Benchmark indices wiped out half of the previous week's hope-driven gains, and closed more than half a percent lower for the truncated trading week that ended on August 16.

The selling was seen in the auto, banking and financials, FMCG, infra, technology and pharma stocks.

Selling by foreign institutional investors (FII) due to no decision on foreign portfolio investors (FPI) surcharge from the government, a delay in measures to revive economy, continued slowdown in auto and a sharp fall in treasury bond yields hinting that the US might go into recession etc dampened market sentiment, but the rally in Reliance Industries and its recovery in the later part of week curtailed losses.

The BSE Sensex lost 231.58 points to 37,350.33 for the week and the Nifty50 fell 61.85 points, but it managed to hold its psychological 11,000 market, closing at 11,047.80. The broader markets lost all of the previous week's gains, with the BSE Midcap falling 1.3 percent.

Overall, the market for the last few sessions have been in a consolidation mode, as it is in a wait-and-watch mode for revival measures, and as the results season ended in disappointment, the rangebound trend is expected to continue in the coming week as well, unless some strong measures announcement come from government to revive economy or any global factors pop up, experts feel.

"The markets continued their wild swing with a downward bias by also pulling down the heavyweights with itself. However, now that local factors have largely been discounted for, and there are no unknowns for causing further pain on the bourses as of yet. Nonetheless, any negative cues from global countries can further dent Indian markets as well, but the chances of that being are low currently," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote told Moneycontrol.

He said with the slowdown looming on the economy, the companies could do very little to revive this quarter, and are now mostly dependent on the government to boost sentiment and bring about a change at the grassroot level.

While maintaining a cautious stance on the Indian markets for the near term, Ajit Mishra Vice President, Research, Religare Broking said that investors would also keep a close watch on the progress of the US-China trade talks, the movement of crude oil prices and the rupee/dollar.

Here are 10 key factors that will keep traders busy this week:

Hopes for measures to revive the economy

The recovery by 265 points, which took the Nifty above the 11,000 level, is on riding on hopes that the government may be coming out with measures to revive and the boost economy, which has been eagerly awaited by the Street and corporates.

Lot of meetings with corporates, foreign investors, experts and ministers have taken place, which all indicated that the government may be working out strong solutions to address every affected sector, and that could be announced in short term, experts feel.

The recent source-based reports indicated that the government might have ruled out the rollback of FPI surcharge, and a hike in registration fees for vehicles, GST cut for autos etc, which is why the market has been confused and as a result turned volatile in last few sessions.

Sources told CNBC-TV18 that the government may be working on a 'consolidated' economic package to address sectoral stress, but 'direct' fiscal concessions are unlikely to be part of economic relief measures for now.

"The downhill journey of 1,000 points on the Nifty has finally woken up the government to act. A stimulus is expected to be announced, which can reverse the markets in the short term. Historically, governments act at the tail end of an economic downturn, which in many cases has seen a positive impact on the stock market. This time, it will be interesting how the stimulus causes a turnaround. But till that time, the markets should hold on to its feet," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote said.

Selling by FIIs continues

After a steep fall on Tuesday last week, the market recovered sharply on Wednesday due to buys worth more than Rs 1,600 crore by buying FIIs and DIIs each, which was on the strong hope the government could announce measures and tweak/rollback its FPI surcharge on the 73rd Indpendence Day or over the weekend.

But that is unlikely to happen in the near term, and as a result FIIs continued to remain net sellers in passing week. They net sold Rs 363 crore worth of shares, taking total August month outflow to over Rs 9,000 crore on top of nearly Rs 20,000 crore worth of selling in previous three straight months.

"Easing of bond yields points towards a slowdown in the global economy, the devaluation of the Chinese Yuan making currencies of emerging markets nervous etc, which all are also driving FIIs to sell emerging market equities in favour of safe assets like gold and the dollar," Sanjeev Zarbade, VP PCG Research, Kotak Securities said.

Hence, along with FII selling, global bond yields and currency will be key things to watch out for.

Crude remains supportive

Crude oil prices will also be closely watched as they were trading around $60 a barrel in August so far, which is remained quite suportive for the market as India imports more than 85 percent of its oil requirements.

Brent crude futures, the international benchmark for oil prices, gained marginally for the week after two-week losses, but remained under $60 a barrel and fell more than 20 percent from its 2019 peak in April due to demand worries amid global slowdown fears.

The Organization of the Petroleum Exporting Countries recently reduced its forecast for global oil demand for the rest of 2019 due to slowing economic growth.

Rupee near February lows

The Indian rupee has been under pressure in August so far, and hit a six-month low due to global and domestic factors, which include the US-China trade tensions, recent depreciation of Chinese yuan, sell-off seen in equities and FII outflows from the equity market.

The rupee hit 71.40 against the US dollar during last week, its lowest level since February 2019 and closed at 71.15 on August 16, falling 3.4 percent in August.

Experts feel the depreciation is expected to continue, citing US-China trade tensions, weakness in Chinese yuan and domestic slowdown.

"Overall, global and domestic economies face devastating headwinds. The US-China trade conflict is unlikely to be resolved soon. A weakness in the yuan and in other emerging-market currencies could weigh on the rupee. Hence, we reckon that the rupee might gradually depreciate to 73 in the next few weeks," Rushabh Maru, Research Analyst - Currency and Commodity at Anand Rathi Shares and Stock Brokers told Moneycontrol.

US-China trade tensions

The endless trade tensions between the world's largest economies, the US and China, raised many questions over global growth. As a result, crude prices fell sharply, the Chinese Yuan moved below 7 for first time since the 2008 global financial crisis, which impacted emerging markets currencies, China's faltering economic situation etc.

US president Donald Trump has agreed to delay recent tariffs on some Chinese goods till December 15, which eased pressure on global equity markets, but the many talks held between two countries in the past failed to come out with final conclusion, which has been hitting sentiment across globe.

"Both the parties have agreed to resume trade talks again. However, the truce is unlikely to last long. The Chinese yuan recently breached the psychological 7 mark; as a result, the US immediately labeled China a currency manipulator. China has blamed the US for the continuing protests in Hong Kong. More importantly, Trump's behavior is quite unpredictable. The escalating trade war may have negative ramifications for the global economy," Rushabh Maru said.

The falling US bond yields to multi-year lows will also be closely watched, though experts saying that this won't be a sign of recession in the US.

Recently, US benchmark 10-year treasury bond yields have fallen below two-year bond yields, which had led to a sell-off in global financial markets recently. The steep fall in the US 10-year and 30-year Treasury bond yields indicate the alarming state of the global economy.

Raghuram Rajan told CNBC that US yield curve inversion this time may not be a sure shot sign of a recession as US Federal Reserve has more bullets than Japan and the European Union and that many sectors in USA don't respond to Fed rate cuts now.

Earnings and macro data

The result season has come to an end with announcement of numbers by all largecaps and midcaps, and majority of the companies reported a dismal performance in June quarter. But there are some companies yet to announce their earnings in the coming week.

CG Power and Industrial Solutions, Kwality, Opto Circuits, Proctor & Gamble, Valecha Engineering, Gillete India etc among others will announce earnings in coming week.

The RBI monetary policy meeting minutes will be released on August 21 and foreign exchange reserves data for week that ended on August 16 will be announced on August 23.

Technical View

The Nifty has been in a consolidation mode after hitting more than five-and-half-month low of 10,782 level, but it managed to hold onto the psychological 11,000 level.

The index closed at 11,047.8 on August 16, forming Doji kind of pattern on daily charts, and it saw a Hammer kind of formation on the weekly scale, which suggests buying is visible at lower levels while at the same time follow up is missing at upper band of the falling channel.

Experts feel the 10,782, the low touched recently, could remain a bottom for the time being and on other hand, if index remains above 11,000 for some more time, then there could be a rally, but that needs strong follow up buying to sustain the upward movement.

"The market is trading in a broad range of 500 points in Nifty50. On the weekly chart, it has made a hammer on the closing basis, indicating a rally in the short term. The indicators are deeply oversold making a possibility of a bounce even stronger. The market will continue to remain stock specific and rangebound for some more time," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote said.

He further said that traders are advised to be cautious but selective longs can be initiated on stocks trading above 200 EMA

F&O Cues

Maximum Put open interest is at 11,000 followed by 10,700 and 10,800 strikes while maximum Call open interest is at 11,000 followed by 11,500 and 11,200 strikes.

Call writing is at 11,200 strike followed by 11,300 and 11,400 strikes, while Put writing is at 11,000 strike followed by 10,500 and 10,700 strikes.

Options data suggests the Nifty could trade in a range between 10,800 to 11,200 zones, experts feel.

"Nifty found support near 10,900 during the week on the back of reduced FIIs selling. However, FIIs short positions in the F&O space are still intact, which can lead to rangebound market in the coming days," Amit Gupta of ICICI direct said.

According to him, Nifty is more likely to consolidate around 11,000 as the major options concentration is placed at 11,000 strike. "Put OI has remained highest at 11,000, despite the Nifty moving towards 10,800 levels recently. We believe stock specific positive bias may be seen till Nifty holds 11,000 level," he said.

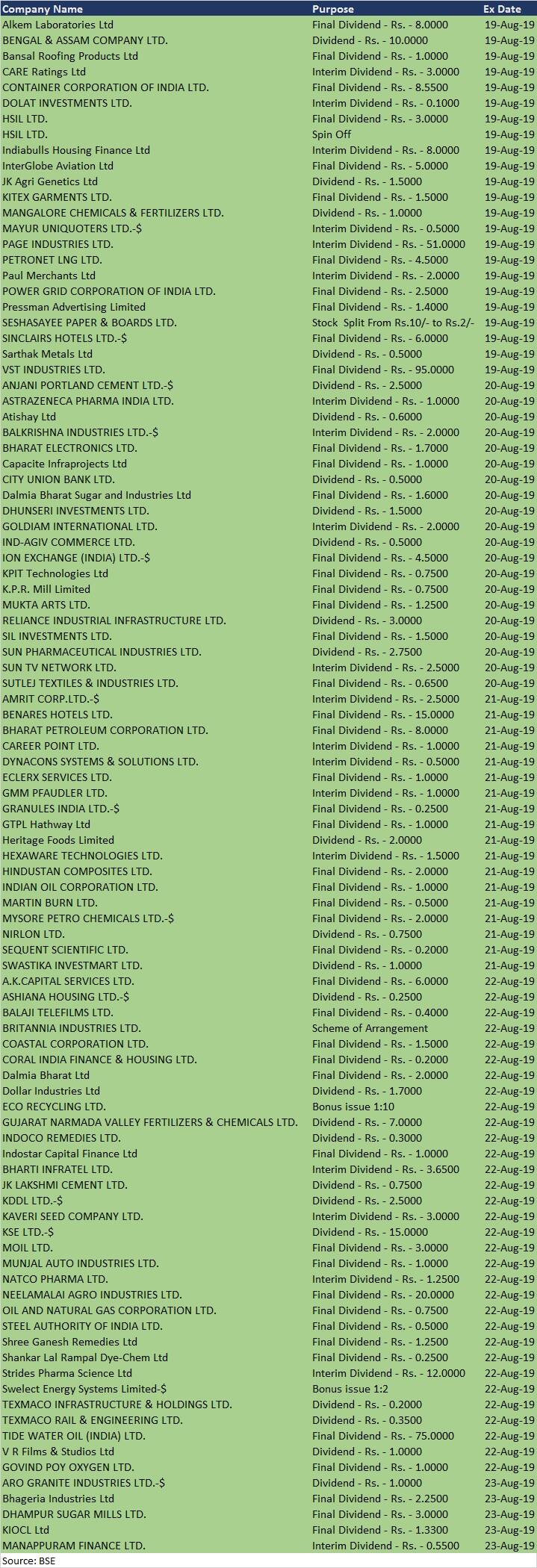

Corporate Action

Here are some corporate action taking place in coming week:

Global Data Cues

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!