The Indian stock market carried forward the strong momentum of Friday's trade closing nearly 3 percent higher on September 23.

The Sensex ended 1,075.41 points, or 2.83 percent, higher at 39,090.03, while the Nifty closed 326 points, or 2.92 percent, up at 11,603.40. About 1,604 shares advanced, 971 shares declined, and 182 shares remained unchanged.

BPCL, Bajaj Finance, Eicher Motors, IOC and L&T were among the top gainers on the Nifty. On the other hand, Zee Entertainment, Infosys, Tata Motors, Power Grid and Dr Reddy’s Labs emerged as the biggest losers.

On the sectoral front, barring IT and pharma, all other indices are ended higher led by the FMCG, bank, infra, auto, metal and energy.

In a surprise move, the government has provided a direct fiscal stimulus of Rs 1.45 lakh crore via a reduction in key tax rates, which ultimately compelled every domestic as well as global brokerage house to revise market strategy upwards.

The fiscal measure's impact is expected to be so big that analysts, investors and brokerages increased their earnings estimates by a wide margin and also revised Sensex and Nifty targets.

Most experts expect earnings to increase by around 8-10 percent in FY20 and revised Sensex and Nifty target by 15-20 percent for next year.

Finance Minister Nirmala Sitharaman, on September 20, also announced several revisions to the goods and services tax (GST) rates following the 37th GST Council meeting.

Several decisions taken were aimed at promoting tourism. The Council approved a cut in tax rates on rooms with a tariff of Rs 7,500 and above to 18 percent and those with tariff below Rs 7,500 to 12 percent. GST on room tariff below Rs 1,000 has been

Technical experts expect the Nifty to surpass its key hurdles 11,800-11,900 levels soon and said supports now shifted higher to 11,000-11,300 levels.

Source: Reuters

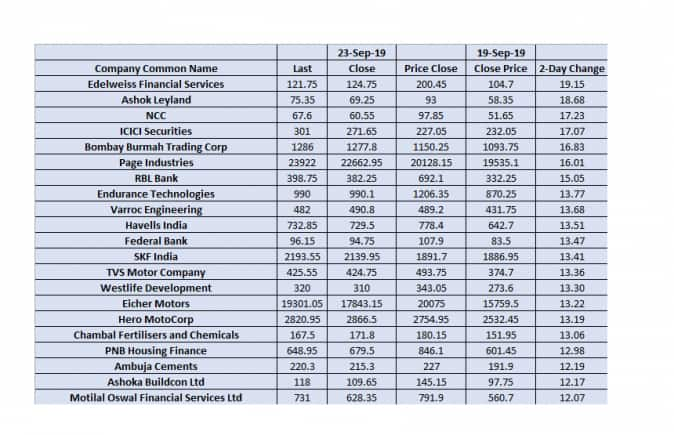

Among the BSE500 names, 44 stocks have gained between 10-19 percent in the last two days with Edelweiss Financial Services surging over 19 percent followed by Ashok Leyland (up 18.68 percent), NCC (up 17.23 percent), ICICI Securities (up 17.07 percent), Bombay Burmah Trading Corporation (up 16.83 percent), Page Industries (up 16.01 percent) and RBL Bank (up 15.05 percent).

The other gainers included Endurance Technologies, Varroc Engineering, Havells India, Federal Bank, SRF, TVS Motor Company, Eicher Motors, Hero MotoCorp, Chambal Fertilisers, PNB Housing Finance, Ambuja Cements, Ashoka Buildcon, Motilal Oswal, Bandhan Bank, Delta Corp, MRF, Jubilant Foodworks, Maruti Suzuki, IndusInd Bank, IRB Infra, HPCL, Escorts, UltraTech, State Bank of India and Bajaj Finance among others.

The Indian benchmark indices started the expiry week on a strong note buoyed by improved domestic sentiments after the government announced yet another set of measures last week. The markets registered second straight session of healthy gains, despite unsupportive global cues.

"The Nifty opened on a strong note and traded with a positive bias throughout the session before ending with gains of 2.9 percent at 11,603. Amongst the broader market indices, ‘BSE Midcap and BSE Smallcap’ ended higher and almost in-line with the benchmark," said Ajit Mishra Vice President, Research at Religare Broking.

The sectoral indices exhibited a mixed trend, wherein Capital Goods, Banks and FMCG were the top gainers rising 4.3-6.6 percent. IT was the worst performer and lost over 3.3 percent, followed by Healthcare and Power.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!