Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves. - Peter Lynch

The golden words hold more weight than one could imagine. It is true that most of us wait for corrections to build the portfolio and market also gives those opportunities that very few are able to capitalise.

But, if you in the markets for a long haul, there is nothing to worry about, say experts. A mix of large and midcaps would be a good option to start building your portfolio that could test the bull and bear cycles of the market for more than 3-5 years.

“Nifty is likely to inch up towards 13,000 in 2019 on the back of strong government mandate, positive Union Budget and improved liquidity situation in the system,” Amar Ambani, President & Research Head, YES Securities told Moneycontrol.

“I would advise investing in a staggered manner because it is extremely difficult to find conviction ideas. Investors should focus on a portfolio of around 20 stocks mostly with largecaps for now, while being extremely selective with midcaps,” he said.

Valuations could be a concern for benchmark indices but individual stocks could present a good opportunity for long-term wealth creation.

Experts suggest that valuations need to be viewed in the context of earnings, interest rates and a variety of macro factors. Even at current levels, the downside remains fairly limited.

Investors who are in the age bracket of 30-40 years could use the opportunity to pick stocks on dips. Sensex is down by more than 1,200 points from its record high of 40,312 registered on June 4.

Given the way mid and smallcaps have crumbled in the last two years, it makes sense to allocate the majority of portfolio weights towards largecaps and the rest in midcaps.

“A 30-40 years investor has a sufficiently long time horizon. We would still build the foundation of the portfolio via a largecap weight. Given the volatility small and midcaps have demonstrated, a healthy allocation—60-65 percent—to largecaps delivers stable and predictable growth,” Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management told Moneycontrol.

“We’d allocate roughly 20-25 percent to midcaps and the balance to small caps. Further, we’d tilt the portfolio towards growth, not value, despite growth being expensive,” he said.

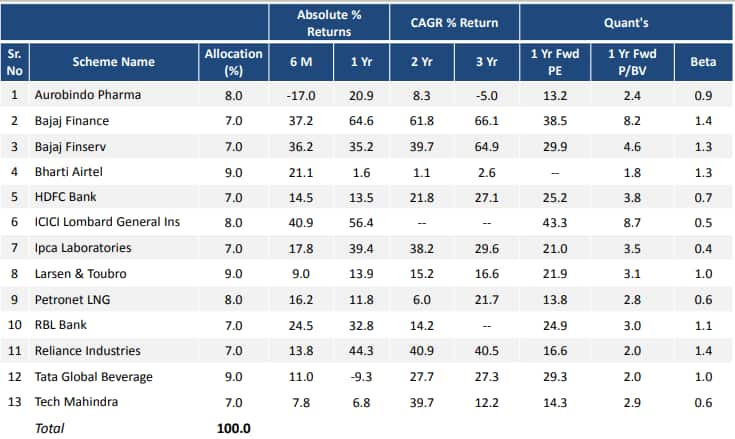

IIFL Securities handpicks 13 stocks for an aggressive portfolio to invest in companies that are growing faster than the industry and offering high risk-reward opportunities. The strategy takes a concentrated position in stocks/sectors and endeavours to dynamically change allocations between sectors depending on change in the business cycles.

The growth rate in the US business is expected to remain strong on account of its own injectables portfolio (shortage opportunity), new launches, and acquisitions (Sandoz+Spectrum).

Apotex acquisition will improve the presence/build scale in Europe. The stock is trading at 9.5x FY21E EPS, providing comfort to valuations.

The management expects India’s business to grow at 1.5x the industry rate. Moreover, focus on clinical research, scientific detailing and improving sales representative productivity should drive mid-teen growth in India business, and also improve the margins by 150-200bps during FY19-21E.

Further, likely significant pick-up in the institutional business along with 10-15 percent growth in the US business could drive earnings growth of 24 percent CAGR over FY19-21E. The stock is trading at 15.5x FY21E EPS.

The company displayed strong performance despite the liquidity crisis, which demonstrates Bajaj Finance's ability to raise funds in an unfavourable scenario, aiding it to achieve growth across segments.

IIFL Securities expects Bajaj Finance's AUM to register CAGR of 38 percent over FY19-21E, while consistently improving cost-income ratio will aid profitability. The stock currently trades at 6.4x FY21E P/BV.

The company will benefit from consolidation within the telecom industry. Subscriber growth offsetting reduction in ARPU, and strong growth in Africa business is positive for the company.

Moreover, the Rights issue of Rs 25,000 crore, SingTel’s intent to invest in Bharti, Africa IPO, potential stake sale in Infratel will aid the company in deleveraging its position.

Tata Global Beverage is set to benefit from the transfer of consumer business from Tata Chemicals, which includes salt, pulses and spices. It will lead to a diverse product portfolio, improvement in growth profile and return ratios.

The synergies and improvement in growth profile will also lead to re-rating of the stock going forward. The stock is trading at 25.1x FY21E EPS.

IIFL Securities expects Bajaj Allianz General Insurance's earnings to witness CAGR of 24 percent over FY18-21E on regulatory changes in motor TP (third-party) segment and health insurance.

Its life insurance business is expected to stabilise over the next two years with a focus towards a sustainable product mix leading to an increase in the value of new business margin.

Reliance Industries' refining business earnings are expected to register growth owing to better diesel cracks on IMO 2020 mandate and due to benefits from the commercialisation of pet coke gasifiers.

This should aid in offsetting the weakness in the petchem segment. The core retail business is posting robust growth led by a focus on tier 3/4 towns, leading to positive operating leverage.

Moreover, with Jio transferring its fiber and tower asset, it can lead lower Reliance Industries' consolidated net debt.

ICICI Lombard is well positioned to capture the growth potential in the sector driven by significant lower penetration and market share gains from PSUs.

Changes in regulations, especially under motor segment, improving competitive dynamics and ICICI Lombard's conservative strategy focusing on profitability will likely accelerate premium growth and improvement in loss ratios. The stock currently trades at 29.3x FY21 EPS.

It is the beneficiary of better loan growth, robust capital position, and relatively superior asset quality. HDFC Bank will continue to deliver robust growth as it benefits from its scale and inherent competitive advantages.

We forecast 21 percent EPS CAGR over FY19-22E. The stock is trading at 3.9x FY20E P/BV.

Industry-leading NII growth, improving the cost-to-income ratio and lower credit cost will drive 32 percent EPS CAGR over FY19-22E.

Further, a ~27bps RoA expansion to ~1.5 percent over FY19-22E will lead to re-rating in the stock. The stock is trading at 2.7x FY20E P/BV.

Petronet LNG is expected to benefit from Dahej terminal expansion, improvement in Kochi terminal utilisation and attractive valuations.

The company expects the 2.5m MT expansion at Dahej should be operative from Q2FY20 (13 percent jump in installed capacity), pipeline connecting the Kochi LNG terminal to Mangalore to be complete by June 2019.

We anticipate the completion of the Kochi-Mangalore pipeline to increase utilisation of Kochi terminal to ~20 percent by FY21E and 40 percent utilisation by FY22E. The stock is trading at 13x FY21E EPS.

IIFL Securities expects the telecom business to post ~9 percent CAGR over FY19-21E (after ~1 percent revenue CAGR decline over FY16-19) on large telecom deal ramp-up.

Enterprise business momentum is likely to sustain the steady performance of BFSI, manufacturing and healthcare.

Moreover, the company has the lowest US dependence, which reduces the impact of US restrictive immigration policies. The stock is trading at 12.8x FY21E EPS.

L&T expects to sustain the core execution momentum in the domestic market (19 percent in FY19) and guides for 12-15 percent revenue growth in FY20, adjusted for softness due to elections.

Core EBITDA margin should be stronger in FY20 led by a recovery in infra OPM against FY19. The order book grew 12 percent YoY to ~Rs 2,93,400 crore (2.7x TTM sales), providing healthy revenue visibility for the next two years. The stock is trading at 18.5x FY21E EPS.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust that controls Network18 Media & Investments Ltd.

The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!