Hindustan Unilever, India’s biggest fast moving consumer goods (FMCG) company, is expected to post double-digit growth in topline in the October-December 2022 quarter but its operating margins are likely to decline year-on-year (YoY) due to increasing advertising spends. HUL will report its numbers on January 19 after market hours.

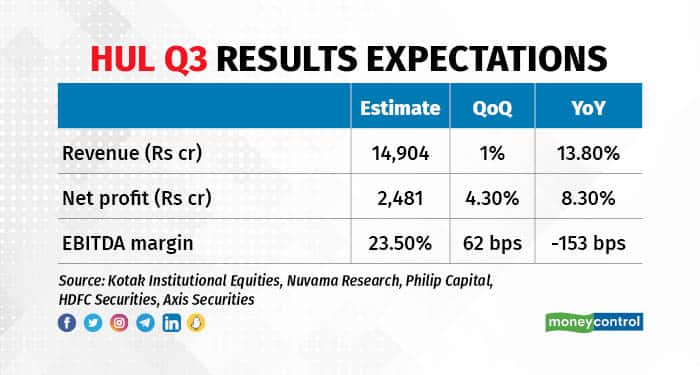

According to a poll of brokerages, standalone revenue may come in at Rs 14,904 crore, a 13.8 percent YoY growth while profit after tax (PAT) is expected to increase 8.3 percent YoY to Rs 2,481 crore.

Sequentially, revenue will be more or less flat while net profit may rise 4.3 percent.

Revenue growth is expected to come on the back of further price hikes taken in laundry products. HUL is the maker of Surf Excel, Rin, Wheel and Breeze in this segment. Meanwhile, price cuts of 5-11 percent were taken in Lifebuoy and Lux soaps after a fall in palm oil prices, which will drive volume growth in soaps.

Volumes growth

HDFC Securities expects overall volumes to grow 5 percent YoY on a base of 2 percent YoY growth. Meanwhile, Kotak Institutional Equities (KIE) has pegged volume growth at 4 percent.

According to analysts, rural demand that plagued consumer companies in Q2 did not improve at all in Q3. “It has not improved structurally, but would look optically better only due to base effect. Rural demand for FMCG remains weak across the board,” as per Nuvama Research.

After Q2 results, the company’s CEO Sanjiv Mehta had said the FMCG market continued to remain “challenging”.

Also Read: Q3 preview | FMCG margins set to expand but slow recovery in rural demand to play spoilsport

Coming to the segment-specific performance, KIE forecast a 28 percent YoY growth in home care, 6.8 percent growth in beauty & personal care and 7 percent growth in the food & refreshments portfolio. EBITDA (earnings before interest, taxes, depreciation and amortisation) margin has been pegged at 23.5 percent, which indicates slight improvement sequentially due to the liquidation of high-cost raw material inventory.

However, margins are expected to contract on a YoY basis as the company has upped its advertising and promotion (A&P) spends. Plus, the food & refreshment segment continues to be impacted by high inflation in sugar, milk, barley and wheat, noted analysts at Nuvama Research.

Investors will be keenly monitoring management commentary on

- Raw material trends

- Pricing actions and new launches strategy

- Sustainability of cost-saving initiatives

- Improvement in rural business

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!