Market rally in the past five-and-half-months has been relentless with dips being bought every time.

The benchmark indices have gained more than 50 percent each from March lows though both are in negative terrain on the year-to-date basis, down nearly 7 percent each. The broader markets outperformed benchmark indices after underperformance of two-and-half-years with Nifty Midcap rising 52 percent and Smallcap up 68 percent from March lows.

The FII money inflow has been the actual booster for this rally, followed by better-to-in-line June quarter earnings, expected strong growth in FY22 given the unlocking of India, rising retail participation, consistent progress on the COVID-19 vaccine front etc.

Experts see the upside to continue given the expected FII money and advise buying strong companies in sectors which are expected to get a boost by several measures taken by the government and COVID-19-led opportunities.

"We believe that the current trend of mid and small-cap outperformance is sustainable as the performance seems more broad-based across various one-year time horizons. Thus, we add more high conviction names to our top picks portfolio," Neeraj Chadawar, Head - Quantitative Equity Research at Axis Securities told Moneycontrol.

Listen | Business has recovered fast to pre-COVID levels: Urban Company Co-founder Abhiraj Bhal

He believes that the equity will continue to trade on higher multiples for some more time as the US FED recently signalled that these interest rates will keep lower for an extended period of time which reduces the derating risk of PE multiple.

Hence he feels the current momentum could lead the rally to 12,000 on the Nifty, but he believes that it will not sustain at that level, rather one should play with quality franchises in mid and small-cap space.

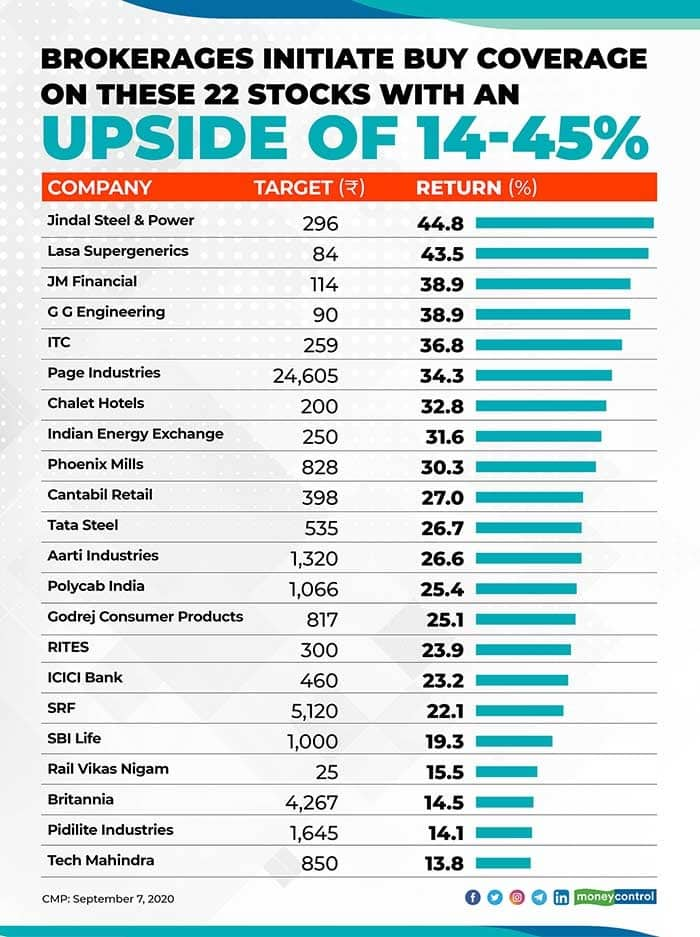

Given the expected growth in several sectors and likely outperformance in broader space, brokerages initiated coverage with a buy call on these 22 stocks in last one month. These stocks are expected to give 14-45 percent return in next one year period:

IDBI Capital initiated coverage on ITC with buy rating and target of Rs 259 based on SOTP valuation. The brokerage believes ITC offers perfect blend of reasonable valuation, decent growth and high dividend yield.

"ITC is less exposed to non-essential categories. Revenue contribution from essentials/semi essentials stands at 90 percent led by cigarettes and branded packaged food. Concerns on GST cess hike on cigarette (85 percent contribution to EBIT) by the government to meet fiscal deficit targets are temporary. In-elastic demand and ability of ITC to hike prices would support the bottomline," the brokerage said.

IDBI Capital expects ITC to continue growing profitably in the branded FMCG business with renewed focus on health and hygiene. In hotel business, the brokerage expects ITC to emerge out stronger from the current pandemic led by cash flow support from strong

balance sheet compared to competition.

IDBI Capital initiated coverage on Godrej Consumer Products (GCPL) with buy rating and target of Rs 817 based on 45x FY22E EPS. The brokerage likes the GCPL's approach of disruptive pricing and product differentiation as a core strategy to drive growth in FMCG sector.

"Market leading position in HI and personal care (soaps in India, baby wipes in Indonesia) will help GCPL to benefit from positive industry tailwinds due to COVID concerns. GCPL expects hygiene category to be the new household insecticide category," said IDBI Capital which is positive on GCPL's ability to deliver strong performance in hygiene category backed by robust R&D and efficient distribution.

In international markets, the brokerage expects Indonesia to bounce back strongly while Africa and Latin America, which has large exposure to non-essentials (89 percent revenue from hair-color), will continue to face growth headwinds.

IDBI Capital initiated coverage on Britannia Industries with buy rating and TP of Rs 4,267 based on 50x FY22E EPS. "The ongoing health crisis has led to significant shift in demand from out-of-home consumption to in-home consumption primarily led by rise in work-from-home culture."

With dominant presence in urban cities and variety of value-to-premium products at popular price points (Rs 5/Rs 10), the brokerage expects Britannia to be biggest beneficiary of the positive industry tailwinds.

"Evidently, Britannia with superior distribution network (40 percent direct distribution) has been able to seize the opportunity and outperform competition with a strong 27 percent YoY revenue growth during Q1FY21. Impressive execution and superior product portfolio will help Britannia to continue its journey of outperformance during FY21-22E," said the brokerage.

HDFC Securities initiated coverage on Aarti Industries (AIL) with a buy recommendation and target price at Rs 1,320 per share. The brokerage expects AIL's PAT to grow at a 29 percent CAGR over FY21-23, led by a 14 percent CAGR in revenue, and expects the return on capital employed (RoCE) to dip in FY21 to 8 percent owing to significant Capex and the adverse impact of the pandemic on the business, but it is expected to recover to 10 percent in FY23.

"The constant focus on R&D will enable the company to remain competitive and expand its customer base. The toluene segment in India is mainly untapped and catered to through imports; AIL will benefit in the long term by entering this segment," said the brokerage.

HDFC Securities initiated coverage on SRF with a buy recommendation and target price of Rs 5,120 per share. The brokerage expects SRF's PAT to grow at a 23 percent CAGR over FY21-23E, led by an 11 percent CAGR in revenue.

"Revenue growth is expected to be driven primarily by a 17 percent revenue CAGR in chemicals segment and a 7 percent revenue CAGR in packaging films segment, while technical textiles revenue is expected to grow by a mere 2 percent, the brokerage feels.

HDFC Securities expects the RoCE to dip to 8.5 percent in FY21, owing to significant Capex spend, but it could recover to 10.5 percent by FY23. "Capacity expansion and the plan to launch 3-4 new products every year will sustain growth momentum. Robust demand for BOPET and ramp-up in capacity utilisation of the recently-commissioned plants should drive earnings growth for packaging business."

"SBI Life is in a sweet spot given its strong distribution network, cost leadership and access to its parent SBI's large customer base. Overall, we expect operating return on embedded value (ROEV) to normalize toward 18 percent levels with Embedded Value (EV) reflecting 16 percent CAGR over FY20-23E. Thus, we value the company at Rs 1,000 per share based on 2.8x FY22E EV," said Motilal Oswal which initiated coverage on SBI Life with a buy rating.

Indian Energy Exchange (IEX) is an electricity exchange that offers a transparent and efficient platform for the Short-Term (ST) trading of power. "Over the past decade (FY11–20), volumes on IEX have jumped over 4x. With new product launches, a continued oversupplied market, and IEX's competitive positioning, we expect volumes/PAT for IEX to increase at a 20/19 percent CAGR over FY21–23," said Motilal Oswal which initiated coverage on IEX with a buy rating, at target of Rs 250 per share based on 30x Sep’22 EPS.

"JSPL is best placed among large steel companies with likely robust volume growth in FY21E (+9 percent), despite weak demand. Importantly, it entered the current weak cycle with higher capacity and lower debt compared to previous weak cycle (CY15-16). Further, with no major capex plans, focus on deleveraging and monetizing overseas assets, we believe the stock can deliver strong returns over the coming two-three years, despite the recent sharp run-up," said IDBI Capital which initiated coverage on the stock with a buy rating and target of Rs 296 per share.

"Tata Steel entered the current weak cycle with high leverage and ongoing brownfield expansion at its Kalinganagar plant. While its domestic operations have strong backward integration; however, its European operations profitability will remain weak in FY21E. Nevertheless, Tata Steel has cut capacity in Europe over the years and with ongoing expansion in India, its volume share from high margin India operations is likely to improve over the coming three years. Asset monetization at its overseas operations could be a key catalyst for the stock," said IDBI Capital which initiated coverage on the stock with a buy rating and target of Rs 535 per share.

"Post sharp drop in occupancy in the month of April the company has reported strong pick up in occupancy for June through August. The company has posted a better than expected set of numbers for Q1FY21 as the commercial real estate segment provided stability to numbers given the sharp fall in the hospitality revenues. Occupancy levels have already started improving from July and expected to improve gradually over the next few months," said Angel Broking which expects significant improvement in business post the festive season and normalization of operations in the second half of FY22.

Given strong promoter group brand recall and balance sheet and expected improvement in business by Q4FY21, the brokerage is initiating a buy on Chalet Hotels with a target price of Rs 200.

"ICICI Bank is well prepared among its peers to weather the COVID-19 storm with a) highest PCR (at 75 percent), b) highest COVID-19 provisions (1.3 percent of advances), and c) higher home loan portfolio (31 percent of advances). Strong liability franchise and higher Tier I capital ratio will advantage bank when the economy growth recovers," said IDBI Capital which expects credit growth for the bank to remain higher than the banking industry led by market share gain.

The brokerage expects loan growth and margin to improve, thus resulting into 50bps YoY improvement in ROA over FY20- FY22E to 1.3 percent. It initiated on ICICI Bank with a buy rating and a target price of Rs 460.

Khambatta Securities expects GGE to deliver exponential topline growth in FY21 and FY22, enabled by strong traction from RVMs and advertising revenues, healthy volumes of legacy products, and contribution from personal protection products.

"The strong growth and increasing contribution from advertising will generate operating leverage, leading to margin expansion and solid gains in RoCE and return on equity (ROE). Basis the robust earnings growth forecast, the GGE stock trades at an attractive forward P/E level of 10.6x FY22E EPS. Valuing at 15.0x FY22E EPS, our target price of Rs 90 informs a buy rating," said the brokerage.

"With overall demand environment remaining weak, we expect a fall in FY21 revenues, followed by a sharp recovery in FY22 aided by pent-up demand. Margins are also expected to recover following a decline due to a difficult operating environment in FY21 with incremental effect at the PAT level due to lower interest expense / debt, leading to solid gains in return ratios. Basis strong earnings growth forecast, the Cantabil stock trades at a very attractive forward P/E of 13.5x FY22E EPS. Valuing at 18.0x FY22E EPS, our target price of Rs 398 informs a buy rating," said Khambatta Securities.

Khambatta Securities expects robust topline growth during FY21 in line with the solid Q1 FY21 performance, followed by normalized healthy growth in FY22.

"Operating leverage will drive margin expansion with incremental effect at the PAT level due to lower interest expense / debt, leading to solid gains in ROCE and ROE. Basis strong earnings growth forecast, the Lasa stock trades at very attractive forward P/E levels of 11.4x and 9.0x FY21E EPS and FY22E EPS, respectively. Valuing at 13.0x FY22E EPS, target price of Rs 84 informs a buy rating," said the brokerage.

"Innerwear is evolving from being functional to a segment with a fashion quotient, also shifting from price sensitive category to a brand sensitive one. Strong margin, debt free status and doubling of capacity by 2025 will help to tap vigorous opportunity in the sector. Higher asset turnover ratio, healthy dividend payout and better working capital management led to consistent improvement in ROE/ROCE," said Geojit Financial Services.

"We expect most of the negatives owing to pandemic are factored in, while discretionary spending is expected to pick-up from H2FY21. We initiate coverage on Page Industries with buy rating and value at P/E of 60x on FY22E with a target price of Rs 24,605," it added.

"JM Financial (JMF), over the past decade, has effectively transitioned to a comprehensive corporate finance advisor-cum-provider and is now actively pursuing scaling up the retail pie as well. What distinguishes JMF from other financiers: 1) leveraging sticky relationships with institutional, wealth and corporate clients through diversified albeit niche offerings; 2) differentiated business approach in operating segments; 3) graded and calibrated growth (not chasing size) with low risk tolerance and superior risk-adjusted returns (>3.5 percent); 4) focus on building optimal blend of principal and flow business, and linear and non-linear revenue streams; and 5) high capitalisation (<4x leverage) all through its existence," said ICICI Securities.

"Weak real estate sentiment and delayed resolution of distressed credit may weigh on earnings in the immediate term (flat in FY21E), partially offset by sustained momentum in IWS (Investment banking, Wealth management & Securities) business. Valuing operating businesses separately, we arrive at an SoTP-based target price of Rs 114. Initiate coverage with buy," the brokerage added.

HDFC Securities initiated coverage on Phoenix Mills (PML) with target of Rs 828 per share, as brokerage believes, with strong balance sheet and marquee assets position, PML is well-poised to ride the cyclical recovery (at present, restrictions on mall's operations and COVID-led fears have curtailed the underlying demand).

"PML is a derivate on richly valued underlying consumption real estate play with a vast scope for expansion. In the long run, it holds the potential for significant cash flow distribution and growth. Near-term headwinds remain, but current prices provide quality at reasonable price," said the brokerage.

"Polycab has successfully transitioned its 20 percent ROE business from being a B2B business to a B2C business by leveraging its tremendous brand equity through innovative ASP strategies and CRM programs. The combination of a multi-pronged growth strategy has enabled the company to grow its profits at a CAGR of 37 percent over the last five years," said LKP Securities which initiated coverage on Polycab after an extremely challenging Q1 due to the pandemic with a buy rating and a price objective of Rs 1,066 per share.

Sharekhan initiated coverage on Tech Mahindra with buy rating and price target of Rs 850, given potential 5G opportunity and anticipated rise in margins.

"Our positive stance underpins company's comprehensive capabilities in telecom space, improving capabilities in enterprise business and a better-go-to market strategy. Tech Mahindra has successfully transformed itself from a telecom-centric player to one with a wide portfolio of differentiated offerings in the enterprise segment. Key levers for margin improvements are (1) reduction in subcontracting expenses, (2) higher offshore mix, (3) better profitability of acquired entities and (4) exit from non-profitable operations," said the brokerage.

Sharekhan initiated coverage on Pidilite Industries with buy recommendation and assigning a price target of Rs 1,645. "Pidilite leads domestic market for adhesives, sealants and construction chemicals. Strong brands (including Fevicol, Dr.Fixit and Fevikwik) give it a competitive edge over peers."

"FY2021 will be affected by impact of Covid-19 spread resulting into a wash-out Q1FY21. With recovery started flowing in (especially in tier-III and IV towns), FY2022 is expected to witness strong bounceback. Fall in VAM prices would help margins continue rise. Launch of premium products in core categories, foray into new categories (largely consumer-centric), wider distribution reach and expansion into international markets remain key growth drivers in the medium to long term," said Sharekhan.

IDBI Capital initiated coverage on RITES with buy rating and target of Rs 300 (valued at 12x FY22E EPS).

"FY20 order-book at Rs 6,200 crore equal to 3x FY20 revenue and composition has marginally tiled towards turnkey projects. In FY21E, we expect revenue growth to be muted but to increase by 20 percent in FY22E. RITES ROE at 25 percent (FY20) is one of the highest amongst its peer set. This is driven by contribution from high margin consultancy business and lean balance sheet with negligible subsidiary/JV investments. RITES has consistently generated OCF and has paid dividends. With payout of 65 percent, dividend yield is 5/6 percent for FY21E/22," said the brokerage.

IDBI Capital initiated coverage on Rail Vikas Nigam (RVNL) with buy and target of Rs 25 (at 6x FY22 EPS, which is based on +1 STD since its IPO).

"Over the last 4 years (FY16-20) RVNL net profit has increased at CAGR of 19 percent and order backlog of Rs 82,300 crore provides revenue visibility (7x FY20 revenue). Balance sheet has own cash of Rs 1,000 crore (25 percent of market cap), and ROE excluding cash and investment is strong at 22 percent. Stock offers a dividend yield of 6-7 percent and seeing its peer set, dividend payout of ~32 percent has a scope to increase," said the brokerage.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!