Ruchi Agrawal

Moneycontrol Research

Highlights

Key positives

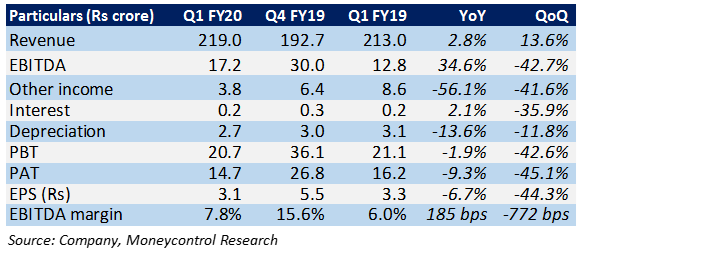

- Earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 185 basis points (bps) year-on-year (YoY) due to the controlled sales expenses and lower overheads.

Key negatives

-Delay in the onset of monsoon and sowing impacted the agrochemical business in June due to which the topline growth for the company remained largely muted at 3 percent YoY.

-While volume growth remained largely tepid, the marginal uptick in revenue was driven by its price increase in order to partially pass on the uptick in raw material costs.

- High cost inventory coupled with increase in competition led to a 110 basis points (bps) contraction in the gross margin.

Other comments

-Dhanuka has six new products which are to be launched this year, of which three have already been launched. Traction from these new launches is expected to support top line in coming quarters. However, gains from the product mix improvement have been negated by higher technical prices and lower demand (due to deficient monsoon).

-The company is revamping its marketing network to accelerate overall business growth. It is focusing more on high revenue generating customers via its Kohinoor scheme and also weeding out uncompetitive dealers.

-Dhanuka Laboratories, a promoter group entity, has successfully bid for Orchid Pharma through the National Company Law Tribunal (NCLT) auction for an estimated Rs 600 crore. The management has guided that promoters will pledge a part of its stake in the company to fund this acquisition.

Outlook

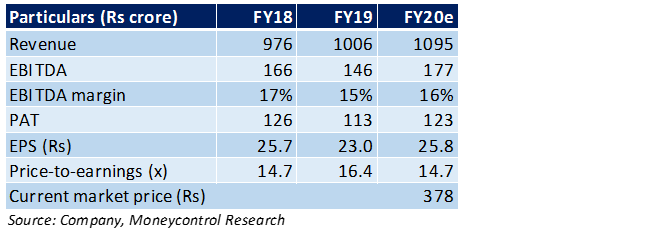

The stock has corrected 39 percent from its 52-week high. After the correction, the stock is trading at an FY20 estimated price-to-earnings of 14.7 times.

While the improving product mix is a positive for the long-term growth for the company, the high raw material prices and unpredictable monsoon are impacting the performance negatively. Monsoon performance in the current quarter (Q2) would be something to watch out for.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research Page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!