On January 16, Nifty continued its choppiness and remained directionless. Last week, Nifty remained in the range of 18,141 and 17,761 and closed in the middle. Open and Close of the week remained almost same and therefore Nifty ended the weekly candlestick with “Doji” pattern, which indicates indecision or probable trend reversal.

This week is the fifth consecutive week, when Nifty did not violate the crucial support of 17,750-17,800. Nifty has formed multiple bottoms in this range and turned bullish in last session of the week. Formation of the “Doji” candlestick near the strong support could be the first sign of probable bullish trend reversal on the weekly chart.

However, Nifty has been finding resistance at 20-day EMA (exponential moving average), which is sloping downward and currently placed at 18,081. Nifty is still in formation of lower tops and lower bottoms on the daily chart. Any level above 18,265 would violate the bearish setup on the daily time frame for the Nifty. At present 55 percent of the NSE500 stocks are above their 200 DMA, which is a sign of strong breadth.

Technical setup of global equity market has turned bullish, which augers well for the Indian markets too. ICE Dollar Index, which has negative correlation with equity markets and gold has broken crucial support of 103. Falling Dollar Index also augers well for the world equity markets.

Indian markets have underperformed the Asian, European and US equity markets in last couple of weeks. Looking at the strong technical setup of global equity markets, Nifty could see catch up rally in the coming days.

We recommend traders to remain long in Nifty for the upside targets of 18,141 and 18,250, keeping 17,700 stop-loss.

Here are three buy calls for next 2-3 weeks:

Greaves Cotton: Buy | LTP: Rs 142 | Stop-Loss: Rs 131.5 | Targets: Rs 157-170 | Return: 20 percent

The stock price has broken out from bullish Inverted Head and Shoulder pattern on the daily chart. Price breakout is accompanied with rising volumes.

The stock is on the verge of surpassing crucial resistance of its 50-day EMA (Rs 142). Indicators and oscillators have turned bullish on daily charts.

HIL: Buy | LTP: Rs 2,853.5 | Stop-Loss: Rs 2,660 | Targets: Rs 3,090-3,250 | Return: 14 percent

The stock price has surpassed the crucial resistance of its 50-day EMA (Rs 2,730). It has also confirmed higher top and higher bottom formation on the daily chart. Price has been rising with healthy volumes.

On month ended December 2022, the stock formed “Doji” candlestick pattern on the monthly chart, which indicates trend reversal after prolonged down trend.

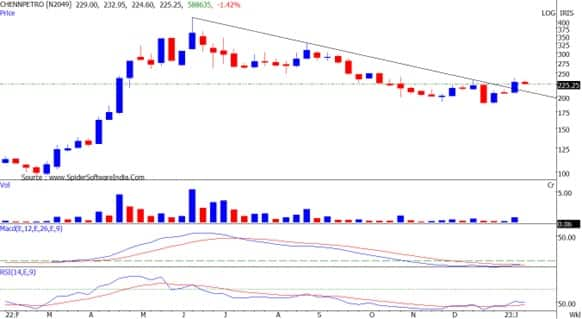

Chennai Petroleum Corporation: Buy | LTP: Rs 226 | Stop-Loss: Rs 207 | Targets: Rs 250-265 | Return: 17 percent

The stock price has broken out from downward sloping trend line on the weekly chart. Price breakout is witnessed with jump in Oil and gas sector which has started outperforming for last two weeks. Indicators and oscillators like RSI (relative strength index) and MACD (moving average convergence divergence) have turned bullish on the weekly chart.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!