Shshank Saurav

The Indian automobile industry, plagued by prolonged sluggish sales, is making a strong pitch for government support in the form of tax cuts.

This is all the more significant especially after the latest measures announced by Finance Minister (FM) Nirmala Sitharaman to revive the ailing housing sector and boost exports.

The matter is high on agenda for the GST Council meeting in Goa slated for September 20.

No doubt, there is a decline in overall sales volume, but there are other aspects, including financial performance of the auto sector, that need to be looked at carefully before reaching any conclusion.

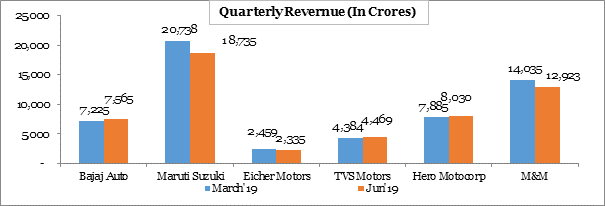

Data suggests that the entire auto industry is not affected by slowdown. Some of the big players like Bajaj Auto, Hero MotoCorp and TVS Motors have all posted higher sales than the previous quarter, which means the slowdown is not pervasive.

Though car makers have reported a drop in overall revenue, there is increase in sales in the SUV segment. In other words, Indian buyers are shifting from small cars to compact SUVs.

Source- Quarterly reports filed with stock exchange

Source- Quarterly reports filed with stock exchange

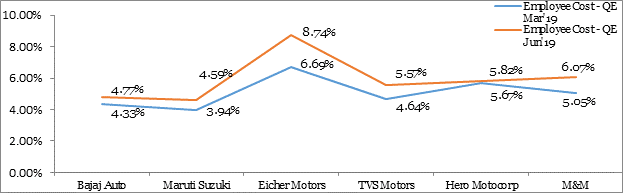

The biggest concern of the sector is loss of jobs due to the slowdown. If we analyse available information, it becomes clear that employee cost as a proportion of revenue or entire operating expenditure is quite insignificant.

Employee cost as percentage of revenue: Source- Quarterly reports filed with stock exchange

Source- Quarterly reports filed with stock exchange

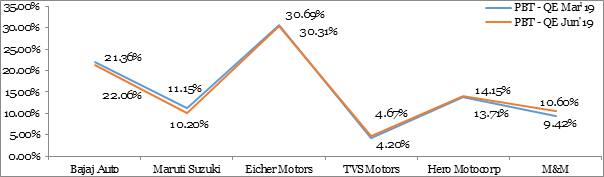

Despite the slump in sales, the profitability ratio (profit before tax PBT as percentage of revenue) of all major auto players is almost similar to the preceding quarter. TVS Motors, Hero MotoCorp and Mahindra and Mahindra (M&M) have, in fact, reported a jump in their profit margins. A stable profit margin indicates that the companies have managed to reduce their cost and aligned it with revenue decline.

Profit before tax (PBT) as percentage of revenue: Source- Quarterly reports filed with stock exchange

Source- Quarterly reports filed with stock exchange

The industry is pushing for a tax rate cut to reduce price of cars, which may push up demand. In this entire context, one thing comes to mind. If the industrialists are concerned about volume of sales or future of employees and job security, then why can’t they compromise a little bit on profit margins and reduce the ex-showroom price?

The auto industry has accumulated huge profits over the years and PBT of top nine listed entities was more than Rs 34,000 crore on a standalone basis. India’s largest carmaker Maruti Suzuki clocked more than Rs 10,000 crore PBT in the previous year itself. If profits of corporates are private, then a cyclical reduction in profitability should not be borne by the public exchequer by reducing tax rates.

Maruti Suzuki paid royalty of Rs 4,498 crore and Rs 4,035 crore during 2018-19 and 2017-18, respectively while corresponding employee cost stood at Rs 3,255 crore and Rs 2,834 crore. Suzuki Corporation derives more than three-fourths of its market capitalisation from Maruti Suzuki and if the auto maker is really concerned about decline in sales volume, then it can reduce the royalty paid and the commensurate reduction should be made in the vehicle prices.

Expenditure on research and development (R&D) forms 1.5-5 percent of revenue for Indian automobile makers. This is much below the industry average in Europe or the US. If Indian products are not up to the mark, then they are bound to fail in the export market. No industry representative wants to talk about the fact that passenger vehicle exports declined by 9.64 percent in the previous financial year. Sales volume decline in domestic market is highlighted as a rationale behind asking for tax cuts.

Notably, the FM has waived the surcharge on FPIs, but it failed to stop the funds outflow and therefore, it must be understood that tax cut is not the panacea. Growth of personal vehicle segment is dependent on economic growth and not vice-versa.

The 15th Finance Commission is examining the states’ demand of extending the compensation period by three years and if this proposal is accepted, it will increase the burden on the central government, which is already facing difficulty in managing the fiscal deficit while increasing expenditure to boost growth.

If GST rate cut demand of any particular sector is accepted, then similar demands from other sectors are bound to come in. The demand is also not backed by any supporting data that tax incidence has increased because automakers are now eligible for input credit on almost all the duties and taxes paid by them, which was not possible in the earlier framework (eg. central sales tax was not eligible for input credit).

Usually, government support is provided to any sector during the infancy stage or in a crisis-like situation. The tax cut call of the auto sector lacks both moral and financial ground. The industry players have to prepare themselves for change in consumer behaviour and mould their business strategies to survive in a market-driven economy.

Shshank Saurav is a Chartered Accountant. Views are personal.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!