Indian markets have remained resilient in 2019 despite bad news and even hit new record highs largely on the back of strong buying seen in some key heavyweights, describes as ‘HRITHIK’ stocks by market commentators .

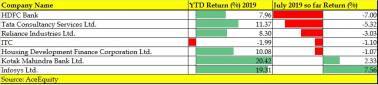

HRITHIK is an acronym for the seven blue chips – HDFC Bank, Reliance Industries, Infosys, TCS, HDFC, ITC, and Kotak Mahindra Bank. Six of the seven stocks rose 8-20 percent compared to 4 percent rise seen in Nfity50 so far in 2019.

These seven account for more than 40 percent weight in the Nifty, and any substantial rise or fall in these stocks is likely to dictate the fate of the index.

The Nifty50, which hit a record high in June, went south and broke below crucial support levels on its way down. A close look at the HRITHIK stocks will help us understand this sudden U-turn .

Five—HDFC Bank, TCS, RIL, ITC, and HDFC Ltd —of the seven stocks have fallen 1-7 percent in July. Kotak Mahindra Bank rose 2 percent, and Infosys rallied more than 7 percent in the same period.

Most experts feel that investors are booking profits in the HRITHIK stocks, which were already trading at expensive valuations, and trend could well continue for some more time that would eventually cap the upside for the Nifty50 index as well.

“HRITHIK (HDFC, RIL, INFY, TCS, HUL, INDUS, KOTAK BANK) stocks can perform contrary to the broader market for quite a long time although these will also undergo correction due to relative valuation concerns or profit booking or reweighting of portfolios,” Deepak Jasani , Head, Retail Research at HDFC Securities, told Moneycontrol.

“The rally in these stocks enabled Nifty to break into new high in early June 2019. However, now it may be difficult for the Nifty to make another high till a wider section of the top 100-150 stock starts to perform; of course one would wish for even the small and midcap stocks to start performing,” he said.

Experts are of the opinion that at a time when the economy is showing signs of a slowdown, the HRITHIK stocks could underperform but will not fail or investors will not losses all their money. They could be called safe bets.

“As long as these companies deliver on performance, they will continue to move higher. Corrections will happen along the way. We disagree with the notion that these companies will fail but they could certainly disappoint on growth. Some of these stocks have stellar management and strong barriers to entry,” Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management, told Moneycontrol.

“One or two of them may not succeed but if you look at Amazon, Apple in the US, they have worked for over 20 years, Coke for over 50 years, etc. Certainly along the way business models will change and it is the job of the investor to identify changing conditions,” he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!