Update: This story, first published on July 24, is being shared among social media circles as part of a fake message saying the bank may shut down. The story does not subscribe to or present any such occurrence or event. You can find more details about it by following this link.

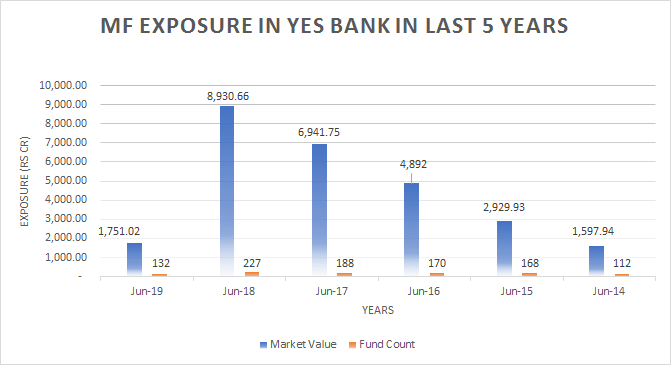

In the last one year, about 100 mutual fund managers have completely sold their stake in Yes Bank. In June 2018, 227 mutual fund schemes had Yes Bank in their portfolio; however, by June 2019, the number was reduced to 132, data from Morningstar India showed.

Consequently, the exposure of mutual funds to Yes Bank drastically came down to Rs 1,751 crore in June 2019 from Rs 8,930 crore in June 2018. However, a sharp fall in the price of the scrip is also responsible for this.

Yes Bank shares hit a 5-year low last week after the private sector lender reported 91 percent year-on-year (YoY) drop in the net profit for the quarter ended June 30, weighed down by a three-fold increase in provisions and weak asset quality.

After a poor Q1 show, some global brokerage firms cut their target price by more than 50 percent. Jefferies has a target price of Rs 50, which implies downside of nearly 50 percent.

Experts feel it is best to stay away from the scrip as of now even though valuation looks attractive. “Investing in beaten-down stocks only because it is cheaper from a valuation perspective shouldn’t be the sole mantra of an investor,” Umesh Mehta, Head of Research, SAMCO Securities told Moneycontrol.

“Also, banking is a business of trust and when this is lost revival is difficult. Since there is no turnaround and signs of improvement yet in this bank’s numbers, we do not recommend buying this stock,” he said.

Romesh Tiwari, Head of Research, CapitalAim also echoed Mehta and said any substantial recovery seems difficult from current levels in the short term.

“We do not know if the worst is over with the company, although the management has been signalling this. Even if the company has provided for the worst, it will need an infusion of fresh capital to get over with the past," he said.

Tiwari advised that for a person with high-risk appetite, this stock can be bought for a handsome return in the long term. However, he said investors should keep the exposure limited.

June quarter earnings

June quarter results raised more questions than answers, feel experts. The results were below market expectations. Stress on asset quality will take some more time to heal and that will be an overhang on the stock.

Provisions for bad loans shot up by 185.2 percent year-on-year to Rs 1,784.1 crore, but fell 51.3 percent quarter-on-quarter. Provision coverage ratio was unchanged at 43.1 percent in Q1FY20 compared to Q4FY19.

“From the time, the new CEO has taken charge there are only two questions that have haunted all the investors, viz. bank’s ability to raise capital and the quality of assets on the books. Looking at the current quarter results and management commentary, it seems there is some respite on the capital raised, which the management expressed is on track,” Vijay Kuppa, Co-Founder, Orowealth told Moneycontrol.

“However, there is still a major challenge on the asset quality especially the below investment grade book. Though the bank released a watch list, during Q1 major slippages were witnessed outside the watchlist that raises fresh concerns on the asset quality,” he said.

Asset quality deteriorated sequentially. Gross non-performing assets as a percentage of gross advances increased 179 bps sequentially to 5.01 percent (Rs 12,092 crore) and net NPA jumped to 105bps QoQ to 2.91 percent (Rs 6,883.27 crore).

The near-term recovery seems unlikely and some more quarter of numbers would be required to restore confidence among investors, suggest experts.

Disclaimer: The views and investment tips expressed by investment experts and brokerages on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!