We are recommending leading integrated chemical manufacturer Atul Industries (CMP: Rs 3,611, market capitalisation: Rs 10,736 crore) as a tactical pick. Atul posted a decent set of Q1 FY20 numbers despite growth headwinds prevailing for the sector and economy. Further, the recent de-rating due to broad sectoral concerns offers an interesting entry opportunity in our view.

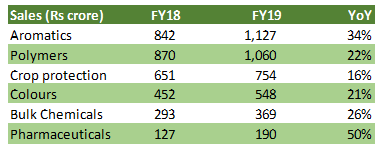

Leadership in key product groups: In FY19, growth in key product categories such as aromatics, pharmaceuticals, commodity chemicals and polymers was remarkable. The company is a market leader in aromatic compounds, which finds applications in personal care and fragrance markets.

In pharmaceuticals, Atul is involved in the production of various basic chemicals (amino acids, phosgene derivatives) and APIs. The major API where it is a market leader is diaminodiphenyl sulfone (Dapsone), which is used to treat skin disorders like Hansen's disease.

Earnings at a glance Source: Company

Source: Company

Strong Q1 FY20 performance: Consolidated revenue grew 14 percent driven by double-digit growth for both life-science and specialty chemicals, which constituted 32 percent and 68 percent of FY19 sales, respectively. Exceptionally high gross margin (over 417 bps) and lower other expenses aided EBITDA margin at 23.1 percent.

Big capex underway: Atul is executing capex worth Rs 400 crore (fixed asset turnover of two times), which is expected to conclude by mid-2020. Capex includes 30 percent expansion in aromatic compound -- para-Cresol -- capacity to 36,000 tonne, where the company commands more than 40 percent market share and which has applications in the fragrance and anti-oxidant industries.

Phosgene value chain: The company recently expanded its phosgene capacity by five times and is now working towards vertical integration of the phosgene value chain. The management has approved a caustic-chlorine project which will supply chlorine used in the manufacture of phosgene.

Read: Paushak – technology prowess in phosgene-based specialty chemicals

Deployment towards environmental complianceThe management is deploying about Rs 100 crore towards environmental compliance, which would help turn couple of units into zero liquid discharge units. In the recent past, volume growth was impacted due to self-imposed pollution compliance norms.

Outlook

While Q1 performance was an outlier, particularly on the margin front, we continue to expect double-digit sales growth for the next three years aided by the positive outlook in diverse end-markets (mainly crop protection, dyes, pharma and fragrances). The company has adequate capacity to meet this improving demand. Atul’s additional revenue potential, based on capacity bandwidth and projects under implementation, is more than 0.4 times FY19 sales.

Any sharp slowdown in domestic and international demand for end-markets remains a key risk to monitor. While China is gradually re-building its chemical capabilities, we believe Atul is one of the few in India which has developed competitive strength in the interim. The management is also deliberating with its Chinese peers for possible manufacturing collaboration.

As far as the stock is concerned, it has corrected 14 percent in the last two months and now trades at 19 times FY21 estimated earnings. Recent correction has brought to a level, wherein it can be accumulated for a long term.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!