Raja Venkatraman

In the budget, the government addressed some key issues like disinvestment, liquidity concerns for NBFCs, addressing problems of PSU banks, subsumed FDI and FPI limits, took certain steps to increase the free float in the market and did all of this without inflating the fiscal deficit. In fact, the budget deficit has been revised downward to 3.3 percent.

The government has for the first time decided to venture into the vibrant global market and raised the dollar-denominated sovereign bond.

The global market is flushed with liquidity and the interest rates to raise capital globally are clearly lower so this move is definitely a positive.

The tone of the Budget sounded more tilted to creating a longer-term vision where the government laid a roadmap to transform India into a $5 trillion economy.

While we believe that the proposals are good, implementation will be the key and the process will actually have to play out in the long-term.

Perhaps, the market will now start looking back at the near-term factors and the focus now again will shift back to technicals.

Skewness in the market towards mega caps at the highest level!

In our March 19 letter, we highlighted how the market is skewed towards those few pockets that are working.

The sell-off in the past 12 months had triggered a massive risk-on sentiment and investors flocked to safety to invest in those counters where there were stability and predictability in earnings namely in some select mega-cap stocks.

This shows that the market breadth has completely narrowed down and we will need some fresh set of triggers to kick start a broader-based recovery in the market.

The polarisation in the Nifty has continued to June where top 15 stocks have delivered 30 percent returns, while other 35 stocks are down 11 percent over Dec'17-June'19.

The top quartile is trading at a premium to their historical valuations while the balance 35 stocks are trading at a significant discount to their historical averages.

Stocks like Eicher Motors, L&T, ITC, M&M, Coal India, and ONGC are all at a substantial discount to their long term averages while Bajaj Finance, Reliance, Titan, Asian Paints, Kotak Mahindra Bank, TCS, HUL and UltraTech are trading at a substantial premium to their 5/10 year avg PE/PB ratios.

Institutional holdings have also been concentrated in these small pockets. For instance, the top 10 stocks account for 41 percent of total institutional holding.

Moreover out of 3,000+ listed stocks - the top 100 stocks account for nearly 94 percent of all institutional holding, the next 5 percent goes to the next 150 stocks that are midcaps and the entire small-cap universe accounts for only 1 percent of the institutional holdings.

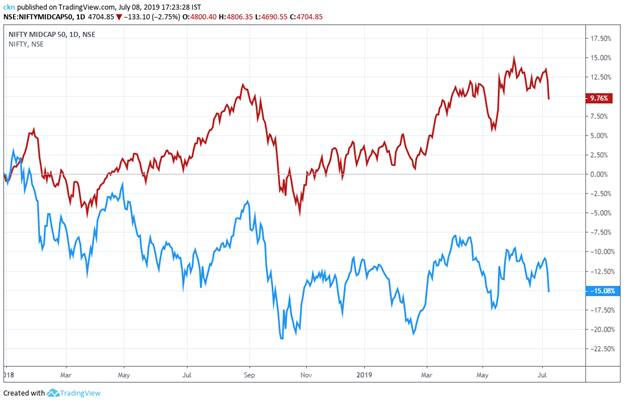

Midcap underperformance continues:

The mid and smallcap space has been under pressure, although they got some respite when election uncertainty was lifted by the strong mandate won by the incumbent government.

But, currently, the Nifty Midcap is trading at a 10 percent discount to the Nifty so far this year compared with the 2019 daily average of 6.8 percent.

Nifty Midcap trading at a discount to Nifty

Fibonacci confluence zones provide support to the midcap index:

Nifty Midcap index corrected more than 25 percent from the highs but some of the midcap stocks were beaten down in the process. The fall in the index halted at the Fibonacci confluence zone of 4484-4534 and has not broken the zone since it first touched it in Oct'18.

The 38.2 percent of the higher swing from 2,734 lies at 4,470 and that’s the zone the index held on to. The Fibonacci analysis states that an index/stock that doesn’t correct more than 38.2 percent of a major swing is in a strong uptrend.

In this case, the 38.2 percent of a higher swing is still intact and that tells that the midcap index is in a strong uptrend.

The RSI on the monthly charts is still in the bull zone. But, on the weekly charts, RSI fell in the bear zone and is still oscillating between 35-65 levels, which are the bear zone.

RSI has now taken support above the bull zone of 40 on the weekly charts, which are indicating strength and a move above the 65 will confirm the same.

Therefore, it looks like a good opportunity to buy some of the midcap stocks that have corrected around 50 percent and are indicating reversal signals.

Investment Implications - Go Bottom Up

This indeed is a difficult time for investors as there is a lot of chatter of a slowdown. The headline market leaders are issuing statements of slackening demand.

Earnings growth in the current quarter will be elusive as the banking space will account for the bulk of the Nifty's earnings growth. The stocks in this space are already richly valued while other sectors will struggle.

The midcap index is yet to recover but considering the narrowing down of the valuation differential and consistent under-performance, investors can go bottom-up and look for plays in the mid-cap space where earnings visibility and trend momentum is still intact.

At Plus Delta Portfolios, were are identifying such plays for our clients and also sharing one such company with our readers.

Just Dial – a strong pick in the midcap space

Just Dial has been showing strong momentum in the recent past and is one of our picks in the midcap space. Justdial is a leading local search engine with a database of 25.7 million listings and over 139.1 million unique quarterly visitors.

The company has displayed strong financial performance in FY19 where profits have growing 44 percent and revenues are growing at 14 percent. The company has grown its unique visitors by 25 percent in FY19, added 1,200+ fees on-street staff to grow its business and added 17,000+ paid customers to its kitty in Q4FY19.

The company is nearly debt-free and has generated free cash flow of Rs 201 crore in FY18 and has continued to throw out more free cash in FY19.

We continue to remain bullish on Just Dial as the stock has sustained strong momentum post a 16-month consolidation. Just Dial has shown an ascending triangle breakout that has been accompanied by large volumes and a favourable bullish up move in the RSI, which has consistently stayed above the 60 mark.

The author is Head of Training, Chart Advise.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!