Tata Motors, the commercial vehicle major and the owner of Jaguar Land Rover, reported a consolidated loss of Rs 8,443.98 crore on July 31, for the quarter ended June 2020 as lockdown in several countries affected JLR as well as domestic businesses.

The loss in fact was significantly higher than Rs 3,679.66 crore loss posted in Q1FY20 and Rs 9,863.75 crore loss in Q4FY20.

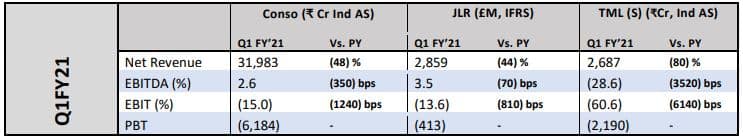

Revenue from operations during the June quarter fell significantly to Rs 31,983.1 crore, compared to Rs 61,467 crore in the year-ago period.

A CNBC-TV18 poll had estimated the company's Q1 loss at Rs 9,400 crore and revenue at Rs 36,200 crore.

The company said EBITDA margins impacted due to adverse mix and negative operating leverage.

In the Tata Motors segment, CV retails stood at 3.1K. Market share in MHCV rose 1,440 bps as compared with FY20.

PV retails stood at 18.6K. Market share in passenger cars rose 840 bps and UVs rose 50 bps as compared with FY20.

In the JLR segment, the company said COVID-19 resulted in temporary retailer and plant shutdowns, significantly impacting sales and profits.

Retail sales of 74,067 vehicles in the segment declined 42.4 percent YoY but improved month by month through the quarter with June down 24.9 percent, said the company.

JLR segment's revenue was 2.9 billion pound in the quarter and the company made a pre-tax loss of 413 million pound. However, this was only down 18 million pound year-on-year, said the company.

The company said the outlook remains uncertain for the year with infections continuing to rise and intermittent lockdowns in many countries.

However, it expects a gradual recovery of demand and supply in the coming months.

"In this context, we are committed to significantly deleveraging the business in the coming years and aim to generate positive free cash flows over last 3 quarters of the year by focusing on better front end activations of our exciting product range, and executing our cost and cash savings with rigour," said the company.

Commenting on the quarterly performance, Guenter Butschek, CEO and MD, Tata Motors, said: “The COVID-19 pandemic has deeply impacted the auto industry in Q1FY21. Post a calibrated restart at all plants in mid-May, we gradually scaled up our capacity while prudently safeguarding the health and wellbeing of our employees as well as the larger ecosystem."

"Even as we continue to address the challenges, we see some disruption due to the intermittent shutdowns and supply chain bottlenecks. We have witnessed some green shoots emerging in PV owing to some pent up demand pre-COVID, and are hopeful for a full recovery of the CV industry by end of the fiscal year, with a gradual pickup of demand, aligned to the economic recovery. We remain focused on making Tata Motors more agile to improve our market, operational and financial performance by reducing costs, generating free cash flows and providing the best in class customer experience.”

The stock gained 38 percent during the June quarter following recovery in equity markets and value buying due to a sharp fall in March crash but corrected 44 percent year-to-date.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!