Many bank stocks are trading near their respective multi-year low levels amid a widespread sell-off.

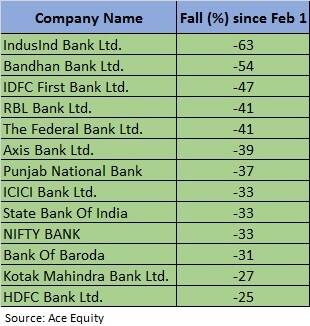

Nifty Bank index has corrected nearly 35 percent since February 1, after the market started falling in the wake of the coronavirus outbreak.

In the index, stocks have fallen up to 60 percent since then and it looks difficult to say how they are going to fare in the near term.

Stocks such as IndusInd Bank, Bandhan Bank, IDFC First Bank, RBL Bank, and Federal Bank have been among the top losers in the Nifty Bank index since Feb 1.

Even as top brokerages and financial firms such as Morgan Stanley believe large private banks, including ICICI Bank and HDFC Bank, are better placed, given their market share gains, they also underscore that the near-term volatility may be high.

While the fears over rising cases of coronavirus and its impact on the economy triggered an all-round selling, investors also turned anxious after the Yes Bank was put on moratorium by the Reserve Bank of India and the Supreme Court refused to offer any relief to the telecom firms.

"A part of it can be assigned to the uncertainties regarding Yes Bank and the issues this has thrown up. Banking stocks have corrected sharply because of 2 things. One is the Covid-19 impact which has affected the market generally, the other is the uncertainty caused by the worry of an increase in stressed assets of banks. With the supreme court not providing any respite to telecom players, the banking stocks which have exposure to the telecom sector were also impacted," said Vinod Nair, Head of Research at Geojit Financial Services.

The risk of bad loans has increased for banks in the wake of the coronavirus outbreak and the road looks bumpy for them.

"A prolonged slowdown in the economy can affect the businesses leading to an impact on earnings. Since the virus spread can be contained only with limited interactions, consumption demand will definitely get affected. This does raise the risk and already over-leveraged firms will be affected, raising the risk of bad loans," Nair said.

Then, the way forward is to look at the large private banks that have a strong market presence. HDFC Bank, State Bank of India and Kotak Mahindra Bank are some names, Nair suggests.

Global brokerage firm Credit Suisse is of the view that after the Yes Bank bailout, the market is concerned about the deposits.

As per Credit Suisse, IndusInd Bank and RBL Bank have reported a 2-3 percent decline in deposits in recent weeks even though liquidity at both banks appears to be adequate.

Credit Suisse warns that liquidity constraints will aggravate the credit crunch in the economy whereas asset quality outlook becomes more uncertain, given the economic disruption.

The global brokerage said larger private banks are well capitalised and competitively well-positioned and HDFC Bank, ICICI Bank and Axis Bank remain its top picks.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!