Private equity/Venture Capital (PE/VC) investments in India stands at an all-time high of $36.70 billion in 2019 having surpassed the previous high of $36.5 billion recorded in 2018, said the IVCA-EY report.

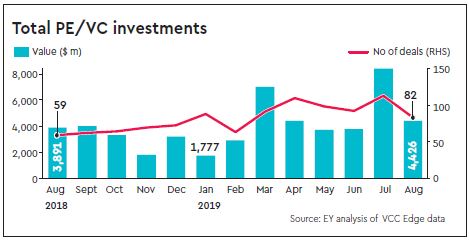

August 2019 recorded investments worth $4.4 billion across 82 deals, on the back of 16 large deals of value greater than $100 million and strong investment activity in infrastructure and real estate asset classes.

Exits recorded $691 million across 11 deals on account of large secondary exits.

From a sector point of view, infrastructure ($803 million), real estate ($764 million) and financial services ($734 million) were the top three sectors in terms of PE/VC investments in August 2019.

Investments in infrastructure and real estate sectors accounted for 35% of the total PE/VC investments in August 2019 compared to 23% in August 2018.

GIC’s $631 million investment in IRB Infra’s road platform was the largest deal in August 2019 followed by Blackstone’s buyout of Coffee Day’s Global Village Tech Park for $400 million.

August 2019 recorded 11 exits worth $691 million, 60% lower compared to the value of exits recorded in August 2018 ($1.6 billion) and 9% higher compared to exits recorded in July 2019 ($635 million).

In terms of fund raise, August recorded total fund raises of $1.1 billion compared to $2 billion raised in August 2018.

In August 2019, Kotak Special Situations Fund raised the largest fund worth $1 billion to target non-performing asset (NPA) opportunities, the report pointed out.

Vivek Soni, partner and national leader, private equity services, EY said that given the deal momentum in various sectors, by the end of 2019, the total Indian PE/VC investment could potentially be in the range of $48 billion to

$50 billion.