Highlights- A strong improvement in operating profit on better product mix

- Molecule commercialisation to pick up in H2

- Ramp-up in Ambernath facility expected in the near term

- Key factors to watch: Commissioning of Vizag facility and foray into CRAMS

Solara Active Pharma Sciences (market cap: Rs 1,067 crore), the demerged API (active pharmaceutical ingredient) entity of Strides and Sequent, posted yet another strong quarter with solid improvement in operating profit as operating leverage helped.

However, sequentially, top line growth was a bit soft due to delay in product approvals and the Ranitidine controversy. Going forward, the management is confident of better H2 FY20 on commercialisation of new molecules. In the medium term, commissioning of its Vizag facility and foray into CRAMS (contract research and manufacturing services) would be a key catalyst for re-rating.

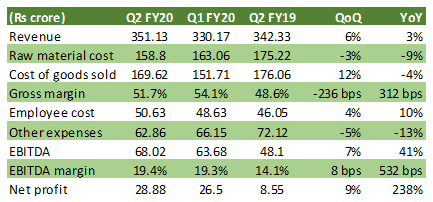

Table: Q2 Financials

Source: Solara Active, Moneycontrol Research

Key negatives

September quarter sales growth moderated to 3 percent YoY (year-on-year) on a high base as the main chunk came from its standalone business.

Sequentially, the subsidiary business (Ambernath facility and US operations) had a lower contribution as the company received a delayed approval in the US for a few products of the Ambernath facility. This has apparently impacted the share of new products in sales, which is down to 5 percent in Q2 FY20, from 7 percent in Q1.

The positive

EBITDA margin expanded by 532 bps mainly on account of better product mix, operating leverage and the cost saving programme partially offset by higher employee cost (10 percent YoY).

Other observations

In FY19, the company filed for nine DMF (Drug Master File). Going forward, it intends to file more than 10 DMF per year with R&D investment run-rate of 3-3.5 percent of sales, which should help in new product launches. In the quarter gone by, it filed one new DMF in the US market. Three of its existing products forayed into four new markets.

The Ranitidine issue

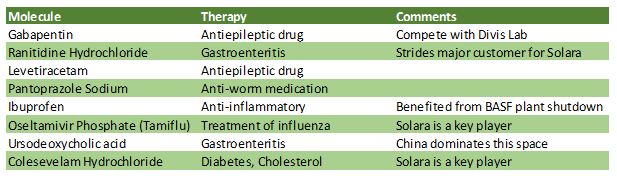

Ranitidine Hydrochloride is one of the key APIs for the company contributing nearly 5 per cent to the overall revenue. The pharma player has temporarily suspended production and distribution of Ranitidine Hydrochloride drug substance. It has completed internal assessment on the criteria as indicated by US FDA and is working with the agency and supply chain partners for the next set of actions. It is hopeful that Ranitidine supplies would be allowed by the regulatory agency as its products meet the criteria.

Also read: The Ranitidine controversy

The drugmaker imports 30 percent of its raw material from China. While it doesn’t see any major supply side disruption, it plans to reduce dependence on China by sourcing a few key APIs/starting material from domestic manufacturers.

The promoter group pledge holding reduced in October to 5.05 percent, from 6.85 percent.

Net debt to equity stood at nearly 0.57 times. In the medium term, gearing ratios are expected to improve as the company pays back from recurring cash flows and the recent fund-raising programme. Early this year, it announced fund-raising worth Rs 460 crore from promoters and private equity player TPG, which would help fund the capex plan, explore inorganic opportunities in CRAMS and reduction in the existing debt.

Outlook

In the immediate future, Solara Active is looking to ramp up utilisation for its newly commissioned Ambernath facility, from about 30 percent in FY19. With the steady commercialization of new molecules, it expects an improved performance in the second half of FY20 compared to H1. Note that most of the new product approvals have come towards the end of Q2 FY20.

Furthermore, we believe that the next leg of growth would come from the niche complex molecules backed by R&D investment (~3-3.5 percent of sales). Its foray into CRAMS should help in double-digit sales CAGR (compounded annual growth rate) for the next 3-5 years.

That company is setting up a new plant with Rs 250 crore investment at Vizag, which is expected to be commissioned in FY21. Fixed asset turnover is likely to be ~1.4x. The pharma player is hopeful of working towards commercialisation and R&D in H2 FY21 and expects gains to accrue in FY22.

The management is confident of maintaining at least 50 per cent gross margin in future. This is expected to improve as the CRAMS business unfolds. EBITDA margin is expected to remain elevated on account of a better product mix and cost-saving initiatives offsetting higher R&D expenses. Taking into account the reduction in interest cost, along with equity dilution due to convertible warrants, earnings CAGR (FY19-21e) is expected to be 23 percent.

Table: Key molecules

Source: Company

Finally, the stock is trading at 11x FY21 estimated earnings, which is at the lower end of the valuation multiple range of the sector. Here, investors should note that the stock can remain volatile depending on progress of the Ranitidine controversy and commercialization of new molecules. We believe long-term investors can take a closer look at the stock, given a mix of growth expectations and reasonable valuations.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!