Jitendra Kumar Gupta

Moneycontrol Research

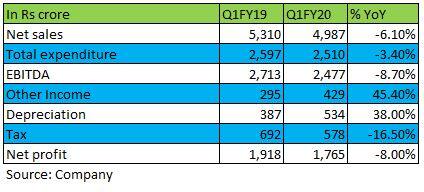

International metal prices and movement of the rupee against the dollar have a huge bearing on earnings of metal companies. Hindustan Zinc is not immune to this trend, which reported a sales decline of 6.1 percent year on year at Rs 4,987 crore.

The company is among the early birds in this space to have reported first quarter results of 2019-20.

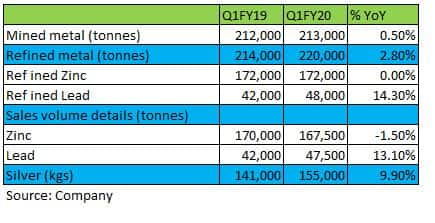

During the quarter, its refined zinc sales volume came down by 1.5 percent to 1,67,500 tonne. Zinc, which accounts for a bulk of HZL’s revenue, too came under strain because of the lower prices at the London Metal Exchange (LME). The LME zinc prices averaged at $2,761 a tonne in April-June as against $3,112 in the same quarter last year, down 11 percent YoY.

Nevertheless, segments like silver and lead businesses offset the sluggish sales to a considerable extent. Lead recorded 13.1 percent growth in volumes whereas that of silver came in at 9.9 percent.

Operational performance

Zinc is a major contributor to the operational show, which accounts for 65 percent of revenue. That explains its impact on operating profit, too.

Lower volumes and realisations in the zinc business compressed the overall EBITDA. Furthermore, the cost of production jumped by 2 percent YoY to $1,067. This is precisely why the company reported an 8.7 percent YoY decline in EBITDA at Rs 2,477 crore during the quarter under review.

The weakness is also attributable to the 21 percent yearly drop in average LME lead prices and 6 percent in the case of silver. Despite higher volumes, their contribution to profitability was negative.

Thankfully, the company is sitting on a net cash of close to Rs 18,300 crore and generated other income. During the quarter, other income jumped 45.4 percent YoY to Rs 429 crore and that helped cushion the negative impact on operating profitability. Net profit saw a marginal 8 percent drop from a year ago.

Outlook and valuations

At the current market price, the stock is trading at an enterprise value to EBITDA of 6.1 times, which is near its long-term average. While there is comfort of cash in the books and reasonable valuations, investors should take note that zinc is used in making steel, which is currently caught in a down cycle because of slower global growth.

Investors, therefore, need to be cautious. Besides, the market is fearful of a zinc price correction as a result of spare global capacity. LME zinc is already trading lower. As against an average price of $2,761 in Q1 FY20, LME zinc is at $2,426 a tonne, a sign of tough climb ahead.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!