.60 percent, at 31,371.12 and the Nifty settled 43 points, or 0.46 percent, lower at 9,196.55.

The market is expected to see strong gains on May 13 after the Prime Minister Narendra Modi announced a fiscal stimulus package of Rs 20 lakh crore, aimed at alleviating pain caused by COVID-19.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,080.05, followed by 8,963.55. If the index moves up, key resistance levels to watch out for are 9,276.95 and 9,357.35.

Nifty Bank

The Nifty Bank closed 0.46 percent lower at 18,862.85. The important pivot level, which will act as crucial support for the index, is placed at 18,435.4, followed by 18,008. On the upside, key resistance levels are placed at 19,141.8 and 19,420.8.

Call option data

Maximum call OI of 15.47 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,000, which holds 6.27 lakh contracts, and 9,700 strikes, which has accumulated 5.45 lakh contracts.

Significant call writing was seen at the 9,200, which added 1.8 lakh contracts, followed by 9,100 strikes that added 1.17 lakh contracts.

Call unwinding was witnessed at 9,700, which shed 15,075 contracts.

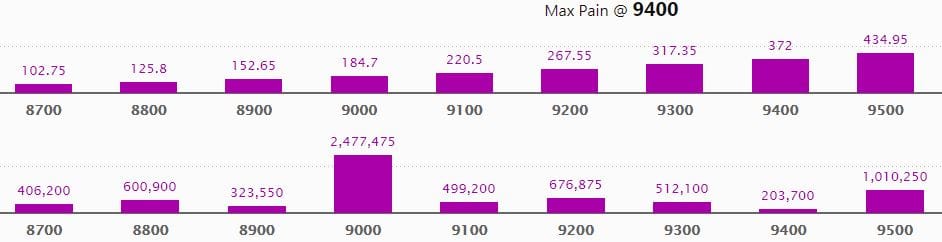

Put option data

Maximum put OI of 24.77 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,500, which holds 10.10 lakh contracts, and 9,200 strikes, which has accumulated 6.77 lakh contracts.

Significant Put writing was seen at 8,800, which added 1.13 lakh contracts, followed by 9,100 strikes, which added 94,800 contracts.

Put unwinding was seen at 9,500, which shed 97,275 contracts, followed by 9,300 strikes that shed 49,725 contracts.

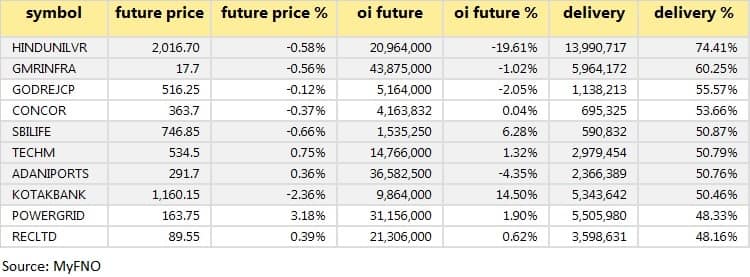

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

45 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

14 stocks saw long unwinding

59 stocks saw short build-up

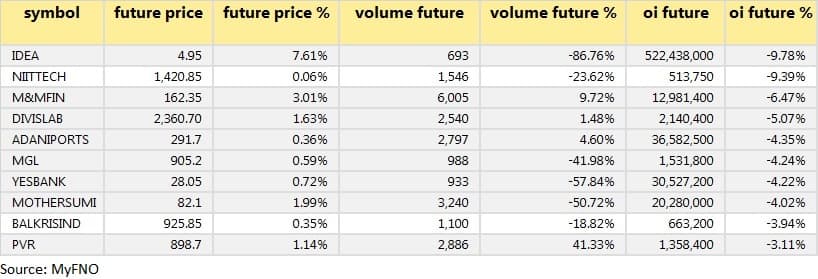

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

26 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Source: NSE

Source: NSE

(For more bulk deals, click here)

Results on May 13

Maruti Suzuki, Kotak Mahindra Bank, ABB India, Siemens, Godrej Consumer Products, Mphasis, Schaeffler India

Stocks in the news

Nestle India Q1: Profit rose to Rs 525.43 cr versus Rs 462.74 cr, revenue jumped to Rs 3,325 cr versus Rs 3,003 cr YoY.

JK Paper Q4: Profit fell to Rs 92.7 cr versus Rs 112.3 cr, revenue dipped to Rs 736 cr versus Rs 807.2 cr YoY.

IndiaMart InterMesh Q4: Profit rose 57% to Rs 44 cr, revenue jumped 23% to Rs 170 cr YoY.

Agro Tech Foods: Rakesh and Rekha Jhunjhunwala cut stake to 5.75% in Q4FY20 from 7.41% in Q3FY20.

Havells India Q4: Profit fell to Rs 177.7 cr versus Rs 199 cr, revenue declined to Rs 2,217.4 cr versus Rs 2,754.77 cr YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,662.03 crore, while domestic institutional investors (DIIs), too, sold shares worth Rs 364 crore in the Indian equity market on May 12, provisional data available on the NSE showed.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!