The Indian market witnessed some recovery on March 24 with Sensex rising nearly 700 points to close at 25,981.24 and Nifty settling 190.8 points higher to close above the 7,800-mark.

Investor sentiment received a big boost after the Finance Minister said an economic package was coming soon to shore up the economy.

Experts believe the market is likely to remain hugely volatile with in-between recoveries occasionally.

Track this blog for latest updates on coronavirus outbreak

"Markets may witness intermittent bounce with any positive news flows as well as policy announcements. However, sustaining the gains is difficult and the market may slide back again as the economic impact of Covid-19 could last longer. European and US manufacturing activity data due today, could influence the markets tomorrow, reflecting the impact of

Covid-19 on the economies," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

On the technical front also, the market looks indecisive.

“Nifty managed to survive above the level of 7,500, which had acted as a major support to the market during the period of 2015-16. Today's formation of the market is indecisive, that too, at the bottom of the current selloff. Such formation generally acts as a positive reversal for the market. The 8,170-8,200 levels would be major hurdles. The strategy should be to buy on dips with a final stop loss at 7,700,” said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

We have collated 14 data points to help you spot profitable trades:

Note: The OI and volume data of stocks given in this story are the aggregates of the three-months data and not of the current month only.

Key support and resistance level for Nifty

According to the pivot charts, the key support level is placed at 7,529.12, followed by 7,257.18. If the index moved upward, key resistance levels to watch out for are 8,054.97 and 8,308.88.

Nifty Bank

The Nifty Bank index closed at 17,107.30, up 1.12 percent. The important pivot level, which will act as crucial support for the index, is placed at 16,201.87, followed by 15,296.43. On the upside, key resistance levels are placed at 17,927.07 and 18,746.83.

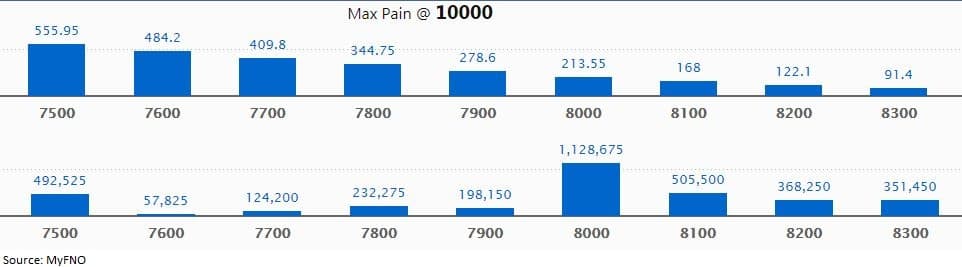

Call options data

Maximum Call Open Interest (OI) of 11.29 lakh contracts was seen at the 8,000 strike price. It will act as a crucial resistance level for the March series.

This is followed by 8,100 strike price, which now holds 5.06 lakh contracts in open interest, and 7,500, which has accumulated 4.93 lakh contracts in open interest.

Call writing was seen at the 8,300 strike price, which added 77,475 contracts, followed by 7,500 strike price, which added 47,325 contracts.

Call Unwinding was seen at 8,000 strike price, which shed 1.1 lakh contracts, followed by 7,800 strike, which shed 66,450 contracts.

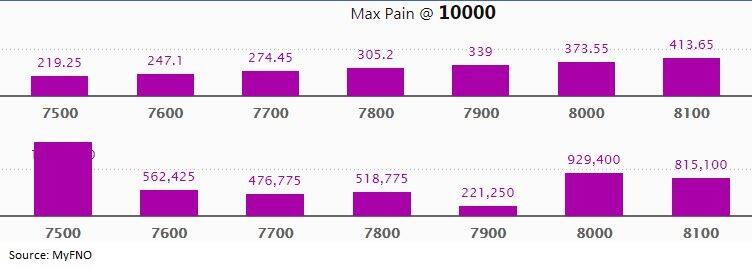

Put options data

Maximum Put Open Interest of 15.7 lakh contracts was seen at 7,500 strike price, which will act as crucial support in the March series.

This is followed by 8,000 strike price, which now holds 9.29 lakh contracts in Open Interest, and 8,100 strike price, which has accumulated 8.15 lakh contracts in open interest.

Put writing was seen at the 7,500 strike price, which added 5.56 lakh contracts, followed by 7,600 strike, which added 3.07 lakh contracts.

Put unwinding was seen at the 8,100 strike price, which shed nearly 5 lakh contracts, followed by 8,300 strike that shed 38,700 contracts.

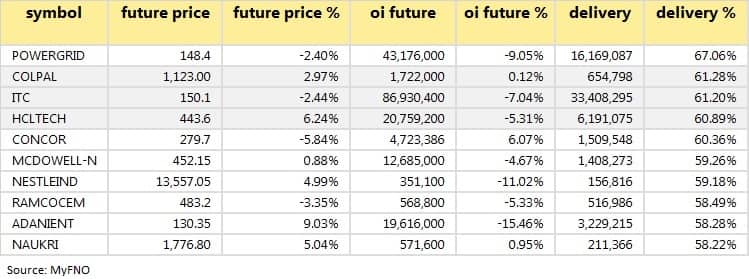

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are accepting delivery of the stock, which means they are bullish on it.

14 stocks saw a long build-up

29 stocks saw long unwinding

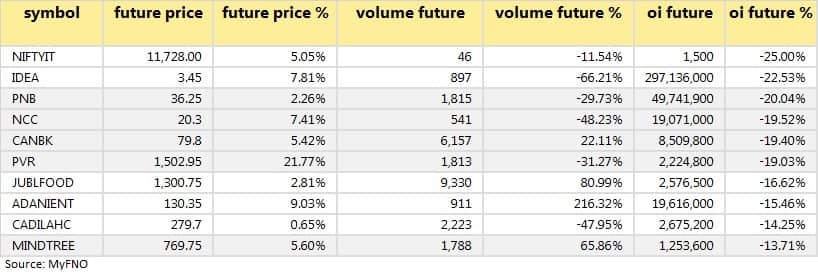

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

16 stocks saw a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

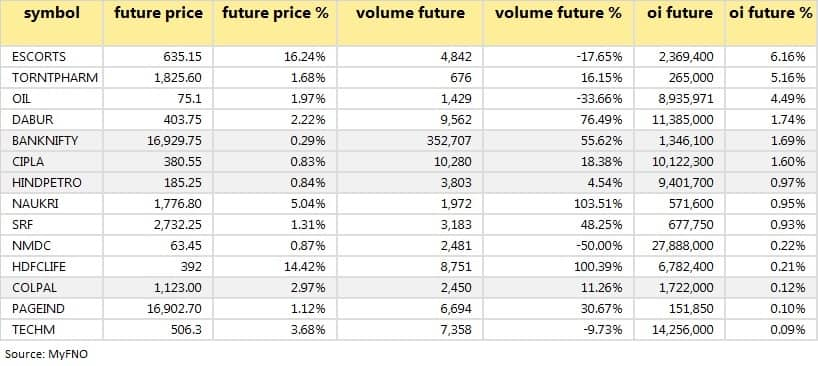

86 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short covering was seen.

Analyst or Board Meetings/Briefings

The respective boards of Tilak Ventures, Shukra Pharmaceuticals, Rockon Enterprises, REC, Midas Infra Trade, Kintech Renewables, Kachchh Minerals, Gulshan Polyols, Brahmaputra Infrastructure, Banas Finance and Axon Ventures will meet on March 25 for general purposes.

Stocks in the news

Fortis Healthcare: ICRA has withdrawn [ICRA] BBB+ (on watch with developing implications) and short term rating of [ICRA]A2 (on watch with developing implications) assigned to Rs 35 crore.

Rallis India: The company has shut its manufacturing operations at some plants due to the outbreak of coronavirus.

Mercator: EXIM sold firm's M T Hansa Prem vessel through e-auction for $3.60 mn on payment default.

Satin Creditcare: Firm approved allotment of NCDs of Rs 50.05 cr through a private placement basis.

Sadbhav Engineering: CARE downgraded the rating on long term bank facilities to A-/(Stable) from A.

India Grid Trust: Company completed the acquisition of its 9th transmission asset from Sterlite Power for $134 mn.

Torrent Pharma: Company fully repaid secured redeemable NCDs of Rs 240 crore.

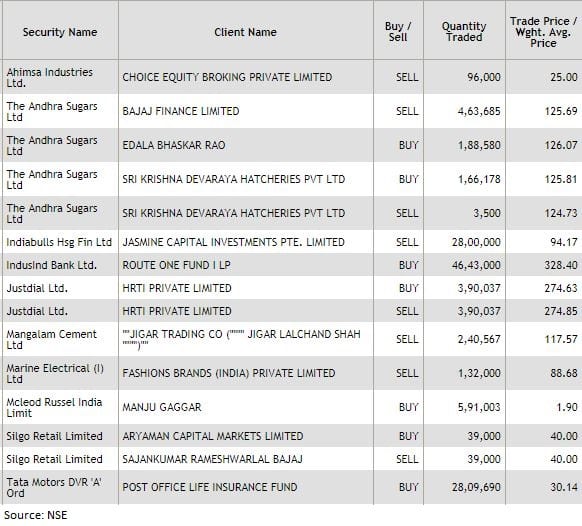

Bulk deals

(For more bulk deals, click here)

Fund Flow

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth net Rs 2,153.35 crore, while Domestic Institutional Investors (DIIs) bought net Rs 1,553.66 crore worth of shares in the Indian equity market on March 24, as per provisional data available on the NSE.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!