Here are stocks that are in the news today:

Results on August 7: Tata Steel, HCL Technologies, Lupin, Cipla, Aurobindo Pharma, Mahindra & Mahindra, Siemens, HPCL, Honda Siel Power Products, Birlasoft, GOCL Corporation, Anup Engineering, Praxis Home Retail, Voltas, Dollar Industries, Signet Industries, Bhagyanagar Properties, Tasty Bite Eatables, Geojit Financial Services, Aster DM Healthcare, DCM Nouvelle, Garware Technical Fibres, Adani Gas, Adani Power, Adani Ports, Adani Green Energy, Matrimony.Com, INEOS Styrolution India, Navkar Corporation, IZMO, Bhagyanagar India, Lemon Tree Hotels, Surana Solar, Ramco Cements, Themis Medicare, Tata Teleservices (Maharashtra), Star Paper Mills, Rajesh Exports, Welspun Investments, Allcargo Logistics, Maharashtra Seamless, Sundram Fasteners, Schneider Electric Infrastructure, Ingersoll Rand, GeeCee Ventures, Cummins India, BAG Films and Media, AstraZeneca Pharma, Welspun Corp, Punjab & Sind Bank, Indian Metals & Ferro Alloys, Kalyani Steels, SREI Infrastructure Finance, Kalyani Investment, Gravita India, Sonata Software, Surana Telecom and Power, Patspin India, KEC International, Precision Wires India, Shreyas Shipping, J Kumar Infraprojects, Phoenix Mills, GTN Textiles, Kothari Sugars, KCP Sugar, Oracle Financial Services Software, Jindal Drilling, Sudarshan Chemical Industries, Ramco Industries, India Cements, Gokul Refoils, Uttam Sugar Mills, Gujarat Lease Financing, Ramco Systems, Balrampur Chini Mills, Bajaj Electricals, ITI, PTC India

Reliance Industries: Company and BP agreed to form a new joint venture that will include a retail service station network and aviation fuels business across India. Reliance to hold 51 percent stake and rest is held by BP in new fuel retail joint venture.

Indiabulls Housing Finance Q1: Consolidated profit falls to Rs 801.5 crore versus Rs 1,054.72 crore, net interest income declines 12.7 percent to Rs 1,475 crore versus Rs 1,690 crore YoY.

Indiabulls Housing Finance: Board approves raising up to Rs 1,000 crore through debt and Rs 25,000 crore via NCDs.

Central Bank of India Q1: Profit at Rs 118.3 crore against loss of Rs 1,522.2 crore and NII rises 6.7 percent to Rs 1,790.2 crore versus Rs 1,678.2 crore YoY. Gross NPA rises to 19.93 percent versus 19.29 percent, net NPA increases to 7.98 percent versus 7.73 percent QoQ.

Cox & Kings: Company defaulted on Rs 5 crore payments on unsecured commercial paper.

IRB Infrastructure Q1: Profit dips 17.4 percent to Rs 206.6 crore versus Rs 250 crore, revenue rises 15.3 percent to Rs 1,773 crore versus Rs 1,538 crore YoY. Singapore's GIC to invest Rs 4,400 crore in company's road operations.

Avenue Supermarts: Radhakishan Damani to sell 62.3 lakh shares to meet minimum public shareholdling norms. Company issued commercial paper of Rs 50 crore.

Jet Airways: All resolutions passed by Committee of Creditors with requisite majority. CoC also approves evaluation matrix, request for resolution plan.

Tata Steel: Company terminated stake sale of South East Asia business to HBIS. Company had inked agreement to sell 70 percent of South East Asia business to HBIS in January.

Shemaroo Entertainment Q1: Consolidated profit dips to Rs 16.15 crore versus Rs 19.54 crore, revenue rises to Rs 143.03 crore versus Rs 123.36 crore YoY.

JK Lakshmi Cement Q1: Consolidated profit jumps to Rs 49.81 crore versus Rs 6.05 crore; revenue rises to Rs 1,136 crore versus Rs 1,040 crore YoY.

Zensar Technologies Q1: Consolidated profit falls to Rs 74.51 crore versus Rs 82.16 crore; revenue rises to Rs 1,071 crore against Rs 904.66 crore YoY.

HSIL Q1: Profit jumps to Rs 14.34 crore versus Rs 2.10 crore, revenue falls to Rs 439 crore versus Rs 542.41 crore YoY.

MBL Infrastructures: Company has completed work of project for improvement/upgradation of roads and bridges of Shivganj—Rafiganj—Goh—Uphara—Devkund— Baidrabad Road (SH—68), Package. Bihar (contract value was Rs 168.53 crore).

Gujarat State Fertilizers & Chemicals Q1: Consolidated profit dips to Rs 41.82 crore versus Rs 70.11 crore, revenue declines to Rs 1,721 crore versus Rs 1,762.7 crore YoY.

Star Cement: ICRA reaffirmed its long term rating to AA- and short term rating to A1+. The outlook on the long-term rating is 'Stable'.

Borosil Glass Works Q1: Consolidated profit drops to Rs 9.4 crore versus Rs 10.5 crore, revenue rises to Rs 172.85 crore versus Rs 155.33 crore YoY.

Deccan Cements Q1: Profit rises to Rs 23.3 crore versus Rs 11.3 crore, revenue climbs 12.6 percent to Rs 182 crore versus Rs 161.7 crore YoY.

JSW Energy Q1: Consolidated profit increases to Rs 244.38 crore versus Rs 229.17 crore, revenue rises to Rs 2,412.2 crore versus Rs 2,360.6 crore YoY.

Khadim India Q1: Profit falls to Rs 3.35 crore versus Rs 7.4 crore, revenue rises to Rs 216 crore versus Rs 189.6 crore YoY.

Excel Crop Care Q1: Profit dips to Rs 23.2 crore versus Rs 38.92 crore, reveneu declines to Rs 378.85 crore versus Rs 402.8 crore YoY.

NLC India: Company decided not to pursue the setting up of pilot plant for coldry matmor integrated project on R&D collaborative mode as agreed to between NLCIL & NMDC & ECT Australia.

Lux Industries Q1: Consolidated profit rises to Rs 18.77 crore versus Rs 17.51 crore, revenue increases to Rs 262.8 crore versus Rs 262.3 crore YoY.

REC: Company approved the proposals for sale and transfer of wholly owned subsidiaries of REC Transmission Projects Company Limited (RECTPCL) and REC Limited.

Mayur Uniquoters Q1: Consolidated profit falls to Rs 9.74 crore versus Rs 22.86 crore, revenue dips to Rs 127.35 crore versus Rs 140.3 crore YoY.

Sheela Foam Q1: Consolidated profit rises to Rs 38.72 crore versus Rs 32.59 crore, revenue increases to Rs 514.24 crore versus Rs 502 crore YoY.

Shriram EPC Q1: Consolidated profit increases to Rs 6.45 crore versus Rs 5.51 crore, revenue rises to Rs 382 crore versus Rs 129.87 crore YoY.

Nilkamal Q1: Consolidated profit falls to Rs 31.06 crore versus Rs 33.58 crore, revenue dips to Rs 536.5 crore versus Rs 585.1 crore YoY.

NLC India Q1: Consolidated profit dips to Rs 288.1 crore versus Rs 355 crore, revenue drops to Rs 2,082.2 crore versus Rs 2,438 crore YoY.

L&T - L&T Construction has secured a mega contract for design and construction of a major airport.

DHFL: Company defaulted on interest, principal amount of total Rs 43.3 crore due on August 5 & 6.

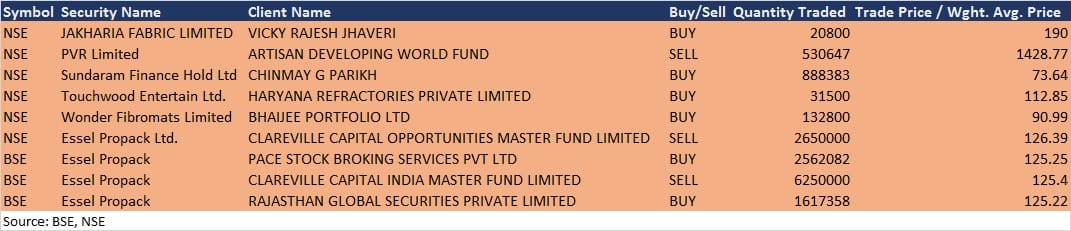

Bulk deals

(For more bulk deals, click here)

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!